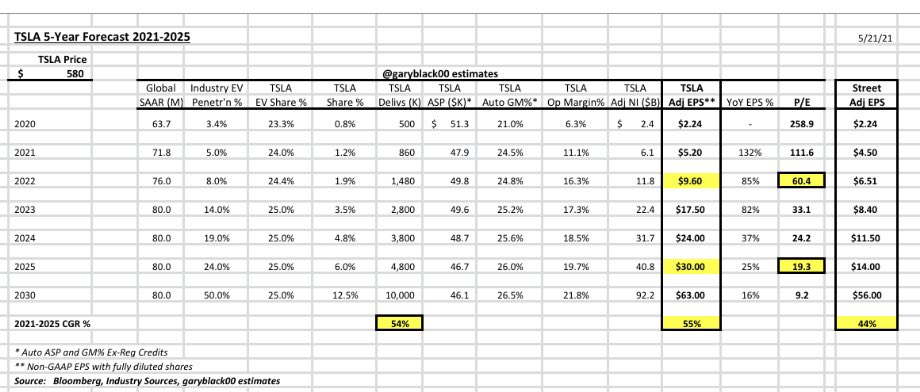

The debate between $TSLA longs and shorts comes down to this: Will the slew of new EV competition cause TSLA growth to slow as EV adoption soars? As EV % goes from 3% to 24% by 2025 (50%+ CGR), will TSLA hold its current 23% EV share (so TSLA CGR also 50%+)? Shorts say no.

2/ There’s no debate about my 2025 P/E of 50x if vol growth continues at 50%+ CGR. It’s math. The debate is over what will $TSLA ‘s growth rate be as new EV competition comes in. Shorts naively assume growth reverts to the mean as ICE mfrs respond with new EVs of their own.

3/ What shorts miss: a) $TSLA TAM keeps expanding to new categories (CUV, pickups, <€25k), and b) TSLA demand is still constrained by lack of supply. FY’22 is setting up as repeat of FY’20 as we get combo of entry to new segments (pickups) and simultaneous double in capacity.

4/ FY’20 was a disaster for shorts who never saw the TAM expansion from $TSLA entering CUVs (40% share of market), China (bigger EV market than US) and simultaneously doubling capacity. With CyTruck, M-A, and Berlin/Austin coming on stream, FY’22 is the same setup as FY’20.

• • •

Missing some Tweet in this thread? You can try to

force a refresh