-/x

I think the crux of the issue here is that no non-sovereign blockchain assets have shown any potential to actually replace stablecoins

A thread on what I mean by this

I think the crux of the issue here is that no non-sovereign blockchain assets have shown any potential to actually replace stablecoins

A thread on what I mean by this

https://twitter.com/TheStalwart/status/1397610345070567429

Tl;dr

- Non sovereign currency narrative is dying because existing attempts have failed

- They've failed because they don't try

- A non-sovereign currency needs a non-sovereign central bank

- A currency with a decentralized bank has the best chance of replacing stablecoins

- Non sovereign currency narrative is dying because existing attempts have failed

- They've failed because they don't try

- A non-sovereign currency needs a non-sovereign central bank

- A currency with a decentralized bank has the best chance of replacing stablecoins

1/x

Bitcoin has been around for over 12 years now. During that time, it has gone from a super volatile, super well-performing asset to...a slightly-less volatile, still well-performing asset

The same can be said for ETH 6 years in

Bitcoin has been around for over 12 years now. During that time, it has gone from a super volatile, super well-performing asset to...a slightly-less volatile, still well-performing asset

The same can be said for ETH 6 years in

2/x

Calls for Bitcoin as a global reserve currency have been around in force for, I'd guess, 5-7 years.

The narrative for over half a decade has been that Bitcoin will grow immensely, stabilize, and then replace fiat currencies

Calls for Bitcoin as a global reserve currency have been around in force for, I'd guess, 5-7 years.

The narrative for over half a decade has been that Bitcoin will grow immensely, stabilize, and then replace fiat currencies

3/x

But see, that middle part gets brushed over.

Stabilize how? We're 12 years in, $1T market cap up, and we're still seeing -50% months.

How big does this thing need to get for the magic stability to kick in?

But see, that middle part gets brushed over.

Stabilize how? We're 12 years in, $1T market cap up, and we're still seeing -50% months.

How big does this thing need to get for the magic stability to kick in?

4/x

I'm of the belief that it never will. There is nothing to suggest it ever will. There are no forces that push Bitcoin to be anything except a poster child free market asset.

And a free market asset is volatile, because the free market is volatile!

I'm of the belief that it never will. There is nothing to suggest it ever will. There are no forces that push Bitcoin to be anything except a poster child free market asset.

And a free market asset is volatile, because the free market is volatile!

5/x

So it makes sense that narratives and attention are shifting away from the idea of non-sovereign currency/money.

Why wouldn't it, if it seems like the idea has failed?

So it makes sense that narratives and attention are shifting away from the idea of non-sovereign currency/money.

Why wouldn't it, if it seems like the idea has failed?

6/x

I, however, believe in the idea of non-sovereign currency. I think it is so important if this industry wants to realize its goals.

I, however, believe in the idea of non-sovereign currency. I think it is so important if this industry wants to realize its goals.

7/x

If we cannot replace fiat with something actually viable, we will be condemned to a stablecoin future. The blockchain will be just a place to do things with your money, not a place for open money.

If we cannot replace fiat with something actually viable, we will be condemned to a stablecoin future. The blockchain will be just a place to do things with your money, not a place for open money.

8/x

If we want something different, we need a new approach. We need a floating currency purpose-built for stability at scale.

In other words, we need our own central bank.

If we want something different, we need a new approach. We need a floating currency purpose-built for stability at scale.

In other words, we need our own central bank.

9/x

That's because, (surprise!), central banks actually do something. The Fed's policies are the main reason we can think of the dollar as stable (even though it isn't really)

Stability isn't natural: volatility is.

To achieve artificial stability, you need artificial forces

That's because, (surprise!), central banks actually do something. The Fed's policies are the main reason we can think of the dollar as stable (even though it isn't really)

Stability isn't natural: volatility is.

To achieve artificial stability, you need artificial forces

10/x

The issue with central banks is not that they exist, it is that they are biased and permissioned with a track record of abusing their power.

The issue with central banks is not that they exist, it is that they are biased and permissioned with a track record of abusing their power.

11/x

The argument for banning central banking because it can be abused is the same as banning guns or nuclear energy or whatever else because they can be abused.

If you think it's a dumb argument against drugs, you should agree it's a dumb argument against central banks.

The argument for banning central banking because it can be abused is the same as banning guns or nuclear energy or whatever else because they can be abused.

If you think it's a dumb argument against drugs, you should agree it's a dumb argument against central banks.

12/x

The better solution, instead of prohibition, is reform and improvement.

Let's take the good, and get rid of the bad.

The better solution, instead of prohibition, is reform and improvement.

Let's take the good, and get rid of the bad.

13/x

So what if we made the central bank a DAO?

What if we used the tools, but threw out the centralization?

What if we changed the game, instead of quitting because the rules aren't fair?

That is @OlympusDAO.

So what if we made the central bank a DAO?

What if we used the tools, but threw out the centralization?

What if we changed the game, instead of quitting because the rules aren't fair?

That is @OlympusDAO.

14/x

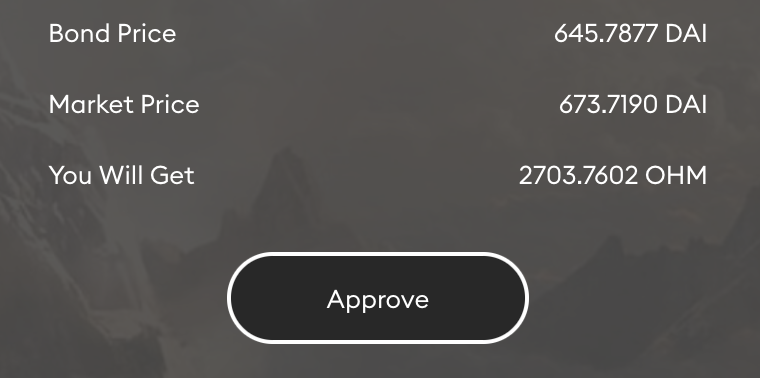

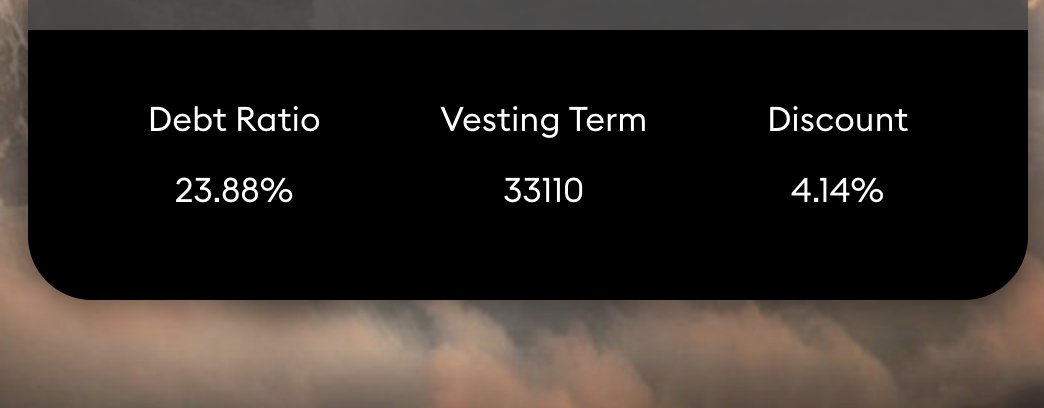

Granted, right now we're not that good either. Our realized volatility is low, but our price isn't particularly stable.

Granted, right now we're not that good either. Our realized volatility is low, but our price isn't particularly stable.

15/x

But we're also a sub $100m currency without a peg. Our liquidity pool is >25% of our market cap, and a <$1m order still moves price by 20%. Kinda hard to have stable prices when you're that small.

But we're also a sub $100m currency without a peg. Our liquidity pool is >25% of our market cap, and a <$1m order still moves price by 20%. Kinda hard to have stable prices when you're that small.

16/x

The key, however, is that the pieces are coming together. Now it is simply a matter of scale.

If over the next few years we push up to Bitcoin's size, I'm pretty confident we'll be a hell of a lot better at the currency role than it is

The key, however, is that the pieces are coming together. Now it is simply a matter of scale.

If over the next few years we push up to Bitcoin's size, I'm pretty confident we'll be a hell of a lot better at the currency role than it is

17/x

I think this is what we need. I honestly believe that without Olympus, or something similar, a lot of the great things we are building are going to get undermined by our reliance on USD.

I think this is what we need. I honestly believe that without Olympus, or something similar, a lot of the great things we are building are going to get undermined by our reliance on USD.

fin/x

If you agree, then join us as we buidl the Future of Greece. There is so much to do to make this a success. Whether your skills lie in the DAO or in the market, we need you!

Join the community: discord.gg/OlympusDAO

Join the DAO: discord.gg/uNNe994jhm

If you agree, then join us as we buidl the Future of Greece. There is so much to do to make this a success. Whether your skills lie in the DAO or in the market, we need you!

Join the community: discord.gg/OlympusDAO

Join the DAO: discord.gg/uNNe994jhm

• • •

Missing some Tweet in this thread? You can try to

force a refresh