Sharing my Investing Principles 🔑

I wrote these when I first started direct equity investing and occasionally revisit them, time and again.

Writing these principles have helped me avoid major pitfalls and stay true to what I think is my investing ideology.

👇🏼

I wrote these when I first started direct equity investing and occasionally revisit them, time and again.

Writing these principles have helped me avoid major pitfalls and stay true to what I think is my investing ideology.

👇🏼

These principles are based on the lessons I have learnt by observing the giants and titans in the industry.

From Lynch, to Buffett, to Munger, Druckenmiller, to Klarman, to Pabrai and many others.

From Lynch, to Buffett, to Munger, Druckenmiller, to Klarman, to Pabrai and many others.

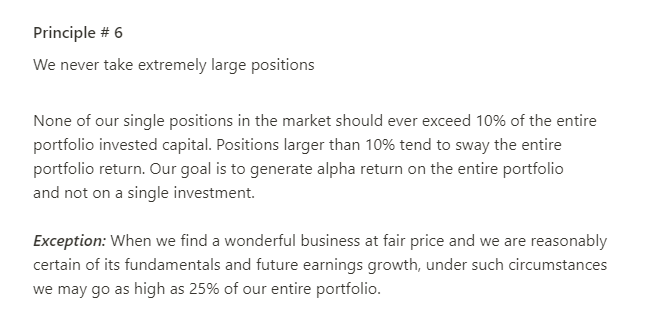

Principle # 4

A sound investment with no change in underlying fundamentals should be held for forever

A sound investment with no change in underlying fundamentals should be held for forever

If I have to boil down my investing to 7 rules, then these are it.

Highly recommend writing your own principles, if you have just started investing.

It will help you stay true to your ideology and ground you if you ever deviate from it.

Highly recommend writing your own principles, if you have just started investing.

It will help you stay true to your ideology and ground you if you ever deviate from it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh