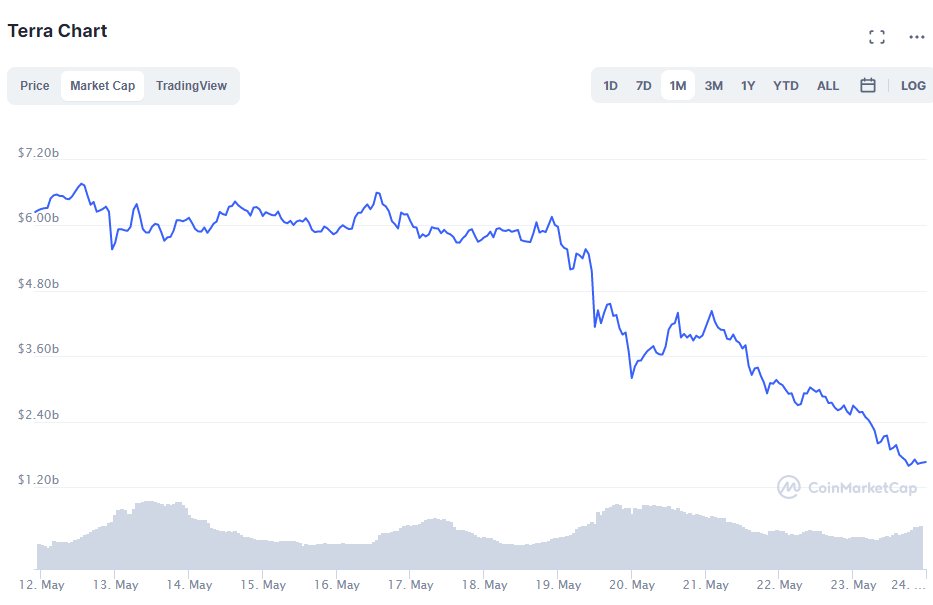

The Terra UST stablecoin could collapse in a bank run effect. UST is backed by an endogenous collateral Luna. Current Luna marketcap has fallen to arguably < outstanding UST. We are now in a dangerous spiral: as users panic out of UST, this reinforces the Luna crash further.

The Terra design is based on endogenous collateral, or seigniorage shares: the value of Luna derives in a ~self-fulfilling way from the anticipated usage of UST. While this brought benefits on the upside, it is now materializing in dangerous spirals on the downside.

Is the system underwater? It's hard to say precisely. On paper, Luna FDNV is still ~2x the 2b UST supply, but measures of circulating marketcap are only ~0.8x. Even the optimistic 2x number would be very unhealthy though given the spiral effect on endogenous collateral.

In our research, we've consistently warned about risks in endogenous collateral, like what is materializing now. It's why I'm highly skeptical of seigniorage shares designs for a primary mechanism.

Read more in our paper here

👉 arxiv.org/abs/2006.12388

Read more in our paper here

👉 arxiv.org/abs/2006.12388

fwiw I reached out to the Terra team yesterday when I saw this possibility. I hope there are some extra cushions in place to help Terra weather this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh