Bitcoin’s 5th wave seems to be underway, in what has been a textbook pattern so far (

https://twitter.com/TimmerFidelity/status/1399825837172707335). A classic 5th (where 5=1) would target 23,076. But sometimes 5th waves can fall short & reach only 0.618x1 (29,872). THREAD/1

Sometimes there can even be a “failed 5th” (retest of the wave 3 low at 30,017). Yes EWT is as much art as science. With all the attention out there on the triangle breakdown, it wouldn’t surprise me if we end up with a shorter 5th. /2

If so, it’ll be important that the retest gets rejected with a powerful reversal. That could trigger a bullish momentum divergence (the opposite of what we saw at the high). But if BTC makes a new low and stays there, that would be a bearish sign. /3

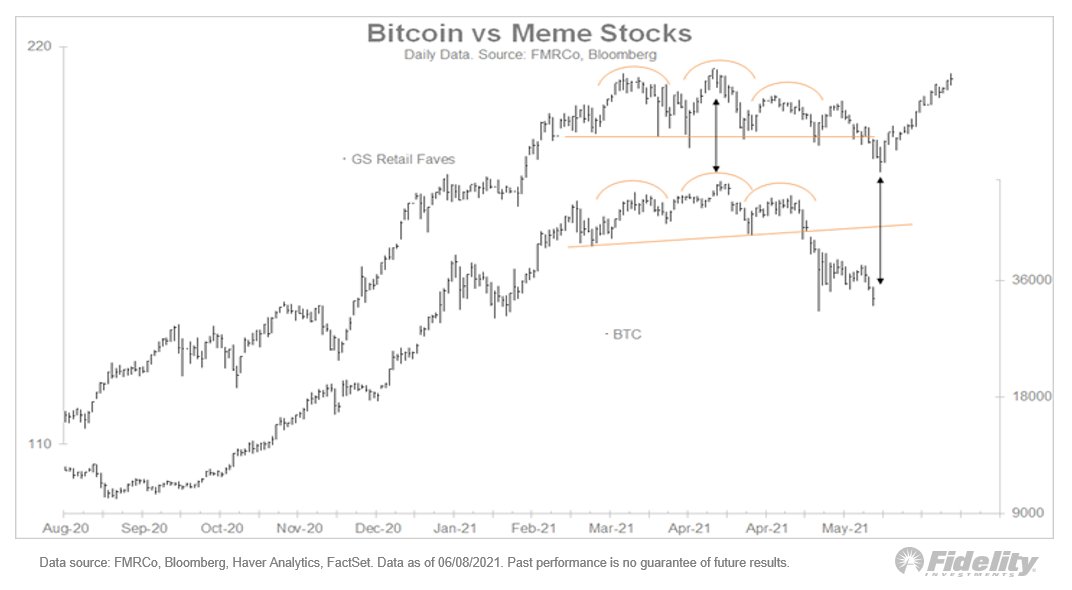

Another positive development is that BTC has followed the general boom/bust pattern of the meme stocks (with a one month lag). This suggests that we are now in the general time zone for a low. /4

Finally, we often find so-called “inter-market” divergences at lows. If BTC does undercut the low, we have the potential for a bullish divergence from the bitcoin-sensitive equities. Note that this index produced the opposite signal at the highs. END/5

• • •

Missing some Tweet in this thread? You can try to

force a refresh