$NKLA negative news flow likely to get much worse: Hanwa, one of two of NKLA’s remaining strategic partners (Iveco other) with 1 board seat, is cutting its 5.6% stake in half, so $175M in stock sales at same time NKLA is trying to raise $100M secondary. Here’s what I see next:

1/ Trevor sells remaining 83M shares (21% stake). Trevor likely hasn’t sold his remaining $NKLA shares so he can cut a better deal with SEC on fraud charges (no cash, unclear NKLA value post-SEC settlement). I believe Trevor will sell his remaining shares once he reaches a deal.

2/ 4/30 lockup expiration - In addition to Trevor’s 83.3M shares, on May 1 the remaining 136.7M NKLA shares subject to lock-up held by execs, board, and partners can be sold, bringing total float to 386M (from 166M). All this cashing out will put huge pressure on $NKLA shares.

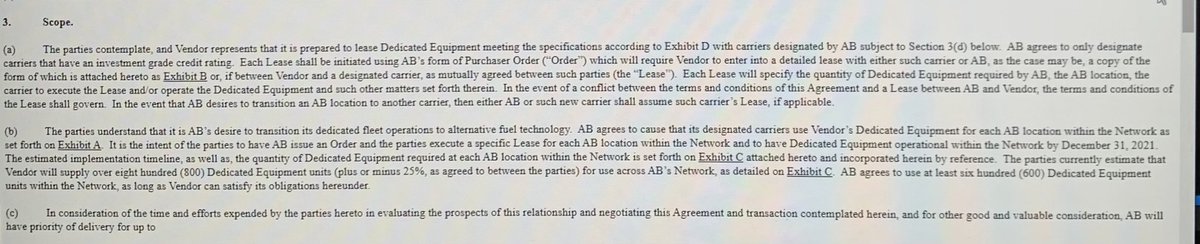

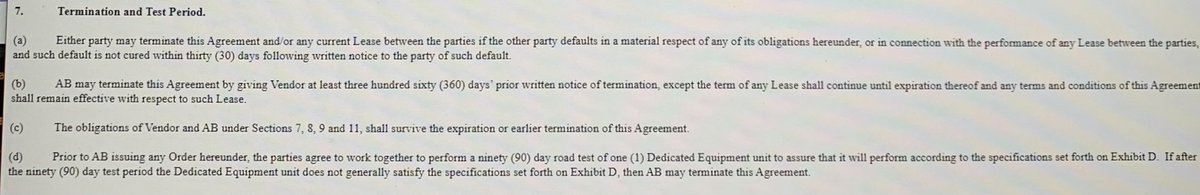

3/ AB truck order likely to be cancelled 12/31. $NKLA ‘s only remaining order for 800 hydrogen fueled trucks by Anheuser-Busch likely to be cancelled on 12/31 if NKLA fails to deliver the first of its hydrogen trucks, as specified by the 2/22/18 agreement (see Sec 3 and 7 below).

4/ Exhibit - Master Agreement between Anheuser Busch and Nikola Motor

$NKLA 2020 10-K

Filed 2/25/2021

Exhibit 10.16

sec.gov/Archives/edgar…

$NKLA 2020 10-K

Filed 2/25/2021

Exhibit 10.16

sec.gov/Archives/edgar…

Disclosure: I remain short $NKLA

$NKLA likely to reach settlement with SEC on fraud charges within next few weeks. Hard to raise $100M from institutional SH in front of SEC fraud settlement. I est $50M-100M deal which would also avoid DOJ action. Would not resolve ~$5B Borteanu class action for securities fraud.

• • •

Missing some Tweet in this thread? You can try to

force a refresh