Stoke City’s 2019/20 financial results covered a season when they finished 15th in the Championship, two years after relegation from the Premier League. Manager Nathan Jones was replaced by Michael O’Neill in November 2019. Some thoughts in the following thread #SCFC

#SCFC pre-tax loss widened from £15m to £88m, as revenue dropped £21m (29%) from £71m to £50m and profit from player sales fell £15m (83%) from £18m to £3m. Total expenses increased £37m, mainly due to £43m impairment charge (reducing player values). Loss after tax was £86m.

The main reason for #SCFC £21m revenue reduction was broadcasting, which dropped £20m (39%) from £51m to £31m, mainly due to lower parachute payment, though match day also fell £1.6m (25%) from £6.4m to £4.8m. In contrast, commercial rose £0.9m (7%) from £12.9m to £13.8m.

Despite the steep revenue reduction, #SCFC only cut the wage bill by £3m (6%) from £56m to £53m, while other expenses were down £1m (8%) to £16m. However, player amortisation again increased, by £1m (4%) to £30m, even after the £43m impairment booking.

Unsurprisingly, #SCFC £88m loss is the highest to date in the 2019/20 Championship, though others have also reported significant losses in 2019/20, including #LUFC £62m (large promotion bonus), Reading £42m and #Boro £36m.

It is also worth noting that some clubs’ figures have been boosted by the sale of stadiums, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying profitability was even worse than reported.

Excluding property sales, only 3 Championship clubs are profitable in 2019/20 to date (#LTFC, #HCAFC and #Swans, all £3m). Very few clubs manage to make money in this ultra-competitive division, though largest losses often from promoted clubs – including hefty promotion bonuses.

#SCFC figures have been significantly hit by the COVID-19 pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 31st May accounting close has been deferred to 2020/21 accounts.

#SCFC estimated a £38m impact from COVID, split between £4m revenue loss, £4m additional costs (e.g. not utilising the furlough scheme) and £30m of the £43m player impairment. Without this, revenue would have been £54m, but the club would still have posted a £50m loss.

#SCFC profit from player sales fell from £18m to just £3m, mainly Erik Pieters to Burnley, whereas prior year included the sales of Shaqiri to Liverpool, Sobhi to Huddersfield Town and Muniesa to Girona. Far below WBA £29m, Bristol City £26m, Brentford £25m and Hull City £23m.

Following four consecutive years of (small) profits between 2014 and 2017, #SCFC have now posted losses three years in a row, adding up to a hefty £134m in total, though it is worth noting that £74m of this is due to player impairment (non-cash) charges.

#SCFC have traditionally made very little from player sales – just £4m a year in the 5 years up to 2015. However, in the last 5 years, profit has increased to £62m, though only £3m of that came in 2019/20 and very few profitable sales have been made in 2020/21 either.

#SCFC operating loss (excluding player sales, impairment and interest) widened from £32m to £49m, which was one of the worst performances in the Championship. That said, almost every club in this division posts substantial operating losses, i.e. half of them are above £30m.

#SCFC revenue has dropped £86m (63%) from £136m in 2017 to £50m in 2020, falling three years in a row. The decline is very largely due to £77m less TV money in the Championship, though commercial and match day are also down £6m (31%) and £2m (33%) respectively.

#SCFC revenue decrease last season was mainly driven by the parachute payment falling, though broadcasting still accounts for 63% of total revenue, followed by commercial 28% and match day 9%. The parachute will further fall this season to £15m, then down to zero from 2021/22.

Even after the fall, #SCFC £50m revenue was still one of the highest in the Championship, though they were overtaken by #LUFC (massive commercial income). They will also be behind the three clubs most recently relegated from the Premier League, when they publish their accounts.

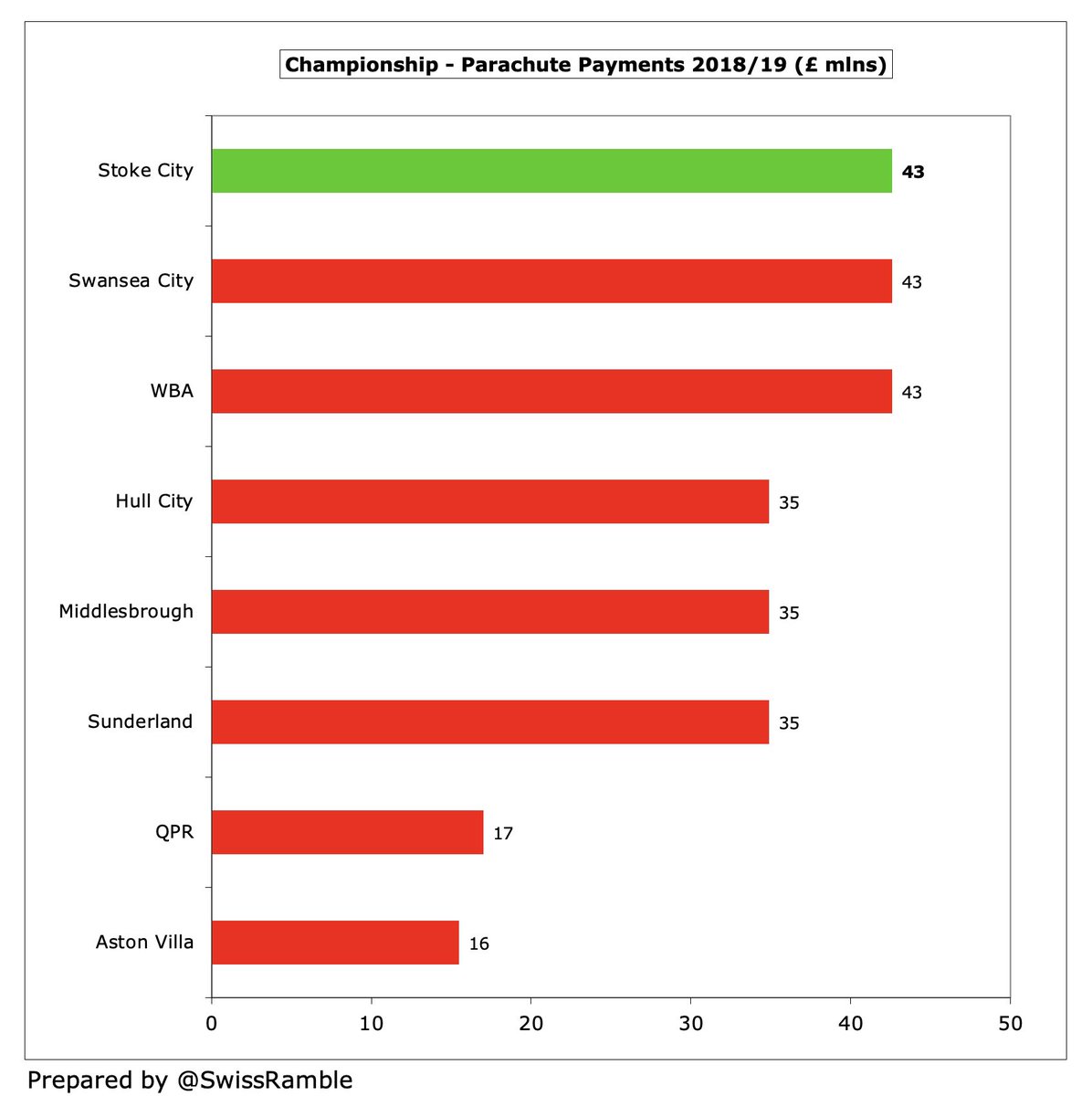

Obviously, #SCFC benefited from £34m parachute payment (before broadcasters’ rebate), though this was down from £43m in the previous season. Six other clubs received parachutes in 2019/20, led by Cardiff City, #FFC and #HTAFC (£42m), followed by Stoke City and WBA (£34m).

If parachute payments were excluded, #SCFC revenue would fall to £20m (£34m parachute replaced by £4.5m solidarity payment). This would have placed them mid-table in the Championship with the gap to the top club (#LUFC £54m) increasing to £34m.

#SCFC broadcasting income fell £20m (31%) from £51m to £31m, due to smaller parachute payment, which is the lowest since 2008. Most Championship clubs earn £7-10m, but there is a significant gap to those with parachute payments, e.g. around £50m for those recently relegated.

#SCFC commercial revenue rose 7% (£0.9m) from £12.9m to £13.8m, comprising sponsorship & advertising £8.0m, conference & hospitality £1.8m and other operating income £4.0m. This is 3rd highest in the Championship, but a long way behind Leeds United £34m.

The main driver of the increase in #SCFC commercial income was sponsorship and advertising, up £2.9m, probably due to a higher payment from owner bet365 for shirt sponsorship and stadium naming rights. Macron 5-year kit supplier deal is due to end this season.

#SCFC gate receipts fell £1.6m (25%) from £6.4m to £4.8m, largely due to playing 4 home games behind closed doors because of the pandemic. Steady decline since £8.4m in 2016 (in Premier League), so revenue is only mid-table in the Championship, less than half #LUFC £11m.

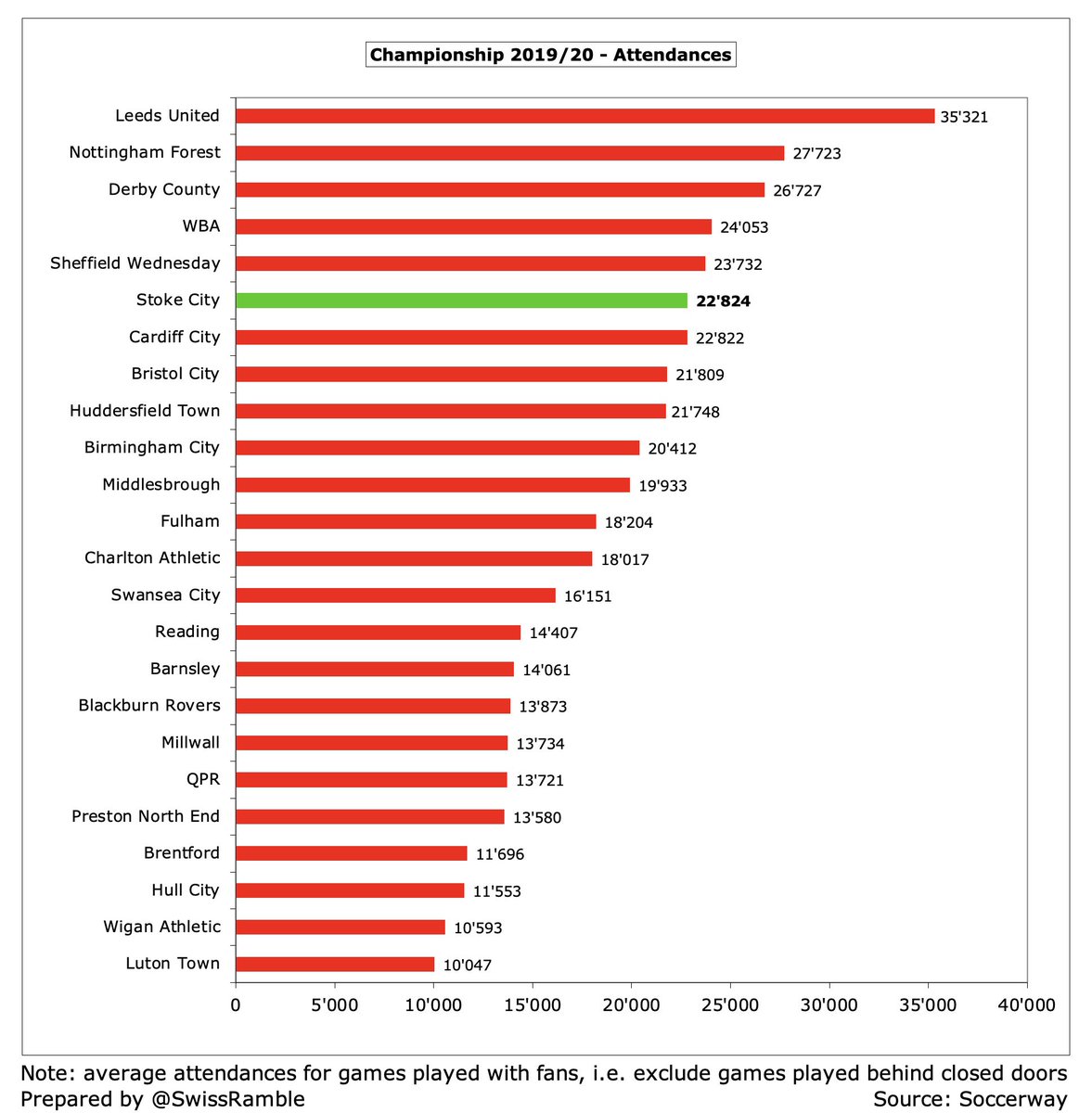

#SCFC average attendance (for games played with fans) dropped 9% from 25,200 to 22,824, so has fallen 6,500 since relegation, but is still 6th highest in the Championship. Ticket prices for 2021/22 were frozen, so they have been held at the same level for an incredible 14 years.

#SCFC wage bill fell £3m (6%) from £56m to £53m, which means wages have been cut £42m (44%) in the two years since relegation (revenue down £77m in the same period). This is the club’s lowest wage bill since £47m in 2011.

Following the decrease, #SCFC £53m wage bill was still one of the highest in the Championship, but far below #LUFC £78m and WBA £67m, though they included promotion bonuses (estimated at £20m and £16m respectively). Actually 11th highest ever in this division.

#SCFC wages to turnover ratio up from 79% to 106%, as “the club invested significantly in its playing squad as well as suffering a reduction in overall turnover.” Still one of the lowest (best) ratios in the Championship, where vast majority of clubs have ratios well over 100%.

#SCFC directors’ remuneration fell 3% from £858k to £834k, though still 2nd highest in the Championship, only below Birmingham £1.6m (and that includes senior management). This was all for one director, almost certainly chief executive Tony Scholes, though others paid by bet365.

#SCFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, slightly increased by £1m (4%) to £30m, a new club record. This is by far the highest in the Championship to date, 50% more than WBA £20m.

In addition, #SCFC reduced player valuations via £43m impairment, of which £30m was attributed to the pandemic, which had “a catastrophic impact” on the transfer market. Club said this was in line with EFL guidelines, but next highest charge in Championship is WBA with only £6m.

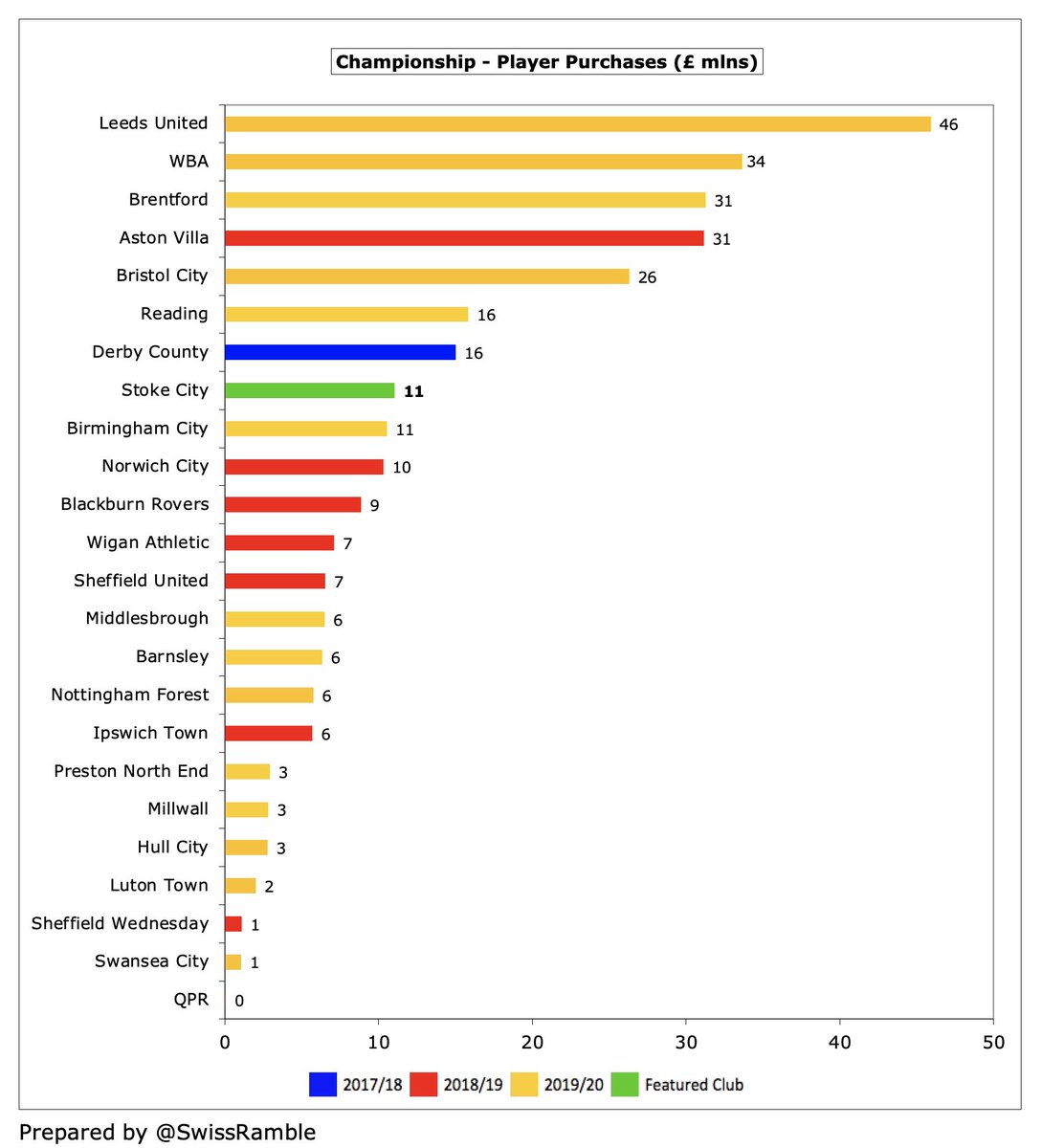

#SCFC spent £11m on player purchases, including Tommy Smith from #HTAFC and Liam Lindsay from Barnsley. This is the lowest outlay since 2015, but still 6th in 2019/20 Championship to date. Massively outspent by #LUFC £46m, #WBA £34m, Brentford £31m and Bristol City £26m.

Incredibly, #SCFC have spent £224m to bring in new players in the last five seasons, including £67m in the first season following relegation. Sales proceeds have also increased, but net spend has doubled compared to previous 5-year period. Hardly anything spent in 2020/21.

#SCFC gross debt increased by £46m from £141m to £187m, all ultimately owed to the Coates family. The good news is that Stoke have no bank debt, but the “friendly” debt with their owners has shot up by around £128m over the past four years.

In fact, #SCFC gross debt of £187m is by far the highest in the Championship. The closest challengers in 2019/20 are Birmingham City and Middlesbrough with £116m apiece, i.e. £71m less.

However, the #SCFC debt picture is a little misleading, so long as the Coates family continues to provide support. The fact that their loans are interest-free gives Stoke a competitive advantage against a number of their rivals, who have to pay interest on their loans.

#SCFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this was slashed from £39m to £6m. Stoke are in turn owed £1m by other clubs, so net payables are £5m. In addition, there are £5m contingent liabilities, dependent on appearances, team success, etc.

#SCFC only had £9m negative cash flow after adding back non-cash items (amortisation and impairment) and working capital movements, but then spent £34m on players (purchases £36m, sales £2m). This was funded by an additional £46m loan from the owners to give £3m net cash inflow.

As a result, #SCFC cash balance increased from £5m to £8m, one of the largest in the Championship. Most clubs in this division have less than £2m cash in the bank, so this was a pretty good buffer in the current economic climate.

Since 2011 #SCFC have had available cash of £233m: (a) £185m from owners’ loans; (b) £46m from operating activities (negative in last 3 years). Virtually all of this was spent on the squad with £227m (97%), albeit with mixed results, and only £4m on infrastructure.

The Coates family’s commitment to #SCFC cannot be doubted. By my reckoning, they have put in £227m of funding since their arrival in 2006, including £128m in the last four years alone. They also made sure there were no pay cuts or redundancies as a result of COVID.

FFP is assessed over 3-year period with annual allowable loss £13m in Championship and £35m in Premier League, so #SCFC maximum FFP loss is £61m, falling to £39m in 2020/21. The club can exclude academy, community & infrastructure costs, which I estimate as £7m.

Even though #SCFC can exclude COVID losses and will average the two seasons impacted by the pandemic (19/20 & 20/21), it will still be a challenge to meet the target. John Coates has complained that FFP rules don’t allow them to support the manager as much as they would like.

Despite the large losses, the club is fortunate that it retains the support of a wealthy benefactor. However, based on the financials, #SCFC should really have done much better since relegation, as their revenue and wages have been among the highest in the Championship.

• • •

Missing some Tweet in this thread? You can try to

force a refresh