7th Post on Q4FY21 Results

Businesses covered:

~AU Small Finance Bank

~Bandhan Bank

~CreditAccess Grameen

~Ujjivan Small Finance Bank

Businesses covered:

~AU Small Finance Bank

~Bandhan Bank

~CreditAccess Grameen

~Ujjivan Small Finance Bank

1/

AU Small Finance Bank

• PAT up 39% YoY in Q4

• AUM up 22% YoY & deposits up 38% YoY despite flat disbursements in FY21

• GNPAs rose to 4.3%

• Overall collection efficiency at >120% in Q4

Detailed Notes: bit.ly/3wsf4do

AU Small Finance Bank

• PAT up 39% YoY in Q4

• AUM up 22% YoY & deposits up 38% YoY despite flat disbursements in FY21

• GNPAs rose to 4.3%

• Overall collection efficiency at >120% in Q4

Detailed Notes: bit.ly/3wsf4do

2/

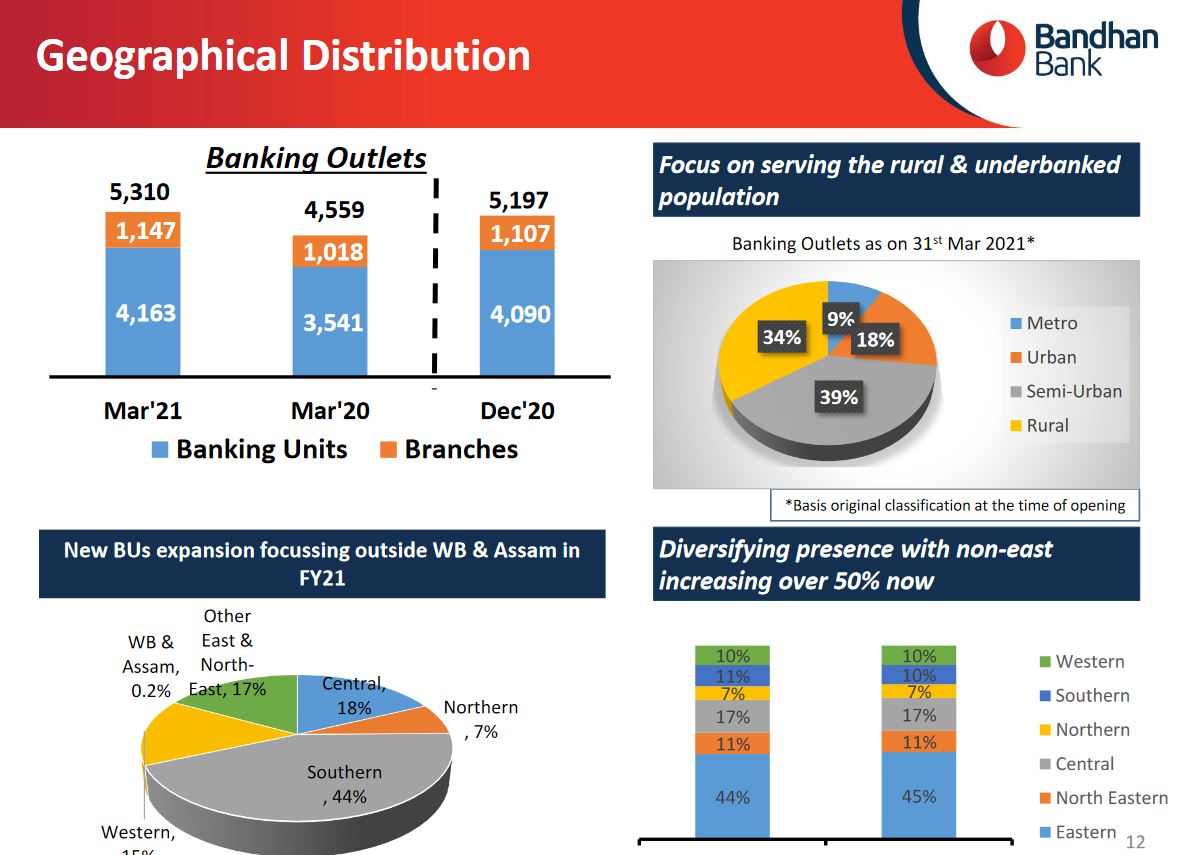

Bandhan Bank

• Revenues up 13% YoY & NII up 4.6% YoY in Q4

• Added 5 Lac customers in Q4 & 29 Lac in FY21

• GNPAs rose to 6.8%

• Interest reversal of Rs 525 Cr in Q4

• Collection efficiency in WB @ 98.3% & Assam @ 83%

Detailed Notes: bit.ly/3yAmHQP

Bandhan Bank

• Revenues up 13% YoY & NII up 4.6% YoY in Q4

• Added 5 Lac customers in Q4 & 29 Lac in FY21

• GNPAs rose to 6.8%

• Interest reversal of Rs 525 Cr in Q4

• Collection efficiency in WB @ 98.3% & Assam @ 83%

Detailed Notes: bit.ly/3yAmHQP

3/

CreditAccess Grameen

• Customer base declined by over 2.4 Lacs

• Disbursements rose by 42% YoY for CAGL & 41% YoY for MMFL

• GNPAs at 4.43%

• Collection efficiency in CAGL @ 97% & MMFL @ 91%

• MMFL integration to be done by H1

Detailed Notes: bit.ly/2T5NPa2

CreditAccess Grameen

• Customer base declined by over 2.4 Lacs

• Disbursements rose by 42% YoY for CAGL & 41% YoY for MMFL

• GNPAs at 4.43%

• Collection efficiency in CAGL @ 97% & MMFL @ 91%

• MMFL integration to be done by H1

Detailed Notes: bit.ly/2T5NPa2

4/

Ujjivan Small Finance Bank

• Rev decline 9% YoY

• Highest ever quarterly disbursement which was up 2.2x YoY

• GNPAs at 7.1%

• Collection efficiency @ 94%

• Added 15 Lac new customers in Q4

Detailed Notes: bit.ly/3hWuOBc

Ujjivan Small Finance Bank

• Rev decline 9% YoY

• Highest ever quarterly disbursement which was up 2.2x YoY

• GNPAs at 7.1%

• Collection efficiency @ 94%

• Added 15 Lac new customers in Q4

Detailed Notes: bit.ly/3hWuOBc

All the four updates together here:

bit.ly/3ubaVJr

L&R for wider reach if you find value in our work.

bit.ly/3ubaVJr

L&R for wider reach if you find value in our work.

• • •

Missing some Tweet in this thread? You can try to

force a refresh