1/ $TMUS - very high conviction holding, a few musings. I'd been underwriting to $220 ish on the basis of 15x $15 in FCF/share in 3 years. I see 19.4% IRR based on 15x their guided ("more than") $18bn in FCF by 2026 & adjusting for $60bn buyback.

2/ Some may feel stock right up there and hence missed it but trading at same level as in Nov 20 with super strong FCF growth & buyback story ahead, still looks timely to me and breaking out of 6m sideways trading range:

3/ Guiding to "more than $18bn" in FCF by 26, putting this on 15x and adjusting for $60bn buyback (guided for 2023-25 based on what mgmt consider a "very conservative leverage ratio") gets to $333/ share in 5 years, a very attractive 19.4% IRR.

4/ Mgmt have never missed a guidance line item and don't expect them to start now given the huge structural competitive adv they have now (vs both $VZ and $T) post the spectrum they got from Sprint deal.

5/ They have managed to take consistent share with a good enough but still not as good (esp vs $VZ) network for the last several years.

6/ With now clear best network, which expert calls have reassured competitors can't catch for at least 3 years, odds are high that they will gain market share at an increasing rate as well as having good pricing power giving upside to consensus top-line numbers.

7/ $VZ will have to spend a lot of money to catch up and given its high dividend and $180bn debt load it will not be able to sustain a slashed price policy (which is not in its DNA in any case).

8/ $T also will have to spend a lot of money to have a chance of catching up given a meaningfully inferior network.

9/ $T's high debt load will make it difficult to get too aggressive on price (you can see the appeal for them shoving as much debt onto the media asset as they can get away with and using the transaction with $DISCA as a way to reduce their dividend burden).

10/ Cost out story and synergy acceleration well known but still to play out, with each update likely to nudge synergies higher and faster (these guys a v good at this stuff, as seen with MetroPCS acquisition).

11/ They're already guiding total run-rate synergies 25% higher than original guide, to $7.5bn annual run-rate.

12/ Aggressive handset discounting strategy from AT&T distorting nt competitive picture but still $TMUS doing well (churn coming from Sprint brand, Magenta brand doing well) and that cannot be sustained forever by $T.

13/ 20% of Sprint accounts now migrated onto T-Mobile brand, 50% of traffic now on TMUS network. Faster they can transition, better the churn number will be.

14/ TMUS's 5G advantage will become increasingly important as we move to AR/VR but even before that, much faster speeds from their Ultra Capacity 5G at cheaper prices than VZ or AT&T will be a compelling consumer value proposition.

15/ Reminds me of the point made by Dan Sundheim of D1 Capital (notes from his recent speech at Sohn here:

https://twitter.com/anthonyc3004/status/1392809019761364997?s=20, which has also been made well by Nick Sleep of Nomad — you want to own businesses that offer much more to consumers than they are taking.

16/ Cable competition (and AT&T giving away handsets) is a talking point but structurally $TMUS's huge 5G advantage (which should show itself over the next 12-18 months) as well as brand power and marketing prowess gives confidence that competitive worries will be transient.

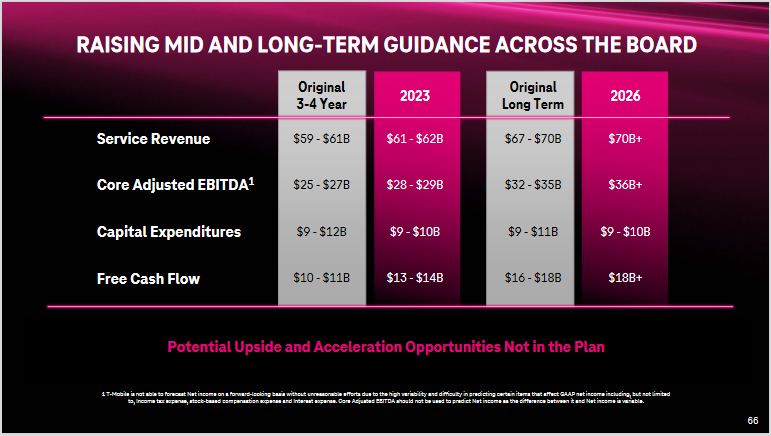

17/ Their confidence came across loud and clear at the recent investor day, with mid and long-term guidance line items raised across the board:

18/ $60bn cash return potential 2023-2025 is 35% of current mkt cap (at a $137 share price). 15x $18bn FCF is $270bn mkt cap by 2026. With 1.247bn shares out, reduce that by 35% to 810m and that's $333 per share, a 19.4% IRR.

19/ In reality they won't be able to buy that many shares at this price so share price will likely be significantly higher. Risk-reward for 2-5 year view skews very favourable to me, low downside, high quality, attractive upside. END.

• • •

Missing some Tweet in this thread? You can try to

force a refresh