1/ $JWS $CANO is a primary care provider for Medicare patients that is merging with Jaws SPAC shortly after a shareholder vote scheduled for 6/2. Valuation analysis supports $30 per share or +100% upside from current levels. #spacs #spacsquad

A short thread:

A short thread:

2/ $JWS $CANO delivers value-based care to patients through a fixed or capitated payment from insurers. CANO assumes all risk and benefit, incentivizing it to invest in preventative care to optimize outcomes and lower costs.

3/ $JWS $CANO is part of a growing trend towards value-based care which increases effectiveness and reduces overall healthcare costs as demonstrated by the company's growing partnerships and financial performance.

4/ $JWS $CANO currently serves 113k members in 15 markets with only 6% penetration in existing markets. The overall TAM is enormous at 24.1M Medicare Advantage enrollees in 2020. The company has plenty of runway to grow organically and through acquisitions.

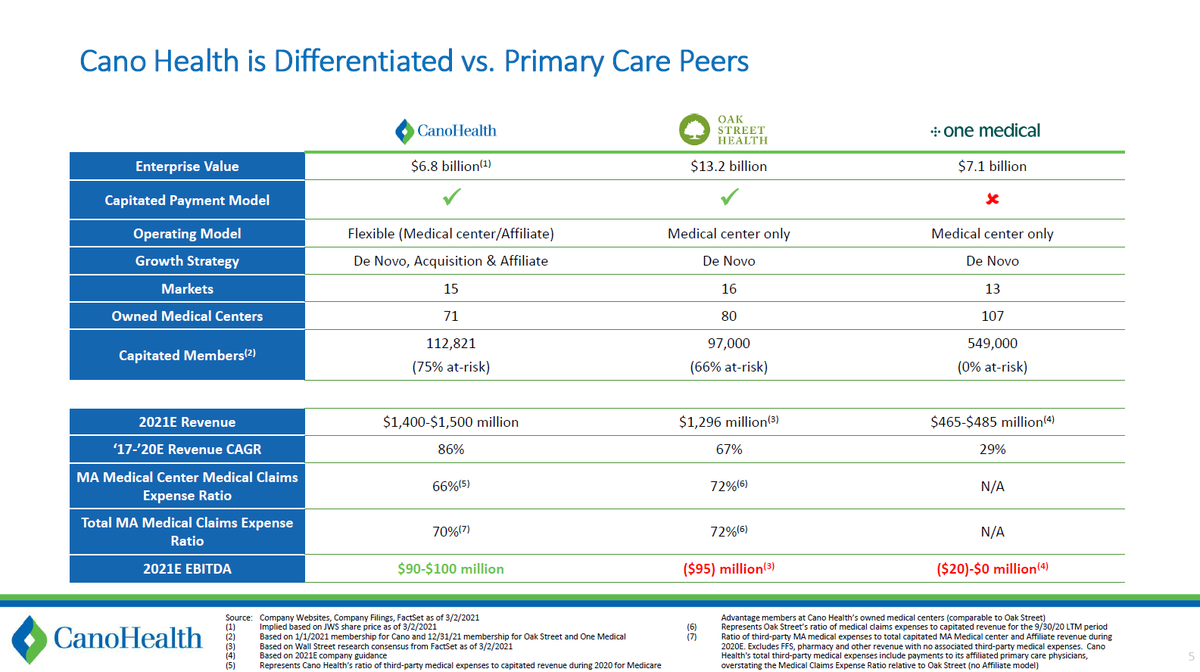

5/ $JWS $CANO compares very favorably to its publicly traded peers $OSH and $ONEM. Not only is CANO projected to have higher topline growth, it is also CURRENTLY PROFITABLE.

6/ $JWS $CANO is expected grow at a 55% CAGR from 2020-2023E, however only trades at 4.6x 2021E revenue compared to slower growing $ONEM @ 10.1x and similarly growing $OSH @ 10.8x. If you were to value $CANO at a similar valuation multiple, you'd get to a $30-$32 stock price.

7/ $JWS $CANO has significant institutional support heading into merger closing which is critical to the performance of the stock. Reviewing the page 1 holder list, it's all long only or "smart" hedge funds --> NO ARBS ARE LEFT. Even short specialist Kerrisdale is a holder. 😘

8/ $JWS $CANO Fidelity, Blackrock and Third Point all purchased shares in addition to their PIPE holdings, which is VERY BULLISH. ArrowMark, Vanguard, Citadel, Suvretta, Owl Creek, Diameter, Eminence have built big stakes. Low volume = many shares have found a permanent home.

9/ $JWS $CANO's $800M PIPE was anchored by Barry Sternlicht (SPAC sponsor), Fidelity, Blackrock, Third Point and Maverick Capital. Importantly, PIPE investors were not restricted in shorting to box their shares prior to deal close, removing potential selling pressure.

10/ $JWS $CANO = rapidly growing and profitable co. attacking massive market that needs disruption and is attractively valued at 50% discount to peers with strong shareholder base that will help it reach $30 PT or +100% upside from here.

12/ $JWS $CANO Merger Presentation:

jawsholdings.com/documents/Cano…

Analyst Day Presentation:

jawsholdings.com/documents/Cano…

jawsholdings.com/documents/Cano…

Analyst Day Presentation:

jawsholdings.com/documents/Cano…

14/ $JWS $CANO shareholder vote today w/ expected ticker change Friday 6/4. Added $AGL as a comparable (not competitor, focused on wealthier & healthier patients). $JWS at $30-$32 would be trading inline with peer valuations. Thx @CorneliaLake for great work on this name.

• • •

Missing some Tweet in this thread? You can try to

force a refresh