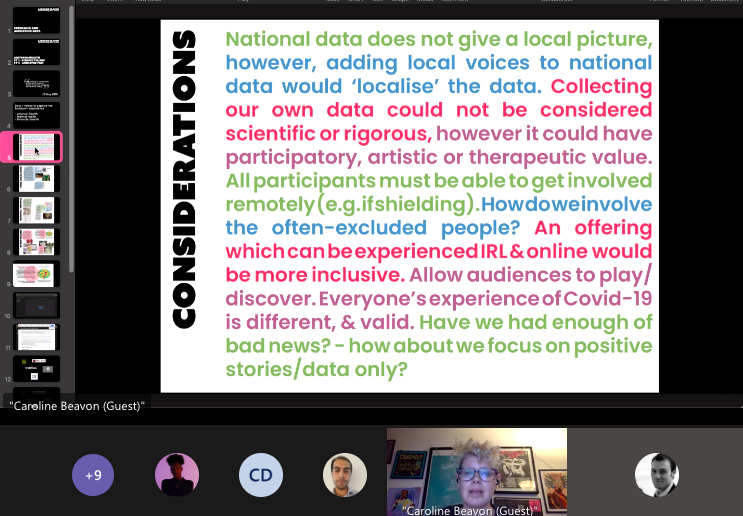

THREAD! I've reverse-engineered @jimwaterson's excellent article on sex-worker social media platform OnlyFans to show you how to find all sorts of stories in company accounts. Here's the article - theguardian.com/culture/2021/m… - now let's begin...🧵

#bcujournos

#bcujournos

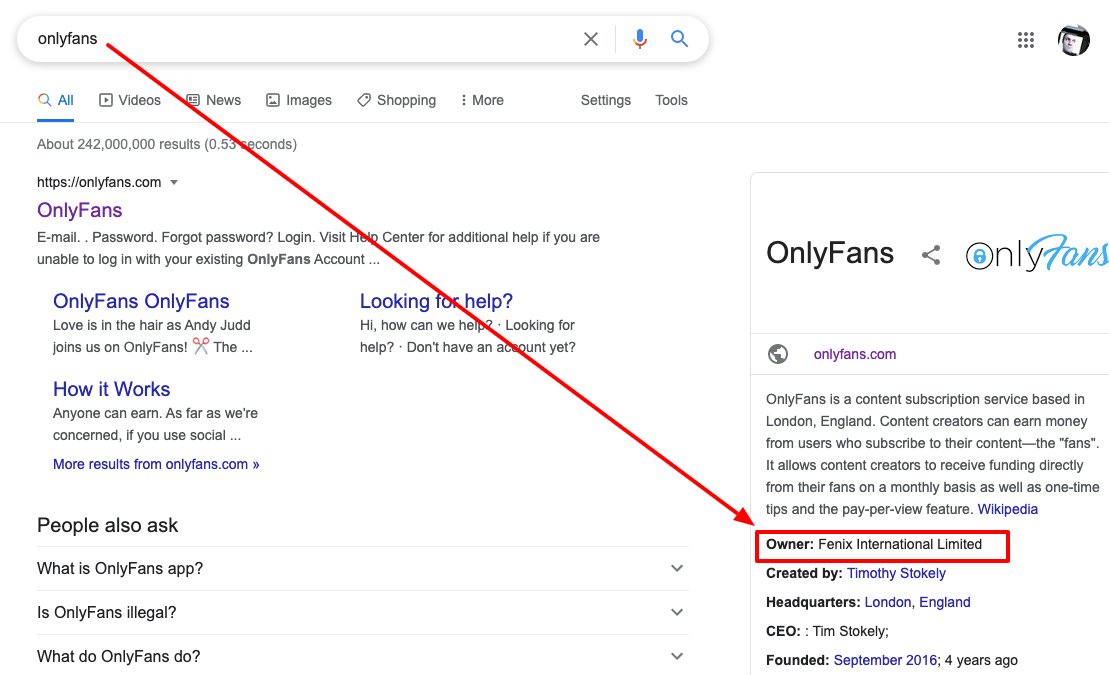

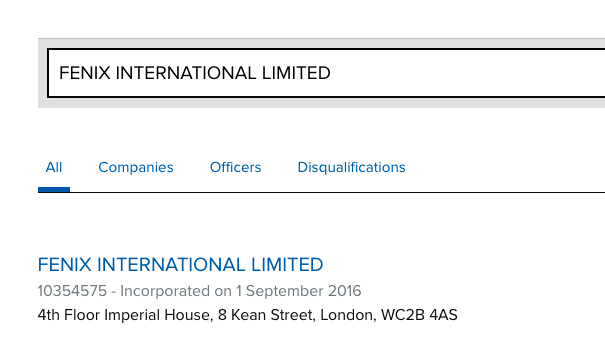

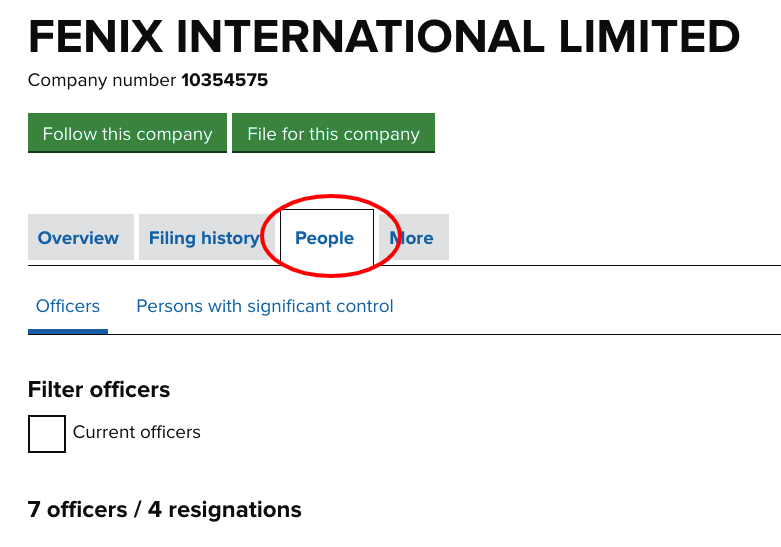

2/ First, you need to locate the company behind OnlyFans. It's not called OnlyFans so you can either Google it, or look for an 'About' section on the site that leads you to the company - in this case, Fenix International Limited

3/ Search for the company on Companies House …te.company-information.service.gov.uk/company/103545… - the About page information on the director and address can be used to confirm that you have the right company

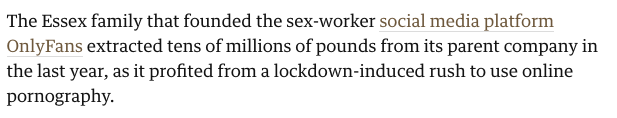

4/ The story starts by reporting that the founders "extracted tens of millions of pounds from its parent company in the last year". I'll come on to how that's established - but note re. libel that company accounts come under qualified privilege legislation.gov.uk/ukpga/1996/31/…

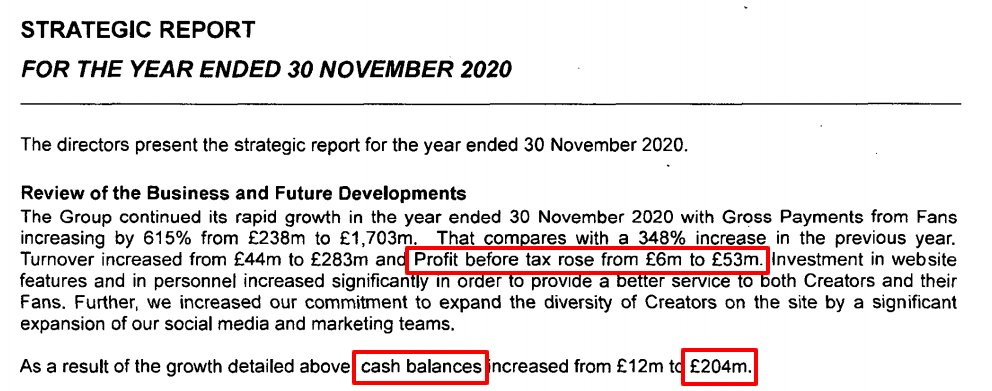

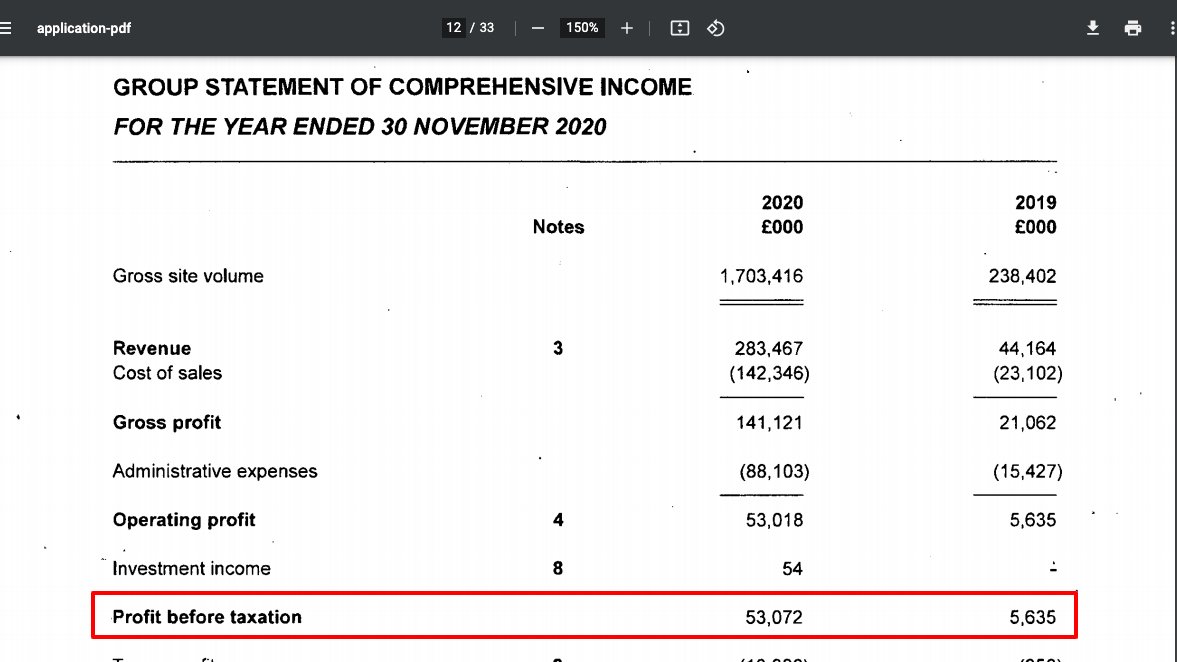

5/ With that carrot dangled, we establish some context: business is booming — a 615% increase in the year up to November 2020 (the period that the accounts cover) to £1.7bn. That's information from the "strategic report" on page 1...

6/ ...but if it hadn’t been there, you could also have found it in the first line of the statement of income, normally found after all the initial waffle in a set of accounts (it comes on p9) 💰💰💰

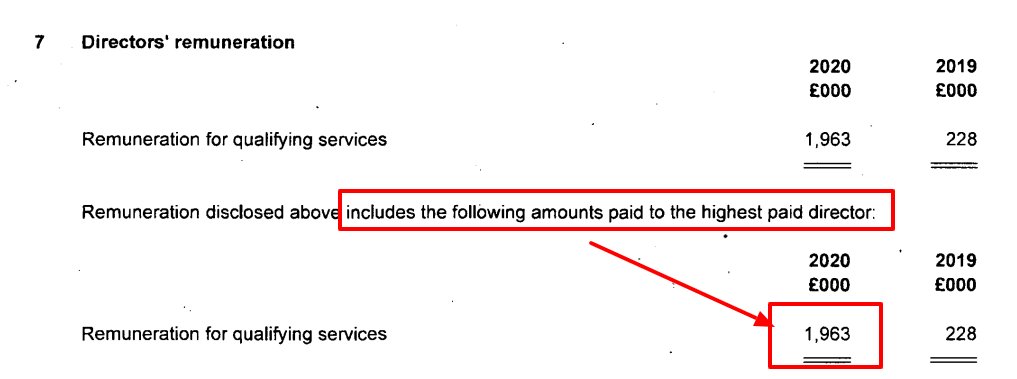

7/ Next up: director pay. This is often compared with workers' pay - but in this case most of the 'workers' aren't directly employed, so instead the juxtaposition is with the claims that it makes about payments to 'creators'

8/ Director pay normally comes in the notes to the accounts - in this case note 7 relating to Directors’ remuneration. Look for the 'highest paid director' as a separate line to directors overall. #bcujournos

9/ You can also work out how big an increase a director has had — in this case it's a 760% pay rise: divide the increase of £1,735,000 by the previous year's pay of £228,000 to work this out (times the result by 100 to get the figure as a percentage change)

10/ Next up: "and it paid £20m in dividends to its backers." This is also in the notes to the accounts. #bcujournos

11/ What about those tens of millions of pounds extracted? This detail is in another note - 21 - on Events after the reporting date. This type of note details anything important that happened after the financial year being reported on.

12/ But how does @jimwaterson know the company that was bought by Fenix for £23m is connected with the founders? For this you need to search for more information on that company, and look at the directors section:

13/ There's more to come on that £23m - but first, some interesting detail on "illegal underage material" and videos related to trafficking. This comes from the ‘Principal Risks and Uncertainties’ section at the front of a company's accounts - often a good source of stories

14/ Company accounts can also be useful for context - a brief paragraph of the relative success of this company can be based on checking the accounts of "long-established mainstream British media companies" to see if their growth is similar (on revenue, profit etc) #bcujournos

15/ More background in the next paragraph is also taken from the first page of the company's accounts. This is translated into simpler language (“fans signing on” becomes “customers”)

#bcujournos

#bcujournos

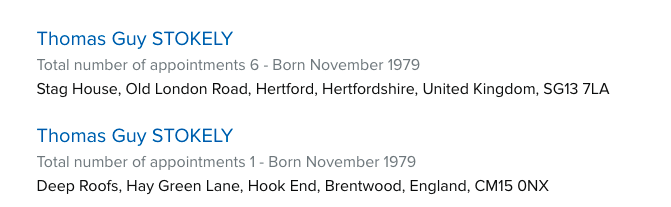

16/ The info on profit is on page 1 too but can be found in the cash flow statement if it's not. Cash held is in the balance statement.

Translating the jargon is important: "cash balances" in the accounts is translated to "held in cash" for the reader.

#bcujournos

Translating the jargon is important: "cash balances" in the accounts is translated to "held in cash" for the reader.

#bcujournos

17/ Family connections! @jimwaterson next tells us about the sister who was a former director. This paragraph draws on information you can find on Companies House by looking at the People tab for the company... …te.company-information.service.gov.uk/company/103545… #bcujournos

18/ ...her brother Tom, however, isn’t listed here. Instead knowledge of his role comes from background research, such as this BuzzFeed article which also provides that information on the increase in signups after a Beyonce mention buzzfeednews.com/article/otilli…

19/ ...To map the family network further you could click on each director’s name to see what other directorships they hold/have held, and search for their name - directors often have multiple entries …te.company-information.service.gov.uk/search/officer…

20/ ...Now @jimwaterson returns to the purchase of that company owned by the founders. Was it worth £23m? To find out we can dig into the accounts of that company …te.company-information.service.gov.uk/company/086624… - this also allows us to establish who controlled the company and when it was bought...

21/ We can investigate whether this company was worth £23m by seeing how much business the company was doing before it was bought. Check which accounts cover a period before the acquisition - they are likely to have been published *after*... …te.company-information.service.gov.uk/company/086624…

#bcujournos

#bcujournos

22/ Those are ‘exemption' accounts, meaning that they don't include details on how much money was coming into the business — but we can tell that the company wasn't doing enough business - "more than £10.2 million" - to be required to publish that... gov.uk/government/pub…

23/ ...What we *can* see, though, is the balance sheet of what it owns and owes. The company only had £4,468 in the bank and its assets had dropped by 74%...

24/ ...The balance sheet also shows the "shareholders’ funds" - described by Investopedia as "the amount that would be returned to shareholders if all a company's assets were liquidated and all its debts repaid” investopedia.com/ask/answers/08… - as being in negative figures

25/ ...There's a final par on the business being sold a couple years ago. Again this can be found in the filing history of the company and the last notification of a person with significant control, in October 2018 BUT...

26/ ...A *quicker* way of seeing when the business was bought is to look under the People tab, and switching to the Persons with significant control sub-section, which also says when the notification was made …te.company-information.service.gov.uk/company/103545…

27/ ...Of course, now you've got his name and month of birth you can look at what other companies he owns, not just in the UK but, using @opencorporates, in other jurisdictions too

28/ And this is all from just ONE article. How did @jimwaterson get the idea? It may be as simple as setting up an alert for companies of interest: create a (free) account on Companies House & you can 'follow' any company to get free email alerts when they post a new filing

29/ (Thanks to @FraserJopp for pointing out that the highest paid director amounts from year to year might not be a 'raise' because the director may have changed in that time - so use phrases like "the amount paid to the highest paid director rose by X%")

https://twitter.com/FraserJopp/status/1397205464006414344

30/ There are plenty more stories you can get from company accounts - here are just 9 ideas onlinejournalismblog.com/2020/03/04/how… #bcujournos

• • •

Missing some Tweet in this thread? You can try to

force a refresh