This one is long overdue.

In this thread I will go over some info you may not of known about one of the top DEX’s in the industry, and what exactly they are about to release...

Let’s begin! 🍣

In this thread I will go over some info you may not of known about one of the top DEX’s in the industry, and what exactly they are about to release...

Let’s begin! 🍣

$SUSHI began with a simple premise:

LP’s on the DEX had the ability to earn protocol governance tokens in rewards, contrary to what $UNI offered at the time.

The idea quickly gained lots of traction, with a vampire attack taking over $1B worth of liquidity from $UNI in 2020

LP’s on the DEX had the ability to earn protocol governance tokens in rewards, contrary to what $UNI offered at the time.

The idea quickly gained lots of traction, with a vampire attack taking over $1B worth of liquidity from $UNI in 2020

Now, the exchange is host to many advanced DeFi products & applications on $ETH, developed by the top names in the industry.

Some hints and actions from the team also led me to believe some massive news is coming very soon for $SUSHI

I’ll go over some of this info below...

Some hints and actions from the team also led me to believe some massive news is coming very soon for $SUSHI

I’ll go over some of this info below...

Onsen

Onsen is a collection of exclusive DeFi liquidity farming pools unique to $SUSHI.

By depositing LP tokens on the DEX, users can begin earning $SUSHI rewards, incentivizing liquidity.

It has grown tremendously since launch, opening up several special collaboration spots

Onsen is a collection of exclusive DeFi liquidity farming pools unique to $SUSHI.

By depositing LP tokens on the DEX, users can begin earning $SUSHI rewards, incentivizing liquidity.

It has grown tremendously since launch, opening up several special collaboration spots

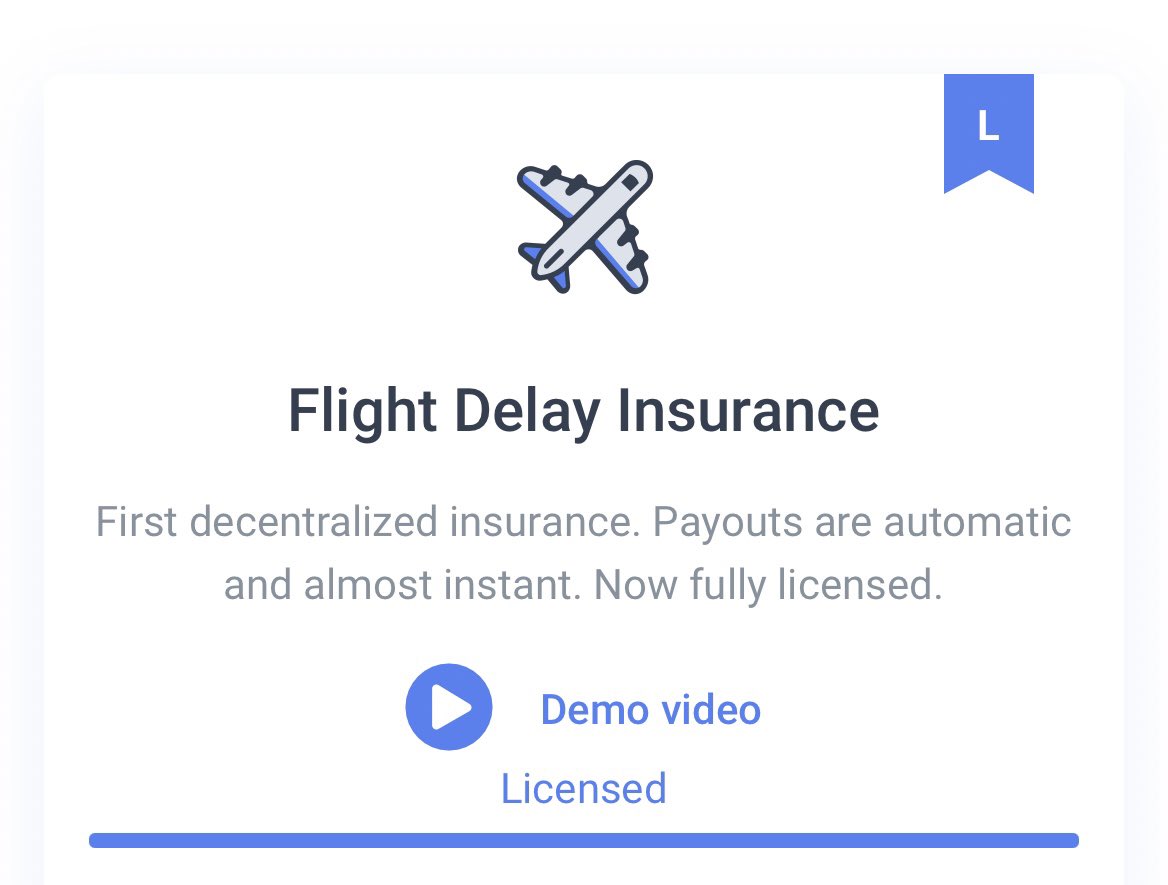

BentoBox

BentoBox is a first of its kind dapp for DeFi combining many dapps into a single permission-less platform for devs & traders

Users can take advantage of its reduced gas costs, passive yield strategies, & more on a simple UI

(BentoBox is like a decentralized App Store)

BentoBox is a first of its kind dapp for DeFi combining many dapps into a single permission-less platform for devs & traders

Users can take advantage of its reduced gas costs, passive yield strategies, & more on a simple UI

(BentoBox is like a decentralized App Store)

Kashi

Kashi is the first of many products to be offered on BentoBox, & it allows users to lend/borrow tokens easily

Lending pairs can be made on any token

Because of this, it offers margin trading for a large number of tokens that are not yet currently available for shorting

Kashi is the first of many products to be offered on BentoBox, & it allows users to lend/borrow tokens easily

Lending pairs can be made on any token

Because of this, it offers margin trading for a large number of tokens that are not yet currently available for shorting

Limit Orders & Stop Losses

In a decentralized fashion, liquidity providers and traders on Sushiswap can set limit orders on various ERC20’s, or even set stop losses to protect their funds

This allows for a completely new and easier level of trading on the DEX

In a decentralized fashion, liquidity providers and traders on Sushiswap can set limit orders on various ERC20’s, or even set stop losses to protect their funds

This allows for a completely new and easier level of trading on the DEX

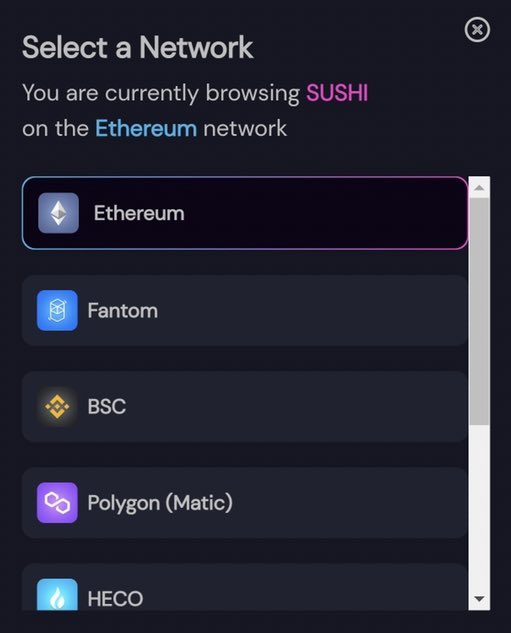

Cross-Chain

Without a word from the team at $SUSHI, the site was silently updated with a stealth launch supporting cross chain trading just last week

Sushiswap now supports $ETH, $FTM, $BNB, $MATIC, $HECO, $XDAI, $ONE, & $AVAX

Further integration with $DOT is planned

Without a word from the team at $SUSHI, the site was silently updated with a stealth launch supporting cross chain trading just last week

Sushiswap now supports $ETH, $FTM, $BNB, $MATIC, $HECO, $XDAI, $ONE, & $AVAX

Further integration with $DOT is planned

MISO

MISO offers a customizable “no-code” token launch interface utilizing $SUSHI

It has the potential to drive some serious value proposition to the DEX, outside of what it already serves for.

V2 of MISO will consist of more complex options for users, auctions, and more!

MISO offers a customizable “no-code” token launch interface utilizing $SUSHI

It has the potential to drive some serious value proposition to the DEX, outside of what it already serves for.

V2 of MISO will consist of more complex options for users, auctions, and more!

SushiBar

The SushiBar is yet another feature unique to $SUSHI, offering an easy way to earn yield for holders of the token.

Everything mentioned here has a swap fee that is taken & distributed to $SUSHI stakers

Significant amounts of $SUSHI have been locked for this purpose

The SushiBar is yet another feature unique to $SUSHI, offering an easy way to earn yield for holders of the token.

Everything mentioned here has a swap fee that is taken & distributed to $SUSHI stakers

Significant amounts of $SUSHI have been locked for this purpose

All of this information so far is exciting... However, let’s now take an even deeper look at what they propose for the upcoming upgrade of the DEX

MIRIN refers to a set of upgrades which may just top $UNI in terms of capital efficiency

I’ll discuss what this includes below...

MIRIN refers to a set of upgrades which may just top $UNI in terms of capital efficiency

I’ll discuss what this includes below...

Franchised Pools

The soon to be released franchised pool feature of $SUSHI appears to be an aim to drive CeFi liquidity to DeFi, in a way that is attractive to both parties

Exchanges like Binance could create a franchised pool with benefits of more yield & malleable parameters

The soon to be released franchised pool feature of $SUSHI appears to be an aim to drive CeFi liquidity to DeFi, in a way that is attractive to both parties

Exchanges like Binance could create a franchised pool with benefits of more yield & malleable parameters

Automated Yield Rebalancing

Utilizing KP3R, $SUSHI has come up with a plan for increasing yield on the DEX

Farmers can soon turn on automation, having their funds swapped to the highest APY pools automatically

Furthermore, Keep3rs will be able to auto compound the rewards

Utilizing KP3R, $SUSHI has come up with a plan for increasing yield on the DEX

Farmers can soon turn on automation, having their funds swapped to the highest APY pools automatically

Furthermore, Keep3rs will be able to auto compound the rewards

1-Click Zaps (Inari)

$SUSHI V3 will have a zap feature making multiple transactions across several DeFi protocols possible, at a reduced gas cost.

This can make up of adding collateral, staking, and more all in a single one-click transaction

Some examples are shown here below:

$SUSHI V3 will have a zap feature making multiple transactions across several DeFi protocols possible, at a reduced gas cost.

This can make up of adding collateral, staking, and more all in a single one-click transaction

Some examples are shown here below:

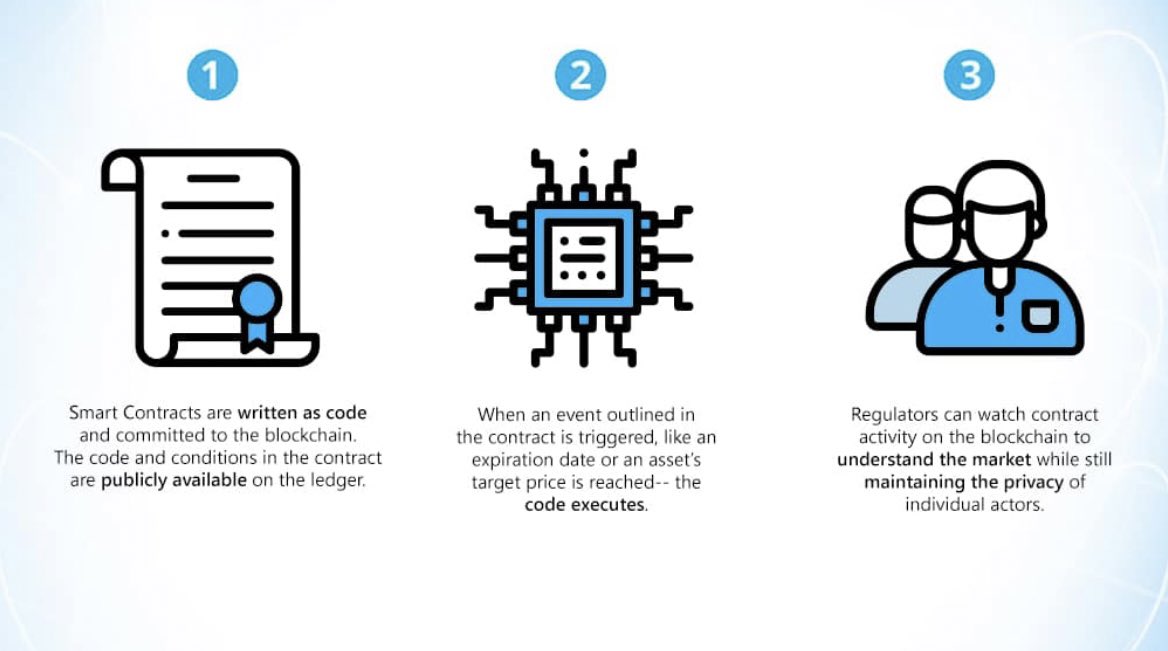

Deriswap

Deriswap, built by AC in collab with $SUSHI, combines swaps, options, loans & more into a single efficient contract between the two assets in a pair

It will change everything for the currently segmented liquidity market across $UNI, $BNT, $AAVE, and $COMP we see today

Deriswap, built by AC in collab with $SUSHI, combines swaps, options, loans & more into a single efficient contract between the two assets in a pair

It will change everything for the currently segmented liquidity market across $UNI, $BNT, $AAVE, and $COMP we see today

NATTO

Sushiswap V3 will include an interesting NFT exchange, which will open up a suitable market for $UNI V3 LP token holders

Franchised stores, auctions, & bidding will be made possible

This NFT exchange will be gas optimized, with a marketplace and studio for #NFT fans

Sushiswap V3 will include an interesting NFT exchange, which will open up a suitable market for $UNI V3 LP token holders

Franchised stores, auctions, & bidding will be made possible

This NFT exchange will be gas optimized, with a marketplace and studio for #NFT fans

Layer Two

$SUSHI is already exploring gas optimization tests, and there is some discussion about Sushiswap launching on @zksync, a zero knowledge proof rollup.

This would bring transaction fees and timing on $SUSHI to less than a tenth of that currently on the $ETH main-net

$SUSHI is already exploring gas optimization tests, and there is some discussion about Sushiswap launching on @zksync, a zero knowledge proof rollup.

This would bring transaction fees and timing on $SUSHI to less than a tenth of that currently on the $ETH main-net

As I’m sure you can tell by now, $SUSHI has one of the top dev teams in the industry when it comes to new features being added to the DEX

But this isn’t even where things get the most exciting...

Just take a look at the staggering numbers being pulled by $SUSHI at the moment 👇🏻

But this isn’t even where things get the most exciting...

Just take a look at the staggering numbers being pulled by $SUSHI at the moment 👇🏻

Volume

The volume on $SUSHI compared to $UNI is nothing short of astounding

$SUSHI has even surpassed $UNI V3 in volume on certain occasions with over $1B daily, a trend I think will continue due to their continuous developments & traditional LP token model

Take a look👇🏻

The volume on $SUSHI compared to $UNI is nothing short of astounding

$SUSHI has even surpassed $UNI V3 in volume on certain occasions with over $1B daily, a trend I think will continue due to their continuous developments & traditional LP token model

Take a look👇🏻

TVL

Even more impressive than volume, is the total value locked in $SUSHI by users who are earning yield by lending, borrowing, or staking their holdings

Despite such difference in terms of market capitalization, the TVL of $SUSHI is nearly that of $UNI, by a very close margin

Even more impressive than volume, is the total value locked in $SUSHI by users who are earning yield by lending, borrowing, or staking their holdings

Despite such difference in terms of market capitalization, the TVL of $SUSHI is nearly that of $UNI, by a very close margin

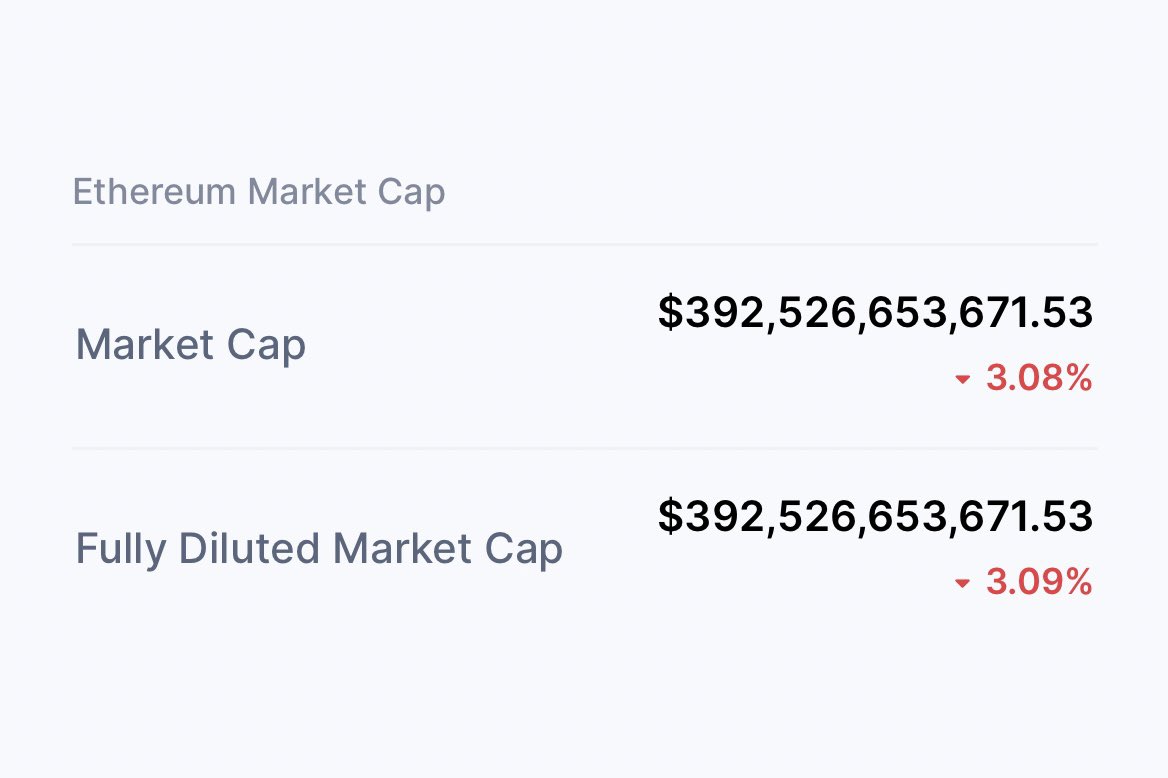

Market Capitalization

When comparing $SUSHI market capitalization to $UNI, it will become quite clear just how undervalued $SUSHI really is...

$SUSHI - $3.6B mcap

$UNI - $18.4B mcap

All of the products currently on Sushiswap accrue value to the $SUSHI token

When comparing $SUSHI market capitalization to $UNI, it will become quite clear just how undervalued $SUSHI really is...

$SUSHI - $3.6B mcap

$UNI - $18.4B mcap

All of the products currently on Sushiswap accrue value to the $SUSHI token

Because I know this is a lot of information to retain at once, I’ll lay out the key points and products by $SUSHI below:

-Onsen

-BentoBox

-Kashi

-Limit orders

-Stop losses

-SushiBar

-Cross-chain

-MISO

-Auto yield rebalancing

-One-click zaps

-Deriswap

-NATTO

-Zk roll ups

-Onsen

-BentoBox

-Kashi

-Limit orders

-Stop losses

-SushiBar

-Cross-chain

-MISO

-Auto yield rebalancing

-One-click zaps

-Deriswap

-NATTO

-Zk roll ups

-More than $1B daily volume on multiple occasions

-$4B+ in total value locked

-Less than 1/5th of $UNI mcap

-All of their products accrue value to $SUSHI from swap fees

Extra points:

-Only “meme coin” name on Coinbase

-Community owned

-Fairly launched, no private sales, or vc’s

-$4B+ in total value locked

-Less than 1/5th of $UNI mcap

-All of their products accrue value to $SUSHI from swap fees

Extra points:

-Only “meme coin” name on Coinbase

-Community owned

-Fairly launched, no private sales, or vc’s

In conclusion I am very bullish on $SUSHI and a big fan of Sushiswap in general.

The upcoming V3 upgrade will prove to be a formidable challenger to $UNI, and it will change capital efficiency on DEX’s as we know it today

I hope you guys enjoy! 🥐

coingecko.com/en/coins/sushi

The upcoming V3 upgrade will prove to be a formidable challenger to $UNI, and it will change capital efficiency on DEX’s as we know it today

I hope you guys enjoy! 🥐

coingecko.com/en/coins/sushi

• • •

Missing some Tweet in this thread? You can try to

force a refresh