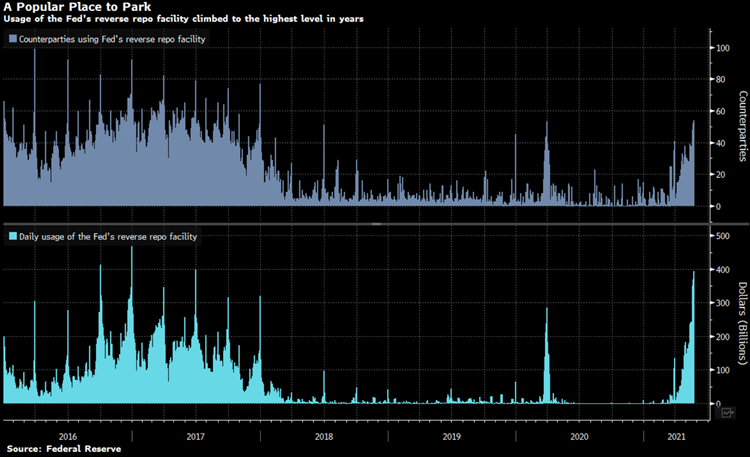

What is the Fed's RRP (Reverse Repo Program)? The "Fed Open Market Trading Desk" sells a security (SOMO) with an agreement to repurchase it at a specified price & time in the future. It helps protect the Fed funds rate and absorbs near term liquidity. Why is this so important?

As the size of RRP increase, it usually signifies the market is saturated with liquidity and tapering will be close(6 months?) Banks have various options to invest excess liquidity, but rising gov't transfer, excess corporate cash, & limited bank loans increase cash on hand.

The Loan-to-Deposit (LDR) is Total Loans/Total Deposits, which ideally is near .8 or said a different way the bank invested $.80 of every $1 received. In the current market, the bank has made limited loans due to shrinking opportunities & returns married with MASSIVE deposits.

The Fed's RRP takes the excess liquidity onto their sheets (temporarily) to keep the O/N from going negative and keep the Fed Funds Rate "range". These funds will be held at the Fed either O/N or an agreed time period discussed earlier.

Banks are trying manage liabilities, but by the Fed maintaining easy monetary policy pressure will mount on bank balance sheets increasing the size of the RRP. It offers a short term solution for a long term problem because the excess money only temporarily leaves the system.

It is the same way as taking flood water and moving it away from the dam about to breach, but only dumping it back up the river hoping the flood subsidies by the time the water comes back downstream.

• • •

Missing some Tweet in this thread? You can try to

force a refresh