$PENDLE is the most undervalued low cap gem in DeFi (~$20mm mkt cap).

Pendle will introduce yield derivatives to the crypto economy as well as a novel AMM specialized for trading time decaying assets.

Behold a brand-new narrative and the next major evolution of DeFi.

1/

Pendle will introduce yield derivatives to the crypto economy as well as a novel AMM specialized for trading time decaying assets.

Behold a brand-new narrative and the next major evolution of DeFi.

1/

Pendle will be the first protocol that will enable the trading of tokenized yields on Ethereum.

For users, Pendle will allow them to tokenize their yields and sell it for upfront cash.

For traders, Pendle will provide the most capital efficient way to speculate on yields.

For users, Pendle will allow them to tokenize their yields and sell it for upfront cash.

For traders, Pendle will provide the most capital efficient way to speculate on yields.

Pendle enables holders of yield generating assets (e.g. lending deposits) to break out their deposits into an ownership token (OT) and a future-yield token (XYT).

OT represents a claim on the underlying asset.

XYT represents a claim on future yields up to a certain date.

OT represents a claim on the underlying asset.

XYT represents a claim on future yields up to a certain date.

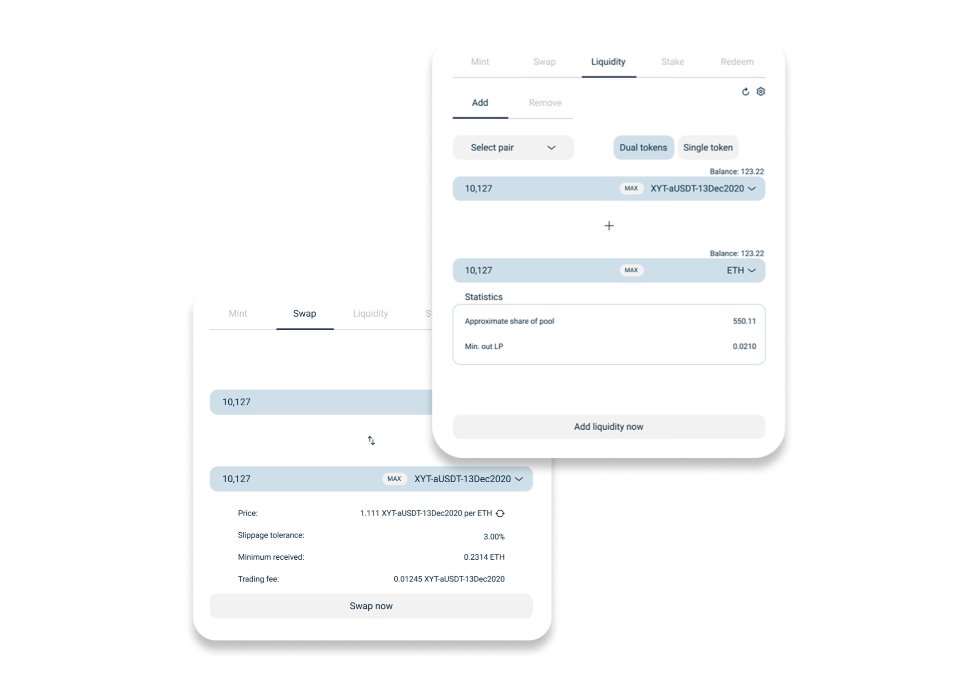

Once a user has minted XYT from Pendle, they can use it for 2 things:

1) XYT can be sold via a futures contract for upfront cash

2) XYT tokens can be LP’ed on Pendle’s AMM to earn additional yield

1) XYT can be sold via a futures contract for upfront cash

2) XYT tokens can be LP’ed on Pendle’s AMM to earn additional yield

Pendle’s AMM for time decaying assets (e.g. yield derivatives, futures, options) is a revolutionary new DeFi primitive.

Up until now it was impossible to trade time decaying assets on an AMM given that doing so would guarantee IL as those assets approach expiry.

Up until now it was impossible to trade time decaying assets on an AMM given that doing so would guarantee IL as those assets approach expiry.

Pendle’s AMM utilizes a shifting AMM curve to prevent IL .

As swaps happen, the AMM curve will shift at the equilibrium point to account for time-decay.

The rate of price reduction tends to accelerate over the duration of a contract period and stops at the expiry date.

As swaps happen, the AMM curve will shift at the equilibrium point to account for time-decay.

The rate of price reduction tends to accelerate over the duration of a contract period and stops at the expiry date.

Pendle’s native token $PENDLE is currently just a governance token.

However, according to the team, Pendle will likely implement a Curve-like gauge system for PENDLE soon, which would align the interests of token holders and LPs as well as provide direct value accrual to PENDLE.

However, according to the team, Pendle will likely implement a Curve-like gauge system for PENDLE soon, which would align the interests of token holders and LPs as well as provide direct value accrual to PENDLE.

The market opportunity is massive for Pendle.

In Tradfi, the yield derivatives market is as large as $524 trillion.

I cannot even fathom how large this market will be for DeFi at maturity.

In Tradfi, the yield derivatives market is as large as $524 trillion.

I cannot even fathom how large this market will be for DeFi at maturity.

If that is not enough, yield derivatives are just the surface level of Pendle’s potential.

Pendle's AMM will be capable of trading ANY time decaying asset on Ethereum in the future, which only further expands the TAM.

Pendle's AMM will be capable of trading ANY time decaying asset on Ethereum in the future, which only further expands the TAM.

What this means is that Pendle will become the first decentralized trading venue for a wide range of derivatives products on Ethereum that do not currently have liquid secondary markets. 🤯

Pendle will be the best of breed platform for time decaying assets.

50%+ market share by end of year is achievable given their first mover advantage and continued leadership in innovation.

This is something that has played out before with $UNI, $MKR, $YFI.

50%+ market share by end of year is achievable given their first mover advantage and continued leadership in innovation.

This is something that has played out before with $UNI, $MKR, $YFI.

Pendle’s investor roster features many of the leading DeFi funds in Asia like Mechanism, Spartan etc…

They also have very prominent angel investors backing the project not pictured in the graphic below.

They also have very prominent angel investors backing the project not pictured in the graphic below.

Pendle will become a building block in DeFi, providing market infrastructure for a variety of assets.

Take a look at other market infrastructure / AMM protocols like $UNI, $CRV.

Is a protocol that is first to market with no competition in a massive category only worth $20mm?

Take a look at other market infrastructure / AMM protocols like $UNI, $CRV.

Is a protocol that is first to market with no competition in a massive category only worth $20mm?

• • •

Missing some Tweet in this thread? You can try to

force a refresh