1/ Macro thesis on BTC & ETH

During @UpOnlyTV with @CryptoCobain @ledgerstatus @Sicarious_ @mattysino, Matty and I got into a debate, I am writing this thread to clarify my Macro thesis.

In my view the only way out of current debt levels is inflation = bullish for BTC & ETH.

During @UpOnlyTV with @CryptoCobain @ledgerstatus @Sicarious_ @mattysino, Matty and I got into a debate, I am writing this thread to clarify my Macro thesis.

In my view the only way out of current debt levels is inflation = bullish for BTC & ETH.

https://twitter.com/UpOnlyTV/status/1400530368009326595

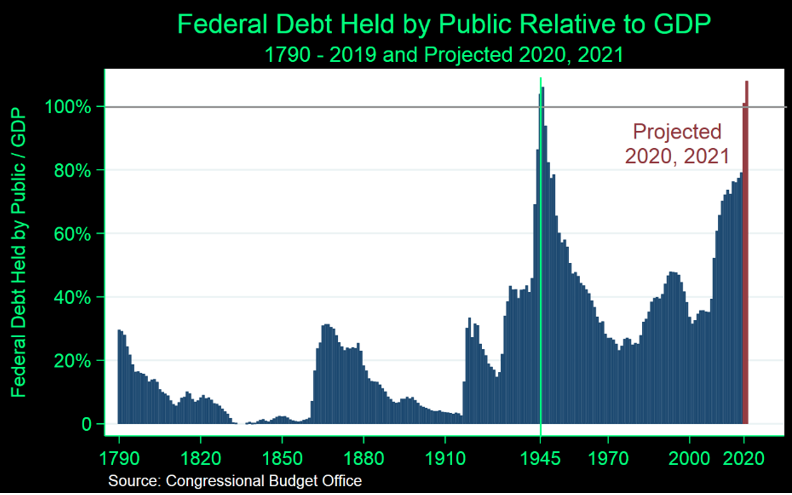

2/ The Debt/GDP ratio in the US has skyrocketed to new all-time highs (~130%), the last time it at these levels was WW2. We peaked in 1946 and quickly de-levered.

This raises two questions 1) Why is Debt to GDP important? 2) How did de-lever so quickly last time?

This raises two questions 1) Why is Debt to GDP important? 2) How did de-lever so quickly last time?

3/ The Debt/GDP ratio is important as it shows the ability for the country issuing debt to pay it back. We have seen creditors get concerned about the US ability to pay its debts in real terms.

Looking back to 2014 when foreign central banks stopped buying US debt on net.

Looking back to 2014 when foreign central banks stopped buying US debt on net.

4/ When foreign CB's stopped/slowed their UST purchases it left a lot of pressure on the FED and the US banking system to absorb US deficits.

Deficit's were further exaggerated by COVID and the FED + US banks have bought 85% of treasuries issued since March of 2020.

Deficit's were further exaggerated by COVID and the FED + US banks have bought 85% of treasuries issued since March of 2020.

5/ This helps to illustrate the lack of foreign demand for US treasuries and the ballooning size of US debt.

US debt demand was once largely driven by foreign creditors but now is left almost entirely to the FED and the US banking system. Indicating worries around Inflation.

US debt demand was once largely driven by foreign creditors but now is left almost entirely to the FED and the US banking system. Indicating worries around Inflation.

6/ The US is in a critical spot now where they have two options, default on their debt (extremely unlikely) or inflate it away reducing the REAL value of their obligations.

Some may ask “Well can’t the government just spend less and get their debt under control that way?”

Some may ask “Well can’t the government just spend less and get their debt under control that way?”

7/ This was still an option a few years ago but the situation since then has become irreversible.

US Gov tax receipts (revenues) are less than their debt servicing cost + recurring expenditures so at this point they are issuing more debt just to SERVICE their own liabilities.

US Gov tax receipts (revenues) are less than their debt servicing cost + recurring expenditures so at this point they are issuing more debt just to SERVICE their own liabilities.

8/ Further more, >20% of US GDP is already from Gov spending, if they tried to reduce this it would send a negative feedback loop through the economy.

Cut spending = lower GDP and less growth = less tax receipts = must issue even more debt to service existing liabilities.

Cut spending = lower GDP and less growth = less tax receipts = must issue even more debt to service existing liabilities.

9/ Look at the following clip where Michael Burry (Big Short) answers the question “When does the US become a Ponzi scheme?”

His answer: “When they start printing money to pay interest on their debt”.

Well Dr. Burry we have arrived.

His answer: “When they start printing money to pay interest on their debt”.

Well Dr. Burry we have arrived.

10/ We also have an IMF working paper: “The Liquidation of Government Debt” which is essentially a guide to how the US will de-lever. It involves running the WW2 playbook. Below is the abstract.

Financial Repression = “Savers earning returns below the rate of inflation”

Financial Repression = “Savers earning returns below the rate of inflation”

11/ To get ~130% Debt to GDP down to 70% the US Gov would need to see nominal GDP growth of 20% for 5 years or 10% for 13 years.

With majority of the "nominal GDP" growth coming from inflation. Ex: Real GDP growth ~5% and inflation between 5-15% = Nominal GDP 10-20%

With majority of the "nominal GDP" growth coming from inflation. Ex: Real GDP growth ~5% and inflation between 5-15% = Nominal GDP 10-20%

12/ Taking our World War 2 example, rates were capped at .5% on the short end and 2.5% on the long end of the curve.

Assuming the same circumstances this time a 10 year UST holder could be facing anywhere between 2.5 – 12.5% negative real rates (nominal yield – inflation).

Assuming the same circumstances this time a 10 year UST holder could be facing anywhere between 2.5 – 12.5% negative real rates (nominal yield – inflation).

13/ Up until 2020/21 Bitcoin was never seen as an asset among institutions but now it is, specifically with the narrative of inflation hedge + SoV.

The importance of this can not be overstated. Bitcoin is now being discussed as a legitimate alternative, see the below from $GLXY.

The importance of this can not be overstated. Bitcoin is now being discussed as a legitimate alternative, see the below from $GLXY.

14/ There are over 45T worth of bonds in the US alone. What do you think happens when these bonds start to see negative real rates of 2.5-12.5% (in line with WW2 numbers)

Money will start flowing to "inflation hedges". Below is a great infographic to help illustrate my point.

Money will start flowing to "inflation hedges". Below is a great infographic to help illustrate my point.

15/ When these bonds start to run it will cause massive asset price appreciation in everything except bonds/cash as money scrambles to escape inflation.

Crypto has positioned itself perfectly with the store of value and digital scarcity narrative.

Crypto has positioned itself perfectly with the store of value and digital scarcity narrative.

16/ As I said on @UpOnlyTV when this inflation kicks in it will be like trying to fit a pool (bonds & cash) inside of a water bottle (BTC).

I remain very bullish and believe this is a mid cycle correction, we are in the largest global deleveraging event since WW2 (70yrs ago).

I remain very bullish and believe this is a mid cycle correction, we are in the largest global deleveraging event since WW2 (70yrs ago).

17/ Clarifying my response to @mattysino when he told me the yield curve says I'm wrong.

My response was the fact that the FED has been artificially keeping these rates low via QE at the pace of $80b a month.

My response was the fact that the FED has been artificially keeping these rates low via QE at the pace of $80b a month.

18/ I understand what @mattysino was saying, the bond market does not seem to be signaling inflation.

But when we look under the hood the FED is doing 80b a month in QE, 4x more then they were in 2019 to keep rates at the same level. The FED is muting the bond market.

But when we look under the hood the FED is doing 80b a month in QE, 4x more then they were in 2019 to keep rates at the same level. The FED is muting the bond market.

19/ Hope this clears up the macro thesis, @mattysino I will take you up on a friendly bet that we will see inflation in the US >7.5% at some point over the next 4 years.

*Not financial advice, DYOR*

*Not financial advice, DYOR*

Readings:

6/home.treasury.gov/system/files/2…

9/ IMF paper imf.org/external/pubs/…

13/ Galaxy Digital Investor Presentation

14/visualcapitalist.com/all-of-the-wor…

6/home.treasury.gov/system/files/2…

9/ IMF paper imf.org/external/pubs/…

13/ Galaxy Digital Investor Presentation

14/visualcapitalist.com/all-of-the-wor…

• • •

Missing some Tweet in this thread? You can try to

force a refresh