1/ $VSPR merger w/ Hydrafacial: Invest in the Leading Beauty Care Services Platform Positioned for Accretive M&A Growth and Post-COVID Reopening Demand

Thread Below @jimcramer @brentlsaunders @HydraFacial

Thread Below @jimcramer @brentlsaunders @HydraFacial

2/ Hydrafacial offers one of the most popular facial skincare treatments across the world with an army of loyal mid and upper-class customers receiving regular treatments on a monthly basis at ~$200 / session.

3/ Skincare is a fast growing market (14% CAGR in US alone) with a worldwide TAM of +$200B.

Consumers have been shifting their expenditures from goods to experiences and have shown an increasing willingness to spend on high end beauty and health services.

Consumers have been shifting their expenditures from goods to experiences and have shown an increasing willingness to spend on high end beauty and health services.

4/ Growth in the beauty industry is now being driven by an emphasis on skincare rather than cosmetics.

Hydrafacial is a patented protected (38 awarded, 18 pending), 30-minute, 3 step treatment that cleanses, extracts, and hydrates

Hydrafacial is a patented protected (38 awarded, 18 pending), 30-minute, 3 step treatment that cleanses, extracts, and hydrates

5/ Hydrafacial is known for its high customer loyalty and satisfaction, and great reputation among estheticians.

Hydrafacial is the only beauty product/service with a higher Net Promoter Score than Botox.

Hydrafacial is the only beauty product/service with a higher Net Promoter Score than Botox.

6/ Hydrafacial boasts a broad and growing base of estheticians including Advanced Dermatology and Cosmetic Surgery, Marina Plastic Surgery, Ideal Image, Bella Sante, Equinox, Four Seasons, Lifetime, OrangeTwist, The Ritz-Carlton, and Sephora.

7/ The Company operates a "razor & razor blade" model with highly attractive blended gross margins of +75%.

The razor: Hydrafacial delivery machine estimated at $25-30k per unit accounts for ~49% of sales with an install base of 15,124

The razor: Hydrafacial delivery machine estimated at $25-30k per unit accounts for ~49% of sales with an install base of 15,124

8/ The razorblade: 10% of the ~$200 / session fee covers the cost of consumables (serums, applicator tips, boosters) that Hydrafacial sells to estheticians accounting for 51% of sales. Consumables will grow bigger as % of sales as the install base of delivery equipment expands.

9/ While the upfront cost of a Hydrafacial delivery machine and training time is fairly high, the economics garnered by the estheticians are highly compelling. These together make the switching cost very high and unattractive.

10/ A standard $200 treatment yields 90% GM or $180 gross profit to the esthetician.

Adding a booster, like a SkinCeutical antioxidant treatment, can increase the treatment price to $325 with minimal increased cost ($3.39), yielding a 93% GM or $301.61 gross profit.

Adding a booster, like a SkinCeutical antioxidant treatment, can increase the treatment price to $325 with minimal increased cost ($3.39), yielding a 93% GM or $301.61 gross profit.

11/ Assuming 60 treatments per month at $200 / session, that's $144,000 of revenue or $129,600 of gross profit a year for the esthetician.

12/ These compelling economics for estheticians along with high customer satisfaction and loyalty have driven increased adoption across 87 countries.

13/ Historically the company enjoyed a healthy +50$ CAGR, reaching $167M in revenue and $41M EBITDA in 2019 (25% EBITDA margin)

14/ However when the COVID pandemic arrived, sales of delivery machines and consumables took a big hit in Q1 and Q2 of 2020 as many estheticians closed during the lockdowns.

Sales quickly recovered in Q3 2020 back to levels comparable to Q3 2019.

Sales quickly recovered in Q3 2020 back to levels comparable to Q3 2019.

15/ The company's delivery machine install base grew significantly despite COVID, up 18% YoY in Q3 2020 compared to Q3 2019.

16/ As world economies are fully reopened in 2021, Hydrafacial expects revenues to rebound to $181M in 2021E and $250M in 2022, a 47% CAGR from 2020.

17/ Gross Margins are expected to rebound back to 76% in 2022E, however the company plans to heavily reinvest in topline growh resulting which will dampen near-term EBITDA Margins at 14-16% vs. a steady state of ~25%

18/ 2022E projections are realistic: assuming 18k installed base, 3k new units ($30k each) and $8.5k consumable rev per unit, Hydrafacial will reach $250M revenue just by keeping with its past performance.

19/ Hydrafacial has unique value creation levers it can pull:

-Implement annual price increases on consumables given low cost vs. treatment price

- Expand US and Intl delivery machine install base by using IPO proceeds to aggressively buildout salesforce.

-Implement annual price increases on consumables given low cost vs. treatment price

- Expand US and Intl delivery machine install base by using IPO proceeds to aggressively buildout salesforce.

20/ - Become delivery platform of choice by partnering with leading cosmetic companies to develop co-branded serum treatments

21/ While there are few direct competitors, Chinese knockoffs do exist. However these competitors have failed to gain traction outside of the Chinese market. Branding power matters a lot in high end beauty.

22/ Management and M&A - the X FACTOR

Brent Saunders of Vesper is a legend in beauty care and specialty pharma. As former CEO of Allergan, he led the commercial expansion of dozens of healthcare products, most notably Botox.

Brent Saunders of Vesper is a legend in beauty care and specialty pharma. As former CEO of Allergan, he led the commercial expansion of dozens of healthcare products, most notably Botox.

23/ Saunders has an exceptional track record of driving shareholder value through accretive M&A for companies that he's led (Bausch & Lomb, Forest Labs, Actavis, Allergan).

24/ Each of these cos traded at premium valuations to peers due to the market's expectation that he'd executive accretive M&A deals or finally sell in a strategic exit.

Saunders has executed +80 M&A transactions over his career.

Saunders has executed +80 M&A transactions over his career.

25/ It's likely Saunders has grand ambitions to use Hydrafacial as an M&A platform to bring additional products & services to customers.

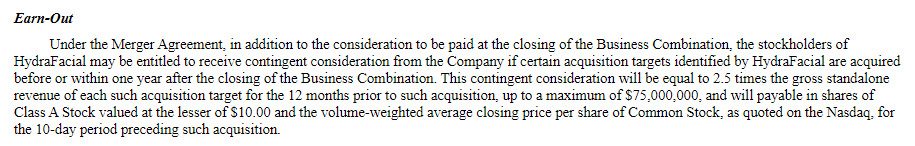

26/ Vesper has set aside $75M of $1.1B purchase price in the form of an earn-out upon completion of certain identified acquisitions within 12 months of closing.

27/ The earn-out will be paid based on 2.5x LTM revenue of target. Assuming $75M earn-out, that's likely $30M of revenue currently identified, which would be a material boost to current projected 2021E revenue of $181M.

28/ Saunders also has a close relationship with Jim Cramer of Mad Money and has been a frequent guest as the CEO of Allergan. It would not be surprising to see Cramer hosting Saunders to discuss Hydrafacial sometime prior to merger consummation in Feb/Mar 2021.

29/ Saunders has built a loyal following, VSPR's largest shareholder Seth Klarman of Baupost owns 10% of the float.

The $350M PIPE is being anchored by quality long-term investors: Fidelity, Redmile Group, Principal Group, Camber Capital, and Woodline Partners.

The $350M PIPE is being anchored by quality long-term investors: Fidelity, Redmile Group, Principal Group, Camber Capital, and Woodline Partners.

30/ Hydrafacial currently trades at $11.45 or 5.3x 2022E rev, inline with low growth traditional beauty cos. Given Hydrafacial's strong growth prospects in the coming years, it should trade at a premium to high growth medical aesthetic peers.

31/ For example, InMode projects 2020E-2022E CAGR of 22.7% and trades at 6.1x 2022E rev while Hydrafacial projects a CAGR of 47.4%, which could justify trading at 12x 2022E revenue or $22.50 per share. The market should start pricing in M&A upside for Hydrafacial as well.

32/ The setup: at $11.45, you're basically risking $1.45 ($10 hard floor of VSPR SPAC) to make potentially $8-11 if the market starts to value Hydrafacial's growth and M&A potential as it progresses towards the merger closing in late Feb or early Mar 2021.

33/ Risks? currently a single product company, alternative cheaper competitors exist, COVID uncertainties could impact reopening and financial performance, the merger could fail and your investment would go back down to $10.

34/ Company Pres: …j22q7jr2xnc83-wpengine.netdna-ssl.com/wp-content/upl…

Deal Webcast: public.viavid.com/player/index.p…

Deal Webcast: public.viavid.com/player/index.p…

35/ @aakashthumaty @SPACuity @FluffTrader @pennycheck @StockMarketNerd @mukund @Gambiste1 @yatesinvesting @SpacTraderinTra @valwithcatalyst @deadnsyde @investor_2 @BillSPACman @RobEducated @SpaCula @SpactorI @SpacBobby @Mindwalletbody @Doc_Steve_Brule @StockLizardKing…

• • •

Missing some Tweet in this thread? You can try to

force a refresh