A thread...

$ROKU What @Roku CEO Anthony Wood is doing with @TheRokuChannel is a display of some of the highest business acumen in practice that media has seen in a generation.

It's absolutely next level and still a decade ahead of the rest.

/1

$ROKU What @Roku CEO Anthony Wood is doing with @TheRokuChannel is a display of some of the highest business acumen in practice that media has seen in a generation.

It's absolutely next level and still a decade ahead of the rest.

/1

$ROKU

... This has thrust Roku into an unprecedented opportunity.

First...

Since it's all AVOD, he uses content acquisition cost precisely. It's not a 'well, gosh, a big movie with big stars probably gets us subscribers."

...

/2

... This has thrust Roku into an unprecedented opportunity.

First...

Since it's all AVOD, he uses content acquisition cost precisely. It's not a 'well, gosh, a big movie with big stars probably gets us subscribers."

...

/2

$ROKU

The revenue estimate measure is exact. "This many impressions at this CPM results in precisely this revenue."

The estimates may be off, but it's not a moving target. "This content is worth this much, exactly, and this is how we have decided that value."

...

/3

The revenue estimate measure is exact. "This many impressions at this CPM results in precisely this revenue."

The estimates may be off, but it's not a moving target. "This content is worth this much, exactly, and this is how we have decided that value."

...

/3

$ROKU

This is basically using Goolge and Facebook ad precision for ROI on his own platform.

This is the opposite of Netflix, HBO, Disney, etc, where they have to pluck an estimate out of the air with nearly impossible ROI metrics.

Second...

/4

This is basically using Goolge and Facebook ad precision for ROI on his own platform.

This is the opposite of Netflix, HBO, Disney, etc, where they have to pluck an estimate out of the air with nearly impossible ROI metrics.

Second...

/4

$ROKU

It creates business diversification. TRC is available on non Roku devices. The proliferation of the OS is the bullish thesis, no two ways about it, but at least there is a 'something' to reap rewards of booming OTT usage without just the OS.

Third...

/5

It creates business diversification. TRC is available on non Roku devices. The proliferation of the OS is the bullish thesis, no two ways about it, but at least there is a 'something' to reap rewards of booming OTT usage without just the OS.

Third...

/5

$ROKU

It's a launching point for other services for which Roku receives revenue share.

(Sign up for X service, recurring commission to Roku. This is the 'software as a platform' business; like Shopify, but, ya know, we can't quite go so far as to call Roku, Shopify.)

...

/6

It's a launching point for other services for which Roku receives revenue share.

(Sign up for X service, recurring commission to Roku. This is the 'software as a platform' business; like Shopify, but, ya know, we can't quite go so far as to call Roku, Shopify.)

...

/6

$ROKU

Fourth...

If TRC gets large enough w content and usage, it can become YouTube of streaming. Tons of content, all free, advertisements are expected, available anywhere. Again, would be silly to compare the scale, Roku is not YouTube, but the strategy is similar.

...

/7

Fourth...

If TRC gets large enough w content and usage, it can become YouTube of streaming. Tons of content, all free, advertisements are expected, available anywhere. Again, would be silly to compare the scale, Roku is not YouTube, but the strategy is similar.

...

/7

$ROKU

Fifth...

First party data is king. Google and Facebook own this world on the web.

All others will sink or swim on their own first party data quality.

Roku has both the OS platform and now TRC with 70M+ viewers worldwide, all with a Roku account.

...

/8

Fifth...

First party data is king. Google and Facebook own this world on the web.

All others will sink or swim on their own first party data quality.

Roku has both the OS platform and now TRC with 70M+ viewers worldwide, all with a Roku account.

...

/8

$ROKU

This is the new Internet.

'Streaming TV' or 'OTT' are not complete descriptors. It is, for the first time, appropriately called Internet TV. The other uses of that phrase are not true to the ethos and scale.

...

/9

This is the new Internet.

'Streaming TV' or 'OTT' are not complete descriptors. It is, for the first time, appropriately called Internet TV. The other uses of that phrase are not true to the ethos and scale.

...

/9

$ROKU @Roku

Roku is trying to win the new Internet and like the web, it will be measured in billions of users.

There's more, but this is good for now...

/10

Roku is trying to win the new Internet and like the web, it will be measured in billions of users.

There's more, but this is good for now...

/10

$ROKU

But the a part of the genius is more subtle, until it isn't.

With linear TV content spend could be measured against ROI with ad sales which were driven by viewership.

With movies, measured with box office revenue.

...

/11

But the a part of the genius is more subtle, until it isn't.

With linear TV content spend could be measured against ROI with ad sales which were driven by viewership.

With movies, measured with box office revenue.

...

/11

$ROKU

But streaming is harder and this is holding back ad buying demand.

(Supply is there in size.)

Roku is using its own platform to create the right content spend strategy to generate ROI. Not only is this successful for the firm but...

...

/12

But streaming is harder and this is holding back ad buying demand.

(Supply is there in size.)

Roku is using its own platform to create the right content spend strategy to generate ROI. Not only is this successful for the firm but...

...

/12

$ROKU

... this is a large scale direct usage of the data and it will serve as a proof point to all other advertisers.

This would be like Google running an ad campaign to get more searches and proving the ROI so others will use search to advertise.

...

/13

... this is a large scale direct usage of the data and it will serve as a proof point to all other advertisers.

This would be like Google running an ad campaign to get more searches and proving the ROI so others will use search to advertise.

...

/13

$ROKU

Roku will accelerate OTT advertising by using its own data to build its own business.

This is the crux of the matter and it's wonderfully addressed.

In the meantime, Roku will use its own competitive advantage to make TRC ever more ppowerful.

...

/14

Roku will accelerate OTT advertising by using its own data to build its own business.

This is the crux of the matter and it's wonderfully addressed.

In the meantime, Roku will use its own competitive advantage to make TRC ever more ppowerful.

...

/14

$ROKU

The demand is coming.

The dollars will follow.

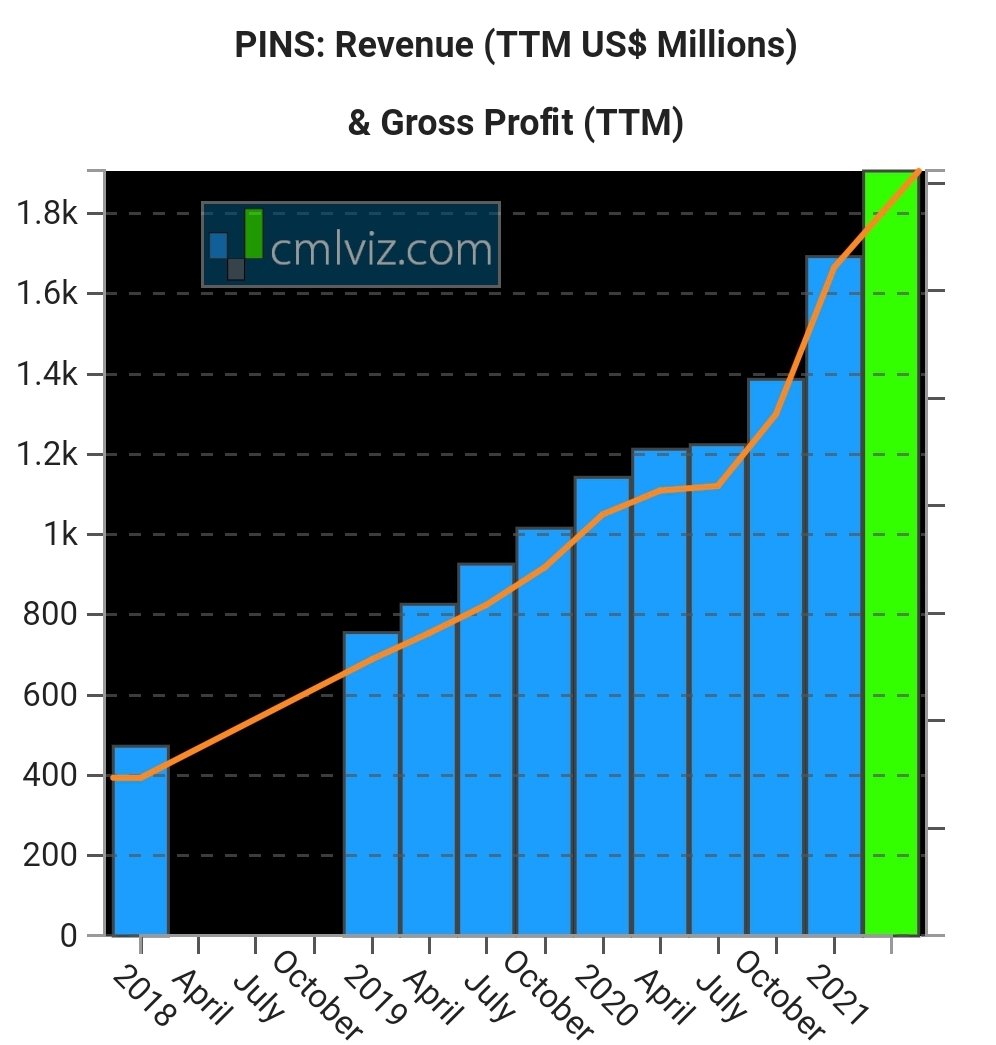

Here is a chart which demonstrates cognition of this reality by sell side analysts.

This is FY 2024 revenue estimates for Roku.

They have risen by 60% in a year.

Wall Street is playing catch up.

/15

The demand is coming.

The dollars will follow.

Here is a chart which demonstrates cognition of this reality by sell side analysts.

This is FY 2024 revenue estimates for Roku.

They have risen by 60% in a year.

Wall Street is playing catch up.

/15

If you learned from this thread, that is, if you feel it makes you a better investor then consider this is 15 tweets.

CML Pro is six years of full blown dossiers and CEO / CFO one-on-one interviews.

Tweets are entertainment.

CML Pro is on purpose.

👇

bit.ly/CMLPro

CML Pro is six years of full blown dossiers and CEO / CFO one-on-one interviews.

Tweets are entertainment.

CML Pro is on purpose.

👇

bit.ly/CMLPro

• • •

Missing some Tweet in this thread? You can try to

force a refresh