This thread is a compilation of selected quotes from @Breedlove22’s interview w/ @lexfridman: Philosophy of Bitcoin from First Principles.

Clocking in at 4hrs, it’s an unbroken chain of logic, crystalizing the importance of Bitcoin as an innovation for society.

Clocking in at 4hrs, it’s an unbroken chain of logic, crystalizing the importance of Bitcoin as an innovation for society.

0/ Quotes are organized according to the following topics-

(although the conversation spans much more)

(although the conversation spans much more)

1/ “When you look at the system of capitalism or the system of communism, there's ideals. And a lot of people argue that in [it’s] perfect form it would actually be good for the world.

The question is how resilient are they to the corruption of human nature?”

The question is how resilient are they to the corruption of human nature?”

2/ “Communism and capitalism [are] a matter of scale.

The ideal behind communism is ‘from each according to their ability to each according to their need’ sounds beautiful.

In very small circles of trust, you're much more likely to behave selflessly towards one another.

The ideal behind communism is ‘from each according to their ability to each according to their need’ sounds beautiful.

In very small circles of trust, you're much more likely to behave selflessly towards one another.

3/ “The problem is..it doesn’t scale.

As we move into this larger system of socio-economic cooperation, which is necessary to deepen the division of labor to generate more wealth,.. we need to interact with one another on much larger scales than this communistic utopian ideal.”

As we move into this larger system of socio-economic cooperation, which is necessary to deepen the division of labor to generate more wealth,.. we need to interact with one another on much larger scales than this communistic utopian ideal.”

4/ “We get into the realm of capitalism where we need really sound rules, hard rules, consensus, verifiability, and frankly prices.”

5/ “[Looking at] Soviet Russia, they tried to replace the profit motive or the price signal with this nationalistic faith and devotion, where..you don't need prices or profits, you can just..serve mother Russia. And that would create wealth.”

6/ “So what happened?

They destroyed price signals. There were shortages, there were famines. There's all levels of corruption because,.. once you have people run the system..

They destroyed price signals. There were shortages, there were famines. There's all levels of corruption because,.. once you have people run the system..

7/ ..and you put someone in a seat much closer to absolute power, where they're making all the pricing decisions, they own all of the productive factors in the economy, they're not beholden to any market force.”

8/ “There's no market check on their action that that institution tends to become more corrupt and further, it's an inferior resource strategy.”

9/ “The other way to think about free market vs. central planning is decentralized or distributed computing vs. centralized computing.

Each one of us, I think that the number is 120 bits per second of active awareness we can take in clearly..”

Each one of us, I think that the number is 120 bits per second of active awareness we can take in clearly..”

10/ “In a centralized planning body like in Soviet Russia, they had maybe 10,000-20,000 people deciding the prices for the entire country.

You're only getting that much data throughput- 20,000 people x 120 bits per second.”

You're only getting that much data throughput- 20,000 people x 120 bits per second.”

11/ “Whereas in a free market, if everyone is free to interact with deep capital markets, based on an accurate price, you're getting the data throughput of 120 bits per second times the entire economy.

It's a more efficient means for disseminating knowledge effectively.”

It's a more efficient means for disseminating knowledge effectively.”

12/ “The more knowledge a socio-economic structure can contain, the more wealthy it is. Prices, tools, all these things are just knowledge..that's why something like capitalism, even in its marginalized form, state capitalism, out competes communism.”

13/ “we can think of price itself as an indication.

The price is a data packet on supply and demand...it's telling you how much supply there is of something in the world relative to the demand.”

The price is a data packet on supply and demand...it's telling you how much supply there is of something in the world relative to the demand.”

14/ “So when you print money and artificially increase that price, it's diverging away from supply and demand.

It’s becoming just a more of a product of policy than it is of free market fundamentals.”

It’s becoming just a more of a product of policy than it is of free market fundamentals.”

15/ “The more expensive something is- that is a signal to the marketplace and to market actors that it is scarce.

Arbitrary fiat currency supply inflation by legal monopoly..I would argue, actually amplifies divisiveness.”

Arbitrary fiat currency supply inflation by legal monopoly..I would argue, actually amplifies divisiveness.”

16/ “Looking at the connection between the monopolization of money and things like cancel culture.. it's increasing our natural predilection to be combative with one another because we think there's more scarcity in the world than there actually is...

17/ ...versus in a world where you're not increasing the money supply, prices are declining every year. This is a signal to market actors in the market that scarcity is declining. There's less need to fight over things.”

18/ “So if we're not trading with one another, if we're not acting interdependently and we're not becoming more intelligent as a market and that increased intelligence or increased knowledge is reflected in decreased prices because prices are just the exchange ratios of things.”

19/ “So the smarter we can solve problems, the better we can solve problems, the less prices would be. So it induces more cooperation.”

20/ “We commonly think of scarcity as strictly a supply property.., but it's not actually true. Scarcity occurs when demand exceeds supply. So when there's more demand than the supply can justify the thing becomes an economic good and it establishes itself a market price.”

21/ “The unique thing about money as a concept at least is that demand always exceeds supply. There's never enough money to satisfy everyone.”

22/ “Another definition for money is it's the most marketable good. It can be traded for any other good, service, piece of knowledge in the marketplace. So money as the ultimate token of obtaining that something is always scarce as a concept.”

23/ “But the problem with money is that if you can...easily increase its supply, then all of a sudden you can compromise the scarcity of it over time and you can rob people through inflation.”

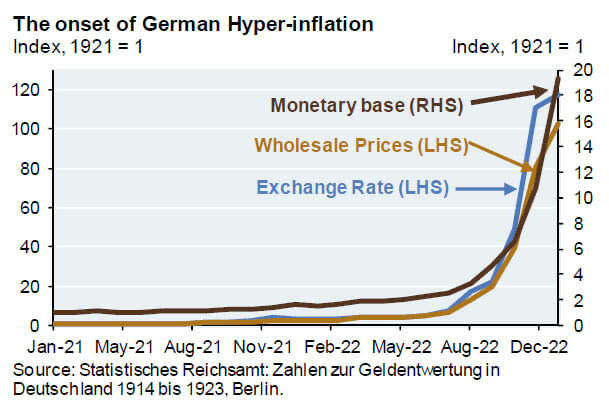

https://twitter.com/anilsaidso/status/1329445616800460802

24/ “You look at something like fiat currency, it's production cost is zero. So there's a reason the market value of fiat currency historically has always converged [towards] zero because its production cost is near zero.”

25/ “What is Bitcoin?

That's a question as complicated as what is money. I think if you get a general understanding of money from a number of angles that we could say, Bitcoin is the most superior monetary technology that has ever existed.”

That's a question as complicated as what is money. I think if you get a general understanding of money from a number of angles that we could say, Bitcoin is the most superior monetary technology that has ever existed.”

26/ “The properties or the services that money renders that human beings value are.. divisibility, durability, recognizability, portability, scarcity.”

27/ “Metals best satisfied those services historically, but Bitcoin, as the most superior monetary technology in human history, essentially perfects them.

It's as close to perfection as we've ever been.”

It's as close to perfection as we've ever been.”

28/ “Clearly something like gold is very durable. It's resistant to degradation over time.

Bitcoin is just pure information, but it's stored in a distributed format. So information stored in a distributed fashion tends to be virtually infinitely durable.”

Bitcoin is just pure information, but it's stored in a distributed format. So information stored in a distributed fashion tends to be virtually infinitely durable.”

29/ “The example I like to give here is something like the Bible.

The Bible is just distributed information. It's stored everywhere and nowhere, so to speak. And for that reason, it has outlasted, empires and Bitcoins similar, or you can't make changes to it.”

The Bible is just distributed information. It's stored everywhere and nowhere, so to speak. And for that reason, it has outlasted, empires and Bitcoins similar, or you can't make changes to it.”

31/ “Central banking was initially designed to be the custodian of gold. They were going to custody the gold and issue paper on top of it..”

32/ “If we could have somehow sent gold across a telecommunications channel, there would have been no need for a central bank. this whole institution itself is rooted in a technological shortcoming of gold.”

33/ “As we became more of a global society, we needed money that can move across space really fast.. So we could trade and international capital markets. So that drove the central bank to become the dominant institution in the world.”

34/ “Gold has been the 𝗴𝗼𝘃𝗲𝗿𝗻𝗼𝗿 𝗼𝗳 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁𝘀 or gold is geopolitical money. it is the base layer operating system that has been the base of their operating system for analog society.”

https://twitter.com/anilsaidso/status/1346559893080141824

35/ “So it's always been about who controls the gold as to who makes the rules. And that's why Bitcoin is so interesting because it is the disruptor to this base level operating system that's functioned for all of human history.”

36/ “Bitcoin is pure information. It can move at the speed of light. Can't get much faster than that.”

37/ “Bitcoin is an idea.

Governments are really good at fighting centralized threats to their power. Whether that's a currency counterfeiter or competing nation state, or business, they don't like, or an individual, they don't like..

But how do you point a gun at an idea?”

Governments are really good at fighting centralized threats to their power. Whether that's a currency counterfeiter or competing nation state, or business, they don't like, or an individual, they don't like..

But how do you point a gun at an idea?”

38/ “A lot of people tend to think of governments as these singular indivisible entities...that move under one plan. But in reality, it's a lot of people... with loosely, coupled interests and agendas.”

39/ “When they're wearing their citizen hat, they're going to see this thing monetizing. They're going to be on the front lines of trying to regulate it, trying to control it.”

40/ “And I think what's likely to happen is they're going to start to adopt it, to buy some of it, even as an individual or possibly even ultimately at a central bank or sovereign wealth fund level as an insurance policy against its success.”

https://twitter.com/anilsaidso/status/1268211283507073029

41/ “Once you start to acquire something and then you have a vested economic interest in its monetization, I think it kind of dissolves any of the power structures that raid against it.”

42/ SOVEREIGNISM

“Based loosely on a book called the sovereign individual...the general thesis is that microprocessing technology would devour our organizational models. The most important of which is the nation state.”

“Based loosely on a book called the sovereign individual...the general thesis is that microprocessing technology would devour our organizational models. The most important of which is the nation state.”

https://twitter.com/anilsaidso/status/1281677133685768192

43/ “I think we're going into this world where coercion and violence is just much less rewarding. the economics of violence are declining because of the low cost of protecting property.”

44/ “You can now protect your monetary property in Bitcoin at orders of magnitude, less costs than is necessary to run a banking network. So it changes the way it changes the way we organize ourselves.”

45/ TOXICITY

“Bitcoin, in my opinion, is this world shattering innovation, but it's in a sea of the most scammy stuff ever.

Anybody can go and create a coin. So it's drawn on a lot of this scam artistry you might say.”

“Bitcoin, in my opinion, is this world shattering innovation, but it's in a sea of the most scammy stuff ever.

Anybody can go and create a coin. So it's drawn on a lot of this scam artistry you might say.”

46/“Bitcoin cultural toxicity evolved as an immune response to those bad ideas.. You don't want a new entrant to the space to get lost in shitcoin jungle and learn the hard way, the way many Bitcoin maximalists have, that the real innovation is Bitcoin.”

https://twitter.com/anilsaidso/status/1343578544111153161

47/ “You could say that the toxicity has a lot of features in the sea of fraudulent projects that steal money from people. It's really useful to make sure that you give people the harsh truth about who is, and isn't a scammer.”

https://twitter.com/anilsaidso/status/1316423300264779776

48/ “But like an immune system, I think it can also go too far. I think it's useful when it’s defending the space from false narratives.., but it becomes detrimental when it's attacking people that are...approaching Bitcoin with...good intention and a desire to learn.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh