1) Almost 90% APR on $BTC with hardly any risk of impermanent loss... This is fully boosted return on mBTC/HBTC pool on @mStable_. Boost requires to lock some $MTA but lock terms are more favorable than trying to get max boost on Curve by locking $CRV. See 🧵 for more details.

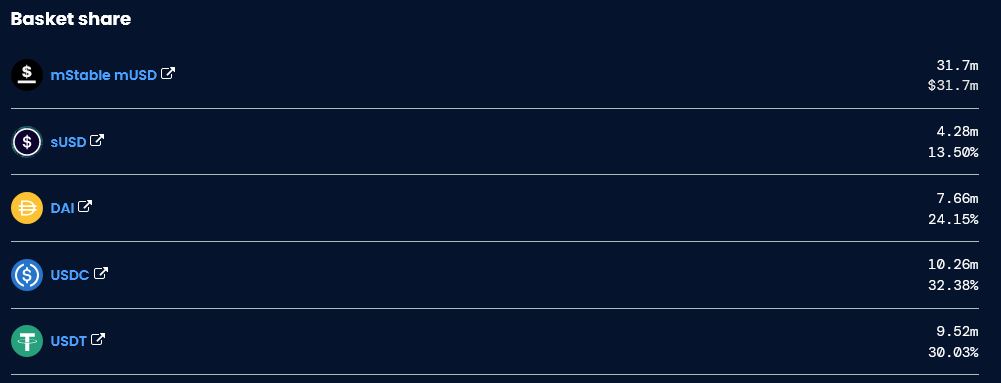

2) Let's first explain what mAssets are. They are meta-stablecoins based on baskets of pegged tokens. mUSD is USD stablecoin which can be minted by depositing sUSD, DAI, USDC or USDT into the basket. mBTC is pegged to BTC and is backed by a pool of renBTC, WBTC and sBTC.

3) Feeder Pools are liquidity pools that contain two assets: 50% of mAsset (mUSD or mBTC) and 50% of any other pegged asset (BUSD/GUSD for mUSD, HBTC/TBTC for mBTC). They are similar to pools on Curve which pair "exotic" stables (e.g. $lUSD, $alUSD) with 3pool (USDT+USDC+DAI).

4) mAssets (mUSD, mBTC) serve as liquidity bridge between other assets in Feeder Pools (fPools) and underlying assets in the mStable's baskets. If you want to swap HBTC to WBTC, mBTC is a bridge between HBTC/mBTC pool and mBTC basket of WBTC, renBTC, sBTC.

5) "But sir. You promised 90% APR on BTC, not a lecture on mStable...". Fair enough. Let's get into it. Liquidity providers for fPools are incentivized with $MTA rewards. Base APR is 17.5% for mBTC/TBTC and 29.5% for mBTC/HBTC. But base APR can be increased 3x - up to almost 90%!

6) For rewards boost, you need to stake $MTA in governance contract. In return, you get vMTA - your voting power which also allows you to participate in the governance. While staking you choose the duration of the lockup period - the longer the period, the more vMTA you get.

7) For example, 1000 MTA staked for 2 days, will give you 5.5 vMTA. Max lockup (17 weeks) - 320.5 vMTA. 17 weeks is a lot of time, especially in crypto, but during lockup you also earn 20% on your stake in a form of extra $MTA rewards.

8) To check how much vMTA is needed to boost rewards on fPools, you can use Earning Power Calculator on the app. It shows the rewards multiplier you get for a given amount of vMTA and fPool LP tokens. Let's imagine you have 1 WBTC and want to deposit it to mStable...

9) Adding 1 WBTC to mBTC/HBTC fPool vault will give you about 0.998 LP tokens. For max boost, you need 6277 vMTA - that's about 19600 $MTA staked for 17 weeks. In other words, to earn 90% APR on 1 BTC deposit ($37k), you need about $19k worth of $MTA locked for 17 weeks.

10) Locked $MTA is worth more than 50% of your deposit value but it's a fraction of what you'd have to lock in Curve for max boost in BTC pools. To get max boost of 2.5x on 1 BTC deposit to hbtc pool, you need more than 20k $CRV = $42k. And it gives you boosted APR of 13% only.

11) Becauce boost in Curve works on multiple pools, it would make sense to split your 1 BTC and enter many pools instead of one. Or even better, use yield aggregator like Yearn to enjoy boosted APR without locking $CRV on your own. But yields are still not even close to 90%...

12) Can single $MTA stake be applied to boost APR on multiple fPools in mStable? Yes. But on up to 3 pools at once. It means you can increase efficiency of your $MTA lockup by depositing more funds into other fPools:

- BTC: mBTC/TBTC.

- USD: mUSD/BUSD and mUSD/GUSD.

- BTC: mBTC/TBTC.

- USD: mUSD/BUSD and mUSD/GUSD.

13) Your 6277 vMTA could be used this way for max boost:

1. 2 x BTC + 1 x USD fPools: 1 BTC to mBTC/HBTC (88%), 1 BTC to mBTC/TBTC (52%), $58k USD to mUSD/GUSD (73%)

2. 1 x BTC + 2 x USD fPools: 1 BTC to mBTC/HBTC (88%), $58k USD to mUSD/GUSD (73%), $58k USD to mUSD/BUSD (70%).

1. 2 x BTC + 1 x USD fPools: 1 BTC to mBTC/HBTC (88%), 1 BTC to mBTC/TBTC (52%), $58k USD to mUSD/GUSD (73%)

2. 1 x BTC + 2 x USD fPools: 1 BTC to mBTC/HBTC (88%), $58k USD to mUSD/GUSD (73%), $58k USD to mUSD/BUSD (70%).

14) With 3 pools fully boosted your initial investment of 19600 $MTA ($19k) becomes only 14% of total deposit in scenario 1. ($19k/$132k) and 12% in scenario 2. ($19k/$153k). Taking into account that boost increases base APR by 50pp, this may be a good bet.

15) Even if you don't want to have exposure to $MTA token, you are still able to boost your yields. This is DeFi in the end! You don't have to buy $MTA. You can borrow it from @CreamdotFinance on app.cream.finance!

16) Staking rewards (20% for max lockup period) can mitigate the borrowing cost (14% APR atm but this can change with the increasing borrowing demand). This way you get your max boost almost for free (transaction costs + opportunity costs due to used borrowing power on Cream).

17) It's important to mention that $MTA rewards are not unlocked immediately. You get 33% when you claim and the rest will be fully unlocked after 26 weeks. This is a bit longer term play. And all the APRs are volatile so it's possible they are different when you are reading it.

18) That's it. Enjoy your boosted APR on BTC!

Feeder Pools Guide: medium.com/mstable/guide-…

mBTC Pools: app.mstable.org/#/mbtc/pools

mUSD Pools: app.mstable.org/#/musd/pools

MTA Staking: governance.mstable.org/#/stake

Feeder Pools Guide: medium.com/mstable/guide-…

mBTC Pools: app.mstable.org/#/mbtc/pools

mUSD Pools: app.mstable.org/#/musd/pools

MTA Staking: governance.mstable.org/#/stake

• • •

Missing some Tweet in this thread? You can try to

force a refresh