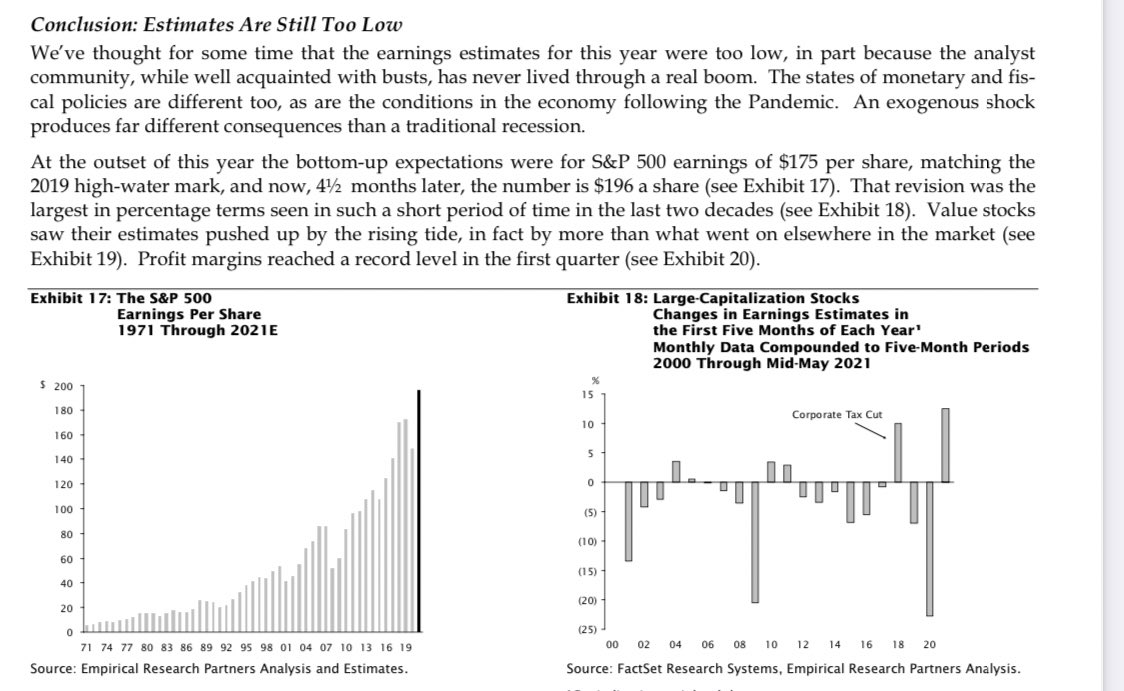

Empirical writes: “We’ve thought for some time that the earnings estimates for this year were too low, in part because the analyst community, while well acquainted with busts, has never lived through a real boom”

Rapid NGDP growth yields massive incremental margins for traditional businesses that are asset intensive and/or high fixed cost. The argument for the level of growth mattering more than rate of change is that high absolute levels mean earnings estimates remain too low.

https://twitter.com/modestproposal1/status/1392557608763072513

This reconciles the “conundrum” of market doing so well when the economy did so poorly

A sideways choppy market as earnings explode and investors wrestle with post stimulus growth and rates seems reasonable

But dramatic overvaluation is harder to argue if estimates are right

A sideways choppy market as earnings explode and investors wrestle with post stimulus growth and rates seems reasonable

But dramatic overvaluation is harder to argue if estimates are right

I love the way @GavinSBaker framed the standard "value/growth" dichotomy as actually a matter of GDP sensitivity. Far better way to frame opportunities.

gavin-baker.medium.com/fear-is-the-mi…

gavin-baker.medium.com/fear-is-the-mi…

I have long suspected it's not inflation/rates that drove the value/growth differential everyone talks about, it's NGDP growth, those were indirect proxies that historically had stable relationship to NGDP growth. Thinking in terms of GDP sensitivity is a very sensible framework.

• • •

Missing some Tweet in this thread? You can try to

force a refresh