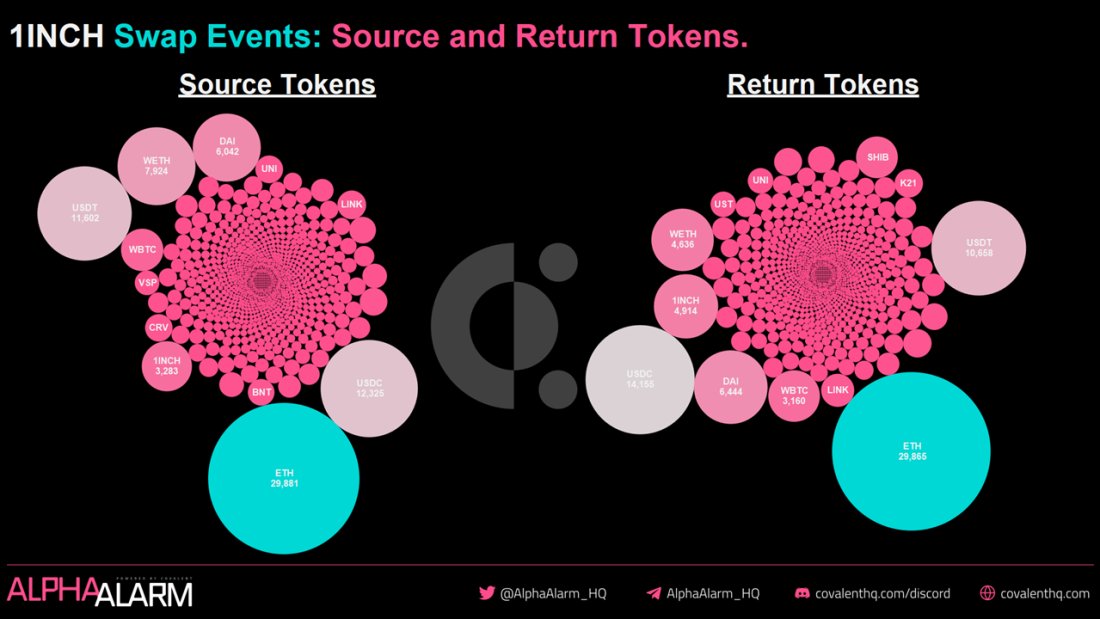

1/ 1inch Swap Events: Source & Return tokens.

There were over 1600 unique tokens swapped on 1inch across a total of 129934 swap events from March 15th to May 18th.

Top 5 source assets: ETH, USDC, USDT, WETH, and DAI.

Top 5 return assets: USDC, USDT, DAI, and 1INCH.

There were over 1600 unique tokens swapped on 1inch across a total of 129934 swap events from March 15th to May 18th.

Top 5 source assets: ETH, USDC, USDT, WETH, and DAI.

Top 5 return assets: USDC, USDT, DAI, and 1INCH.

2/ In our second graphic, we examine the total dollar values for each source and return token swapped on 1inch. These graphics display the top 25 assets for each category. In total, there was over $11.7 Billion in tokens swapped across 1Inch from March 15th to May 18th.

3/ Total swaps per day on ETH, BSC, and Matic.

BSC dwarfed ETH, most likely due to low gas fees.

On May 13th, 1Inch launched on Polygon (MATIC), which quickly attracted volume, surpassing ETH on May 18th!

In total:

-143,467 ETH Swaps.

-939,946 BSC Swaps.

-13,368 Matic Swaps.

BSC dwarfed ETH, most likely due to low gas fees.

On May 13th, 1Inch launched on Polygon (MATIC), which quickly attracted volume, surpassing ETH on May 18th!

In total:

-143,467 ETH Swaps.

-939,946 BSC Swaps.

-13,368 Matic Swaps.

This thread was prepared by @adamxyzxyz. More on the way in a bit!

• • •

Missing some Tweet in this thread? You can try to

force a refresh