1/ Thread on @depop acquisition by $ETSY

Etsy just announced to acquire Depop, a gen Z focused online apparel resale marketplace for $1.625 Bn (all cash). Optically expensive i.e. ~2.5x GMS or ~23x revenue based on 2020 numbers.

Here are my thoughts.

Etsy just announced to acquire Depop, a gen Z focused online apparel resale marketplace for $1.625 Bn (all cash). Optically expensive i.e. ~2.5x GMS or ~23x revenue based on 2020 numbers.

Here are my thoughts.

2/ Etsy coined an interesting term today “house of brands”.

After Reverb acquisition in '19 and now Depop, the strategy seems clear: keep penetrating vintage, handmade core marketplace AND acquire other niche marketplaces that you will have hard time building a connection with.

After Reverb acquisition in '19 and now Depop, the strategy seems clear: keep penetrating vintage, handmade core marketplace AND acquire other niche marketplaces that you will have hard time building a connection with.

3/ Why is this important?

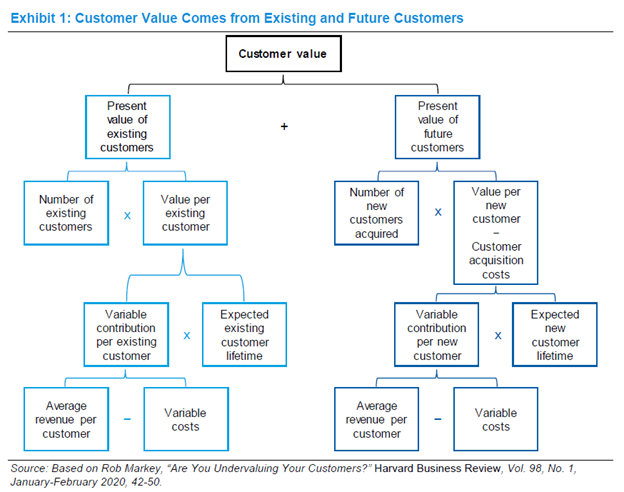

E-commerce is primarily behavioral in nature. Once you buy something from a marketplace, they have enough of your data to encourage you to buy again.

Once a marketplace grabs critical attention in a niche, it can be difficult to unseat the incumbent

E-commerce is primarily behavioral in nature. Once you buy something from a marketplace, they have enough of your data to encourage you to buy again.

Once a marketplace grabs critical attention in a niche, it can be difficult to unseat the incumbent

4/ More importantly, apparel resale seems to have strong secular tailwind as it’s expected to grow from $32 Bn in 2020 to $64 Bn in 2024 (~20% CAGR).

Depop’s GMS was $650 Mn in 2020.

"marketplace gets better as they get bigger"

Depop’s GMS was $650 Mn in 2020.

"marketplace gets better as they get bigger"

5/ GMS grew ~80% CAGR in '17-'20. Here’s a simple math which makes me think the price they paid is not ridiculous.

If you assume 25% FCF margin on 2025 sales and a more than reasonable 25x multiple (given the size and potential runway), you get ~7% return on the price Etsy paid.

If you assume 25% FCF margin on 2025 sales and a more than reasonable 25x multiple (given the size and potential runway), you get ~7% return on the price Etsy paid.

6/ Etsy should be disappointed if Depop grows at the rate I outlined there. Why?

~90% GMS was organic. There was very little marketing dollar invested.

There is ZERO ad revenue, and no shipping/payment integration. So, increasing take rates shouldn’t be too onerous.

~90% GMS was organic. There was very little marketing dollar invested.

There is ZERO ad revenue, and no shipping/payment integration. So, increasing take rates shouldn’t be too onerous.

7/ The bull case is they can replicate what they did with Reverb.

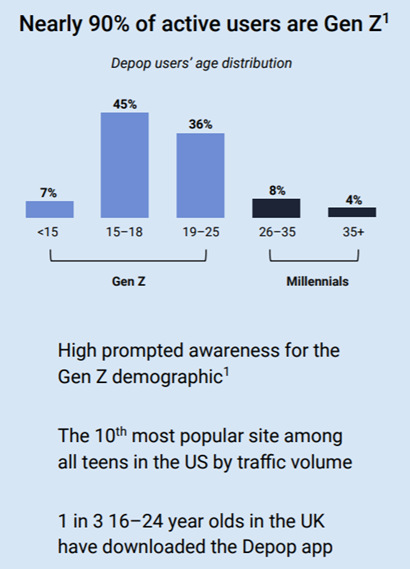

~90% active users are Zen Gs.

There are 4 mn buyers and 2 mn sellers. Buyers on the marketplace buy 6x/year which is significantly higher than Etsy. Buyer retention after year 1 is ~49%, similar to Etsy.

~90% active users are Zen Gs.

There are 4 mn buyers and 2 mn sellers. Buyers on the marketplace buy 6x/year which is significantly higher than Etsy. Buyer retention after year 1 is ~49%, similar to Etsy.

8/ ~75% GMS comes from existing cohorts, and perhaps most interestingly, 74% of sellers are also buyers.

9/ Depop estimates buyer base to be 20x of their current buyers.

In 2030, there will be 1.3 bn Gen Z. Like Venmo, the ambition is to focus on the niche and then grow with them by maniacally owning that niche.

In 2030, there will be 1.3 bn Gen Z. Like Venmo, the ambition is to focus on the niche and then grow with them by maniacally owning that niche.

10/ Future acquisitions are also likely to be niche, capital-light marketplaces. Etsy had been in touch with Depop for two years before finalizing this deal.

11/ In many ways, Etsy got lucky with Reverb acquisition as they bought at ~1x GMS.

Admittedly, musical instrument is a declining industry whereas apparel resale seems to have secular tailwind.

Admittedly, musical instrument is a declining industry whereas apparel resale seems to have secular tailwind.

12/ Nonetheless, given the price paid, I think it’s going to be very important for Etsy management that this acquisition better work.

13/ If their capital allocation skill is recognized in the market over the next 2-3 years, let’s just say there is a very eager shareholder base out there who want to own capital light businesses that’s led by a management with history of execution and prudent capital allocation.

14/ On the other hand, the question is how many niches you need to acquire to cover all your bases. If it’s an endless niche, that may not quite work out for shareholders.

End/ I am more of a “TBD” on the acquisition (market seems to really like it, +7% as of now); I can see why they did it, but usually prefer time and data going forward to help me lean in a specific direction.

My deep dive on Etsy: mbi-deepdives.com/etsy-a-handmad…

My deep dive on Etsy: mbi-deepdives.com/etsy-a-handmad…

Stupid mistake alert: thank you @MIcapital2

https://twitter.com/borrowed_ideas/status/1400134852268154882

• • •

Missing some Tweet in this thread? You can try to

force a refresh