We’re starting to see some nervousness amongst market participants with regard to rates moves and the positioning.

All my positioning trackers continue to show market quite short rates, though there has been some decent change by some players.

1/x

All my positioning trackers continue to show market quite short rates, though there has been some decent change by some players.

1/x

In particular a couple things strike me:

CTAs are now NOT forced sellers. Ie a move higher in rates is not making them increase their FI shorts.

Here is the current positioning, and a move of 10bps higher in the next month will not force them to add to their shorts.

2/x

CTAs are now NOT forced sellers. Ie a move higher in rates is not making them increase their FI shorts.

Here is the current positioning, and a move of 10bps higher in the next month will not force them to add to their shorts.

2/x

Here is how that would look like in Bunds :

a sell-off of 25bp (red line) brings positioning from -31% to -55%

a rally of 25bp (blue line) brings its from -31% to +20%.

3/x

a sell-off of 25bp (red line) brings positioning from -31% to -55%

a rally of 25bp (blue line) brings its from -31% to +20%.

3/x

Now hedge funds have also reduced their long dated shorts in USD but still own them.

Real Money though hasn’t really updated its USD position and continues to reduce its long Europe.

4/x

Real Money though hasn’t really updated its USD position and continues to reduce its long Europe.

4/x

But Hedge Funds and real Money continue to navigate with difficulty the current environment with a lot of two-way action.

Last few days though there’s been some decent receiving across the curve and especially for Hedge Funds in EUR front end.

5/x

Last few days though there’s been some decent receiving across the curve and especially for Hedge Funds in EUR front end.

5/x

Market had reappraised a bit from last week but looking at the vols the receiver skew is still a bit low, especially in EUR 10Y tails and USD 5Y tails, compared to the Mar FOMC level.

6/x

6/x

But I think there’s a lot of stress and a lot of USD outright shorts and steepeners have been entered at not great levels.

In particular when I look at greens/golds in Eurodollars I can see that CTAs have removed the majority of the steepener and are now left with a small pos

7/x

In particular when I look at greens/golds in Eurodollars I can see that CTAs have removed the majority of the steepener and are now left with a small pos

7/x

But the price action has been very tame, much smaller than one would expect.x

But the price action has been very tame, much smaller than one would expect.

8/x

But the price action has been very tame, much smaller than one would expect.

8/x

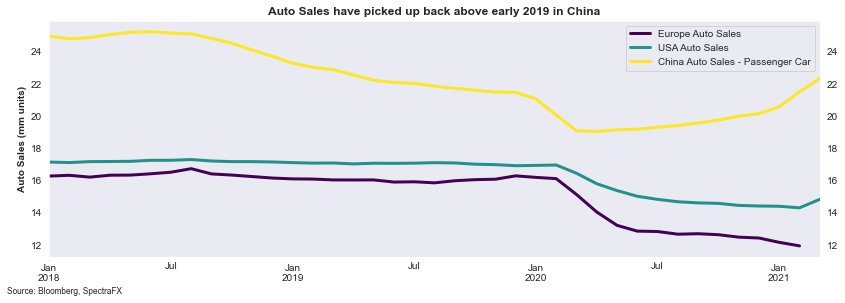

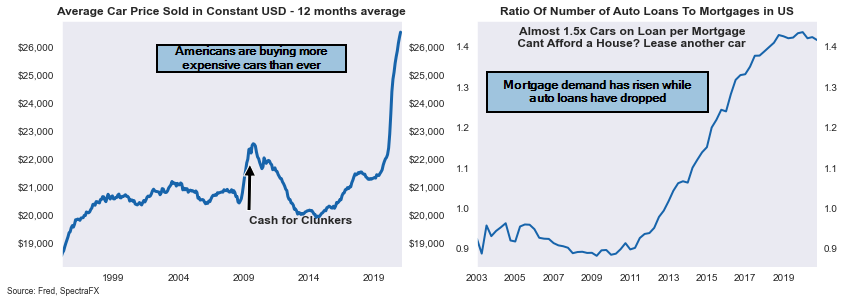

I’m warning about those because a lot is bent on the current “inflation” scene. And I’ve published recently notes disagreeing with those shouting wolf at the return of the 70s.

In particular with China trying to control commodities and the market still quite long.

9/x

In particular with China trying to control commodities and the market still quite long.

9/x

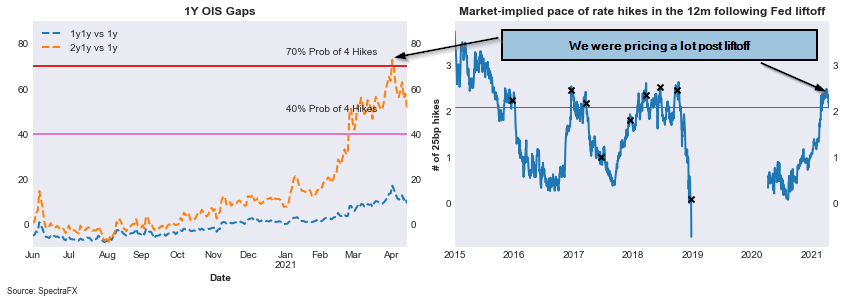

And we know that there’s a large USDCAD short base given the BOC hawkishness.

But looking at the pricing, we are at the highs of what we’ve priced in the last 10 years and I don’t think there’s real decoupling that can occur.

10/x

But looking at the pricing, we are at the highs of what we’ve priced in the last 10 years and I don’t think there’s real decoupling that can occur.

10/x

As such with the BOC meeting ahead (09Jun) and with Fed in blackout, a modestly hawkish BOC could push the pricing down and that move be reflected in USD as well.

Market has started buying USDCAD topside in the last week or so and I believe that’s a smart trade here.

11/x

Market has started buying USDCAD topside in the last week or so and I believe that’s a smart trade here.

11/x

The USDCAD surface is a bit elevated but not that much and with RBNZ/BOC/FED all in one month I think topside is not that expensive.

So I think topside could surprise. EURCAD topside too.

(h/t @donnelly_brent given i'm a "FX Vol & Rates RV guy" - bit of both today)

12/12

So I think topside could surprise. EURCAD topside too.

(h/t @donnelly_brent given i'm a "FX Vol & Rates RV guy" - bit of both today)

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh