1/ Lido Finance Investment Thesis Update:

@LidoFinance continues to impress me. The creation of liquid staking derivatives across top layer 1’s and dApps is a massive untapped market.

Recently a proposal for $SOL was passed and one for $AAVE is in the works!

@LidoFinance continues to impress me. The creation of liquid staking derivatives across top layer 1’s and dApps is a massive untapped market.

Recently a proposal for $SOL was passed and one for $AAVE is in the works!

2/ Since our last thread (40 days ago) ETH in Lido has increased from 250,000 to 460,000! Growing stETH by 75% in May alone.

If stETH were to grow at even 1/4th this pace (19% MoM) for the rest of the year, we would see ~1.3m stETH by December which is ~1.2% of all ETH.

If stETH were to grow at even 1/4th this pace (19% MoM) for the rest of the year, we would see ~1.3m stETH by December which is ~1.2% of all ETH.

3/ Currently there are proposals on AAVE and Maker to integrate stETH as collateral.

If integrated this would increase stETH flows significantly. Assuming the stETH/ETH peg can maintain itself then stETH is simply a better form of collateral.

If integrated this would increase stETH flows significantly. Assuming the stETH/ETH peg can maintain itself then stETH is simply a better form of collateral.

4/ AAVE has 2m ETH, and Maker has 2.6m ETH in use. This provides a benchmark for what stETH lending/borrowing markets could become.

If the 1:1 peg holds, stETH is essentially the same asset with an additional 6% yield on the overall collateral per year.

If the 1:1 peg holds, stETH is essentially the same asset with an additional 6% yield on the overall collateral per year.

5/ 6% is substantial considering over the past 30 days the ETH lend/borrow rate has been between 1-5%.

Not only will this juice the returns of "ETH" in DeFi but will allow for new products. Ex: loans that use staking reward of collateral to pay its own interest (Anchor-Terra).

Not only will this juice the returns of "ETH" in DeFi but will allow for new products. Ex: loans that use staking reward of collateral to pay its own interest (Anchor-Terra).

6/ Speaking of the peg - looking at the most recent drawdown ETH traded down 50% over 4 days, we can see that the stETH/ETH peg held - trading at less than a 1% discount.

This is constructive for the case of stETH being added to AAVE and Maker as a new collateral.

This is constructive for the case of stETH being added to AAVE and Maker as a new collateral.

7/ The peg held up because most users in the curve pool are long term ETH holders and are not using stETH to lever up/speculate.

Although once you add lending/leveraged trading to the asset then a 50% drop over 4 days would cause liquidations and pressure on the peg.

Although once you add lending/leveraged trading to the asset then a 50% drop over 4 days would cause liquidations and pressure on the peg.

8/ We have seen an example of this with Luna and bLuna. During the recent market downturn we saw a very aggressive pullback, Luna went from $15 – $9 in 24hr.

This caused mass bLuna liquidations on Anchor, blowing out the bLuna/Luna peg, bLuna traded at a 30% discount.

This caused mass bLuna liquidations on Anchor, blowing out the bLuna/Luna peg, bLuna traded at a 30% discount.

9/ There are a 3 key differences between bLuna/Luna and stETH/ETH:

1)bLuna/Luna does not have liquidity incentives, but withdrawals are enabled (21 days).

2)Luna is much smaller than ETH and almost everyone on Anchor was levered at a price above $14. Given timing of Anchor.

1)bLuna/Luna does not have liquidity incentives, but withdrawals are enabled (21 days).

2)Luna is much smaller than ETH and almost everyone on Anchor was levered at a price above $14. Given timing of Anchor.

10/ Lastly,

3) Luna staking is live so lots of Luna that could have taken advantage of this arb (~3/4 of circulating supply) was locked.

This is an interesting case study but stETH/ETH seems like it would be able to handle this volatility much better.

3) Luna staking is live so lots of Luna that could have taken advantage of this arb (~3/4 of circulating supply) was locked.

This is an interesting case study but stETH/ETH seems like it would be able to handle this volatility much better.

11/ IMO, stETH/ETH is a different beast in terms of size and amount of ETH on the sideline that would take advantage of a peg break if one happened.

Long term ETH holders would rush to swap their ETH for stETH if they could get a 5-10% increase in their stack, let alone 30%!

Long term ETH holders would rush to swap their ETH for stETH if they could get a 5-10% increase in their stack, let alone 30%!

11/ As stETH liquidity improves and we get the merge these growing pains will go away and stETH’s ability to provide extra yield will be the dominant factor.

I am excited for AAVE and Maker integrations as they will contribute significantly to utility and adoption of stETH!

I am excited for AAVE and Maker integrations as they will contribute significantly to utility and adoption of stETH!

12/ @ChorusOne released and passed a proposal to launch liquid staking on Solana.

This will expand Lido’s reach to another quick growing layer 1. Chorus will receive 1m LDO tokens if it can capture 2.5% of staked SOL and an additional 1m if it can reach 25% of staked SOL.

This will expand Lido’s reach to another quick growing layer 1. Chorus will receive 1m LDO tokens if it can capture 2.5% of staked SOL and an additional 1m if it can reach 25% of staked SOL.

13/ This is a great incentive structure and Lido is shaping up to be the default liquid staking solution on Ethereum, Terra, and Solana.

Not only is this exciting to see Lido expand to other Layer 1’s but recently we have just seen a proposal to create liquid staking for AAVE.

Not only is this exciting to see Lido expand to other Layer 1’s but recently we have just seen a proposal to create liquid staking for AAVE.

14/ The team at @Delphi_Digital has proposed stAAVE a liquid staking derivative of AAVE. With the common benefits of increased capital efficiency and liquidity to staked assets.

Excerpt from @lukedelphi

Excerpt from @lukedelphi

15/ Comments like this from VC's like @Delphi_Digital make me extremely bullish for the future of Lido.

There are so many VC's + Validators invested in the Lido all contributing resources to help it grow.

Another example: @zhusu @kyled116 from 3AC staked ~65k ETH with Lido.

There are so many VC's + Validators invested in the Lido all contributing resources to help it grow.

Another example: @zhusu @kyled116 from 3AC staked ~65k ETH with Lido.

16/ Lido currently:

Has 70% of the ETH liquid derivative staking market.

Holds 8.5% of all ETH staked.

On the 30 day MA is capturing 16% of new ETH flowing into the beacon chain.

Has 70% of the ETH liquid derivative staking market.

Holds 8.5% of all ETH staked.

On the 30 day MA is capturing 16% of new ETH flowing into the beacon chain.

17/ If stETH does become widely adopted, it could become just as big as ETH itself as per @gakonst and @hasufl paper (linked below).

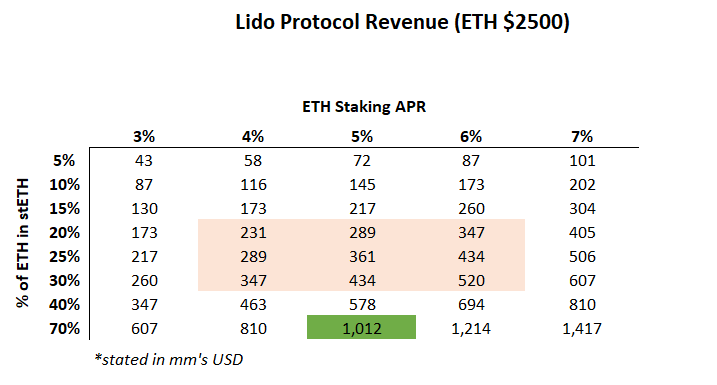

Carrying its current market dominance forward at 2.5k ETH and 5% staking rate that would be ~1b in protocol revenues per year.

Carrying its current market dominance forward at 2.5k ETH and 5% staking rate that would be ~1b in protocol revenues per year.

18/ This would be the best case-scenario, but none the less it is a very real possibility. (base case is in pink)

Everyone wants to use the liquid staking derivative that has the deepest liquidity and most integrations, thus making this a winner take all distribution.

Everyone wants to use the liquid staking derivative that has the deepest liquidity and most integrations, thus making this a winner take all distribution.

19/ The intellectual capital that Lido has attracted is unparalleled. A skilled and brilliant: team, investors, and network of validators.

Furthermore, they are tackling a market with huge growth potential, solving a key issue in DeFi surrounding capital efficiency.

Furthermore, they are tackling a market with huge growth potential, solving a key issue in DeFi surrounding capital efficiency.

20/ To me there is a ton of asymmetry in Lido. If they can capture a dominant position in layer 1's like ETH, SOL, and LUNA then they will be wildly successful.

Read our previous Lido post for more info, thanks!

*Not financial advice DYOR, we are long Lido*

Read our previous Lido post for more info, thanks!

*Not financial advice DYOR, we are long Lido*

21/

AAVE – stETH proposal: governance.aave.com/t/proposal-add…

Maker – stETH proposal: forum.makerdao.com/t/steth-mip6-c…

stAAVE Proposal - research.lido.fi/t/lido-for-aav…

@_vshapovalov on stETH Liquidity - blog.lido.fi/concerning-ste…

@gakonst & @hasufl on stETH following a power law -

research.paradigm.xyz/staking

AAVE – stETH proposal: governance.aave.com/t/proposal-add…

Maker – stETH proposal: forum.makerdao.com/t/steth-mip6-c…

stAAVE Proposal - research.lido.fi/t/lido-for-aav…

@_vshapovalov on stETH Liquidity - blog.lido.fi/concerning-ste…

@gakonst & @hasufl on stETH following a power law -

research.paradigm.xyz/staking

• • •

Missing some Tweet in this thread? You can try to

force a refresh