So I think I’ve got a breadcrumb that could be expanded on by you Intelligent apes.

🦍

I would like y’all to look at this data I compiled from Fintel involving the SFYF a ETF fund that has a 23.53% weighted impact on AMC the underlying stock. #AMC

🦍

I would like y’all to look at this data I compiled from Fintel involving the SFYF a ETF fund that has a 23.53% weighted impact on AMC the underlying stock. #AMC

I’m also seeing that there are very different failure to reliever rules for ETF funds

Source:

Source:

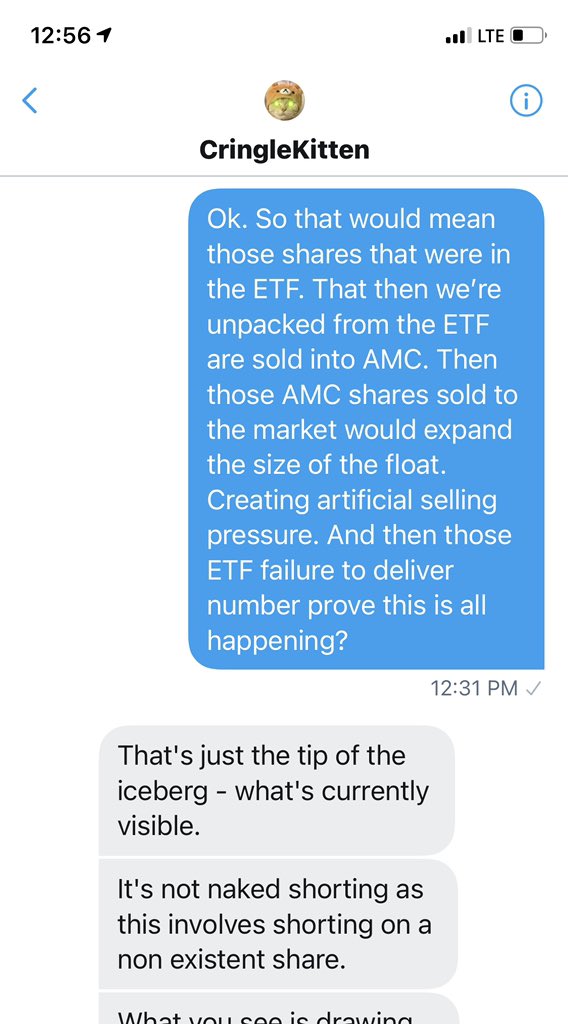

So at the 12minute point he talks about how essentially you can buy and open an ETF. Take out the stock and sell it being AMC in this case. This is Driving down the price of the stock.

...

...

So if they can sell the components of an ETF driving the underlying down. Then they Fail to deliver the ETF while shorting it. Is this not the exact same thing as Naked Shorting because they fail to Deliver the ETF and the underlying stock was still sold into the market.....

This means that more shares are in the available float than should be. Because they were never repackaged into the ETF and delivered back. And the rules for ETF per that video was they have T+6 days. To deliver before it becomes a failure to deliver....

Someone please fact check me here. Thank you

• • •

Missing some Tweet in this thread? You can try to

force a refresh