1/ A thread on decentralized crypto insurance:

Nexus Mutual is currently the leading insurance platform in the space. Time will tell whether or not the insurance model will last, as although it improves upon a P2P model, in theory, it's less efficient than a pooled model.

Nexus Mutual is currently the leading insurance platform in the space. Time will tell whether or not the insurance model will last, as although it improves upon a P2P model, in theory, it's less efficient than a pooled model.

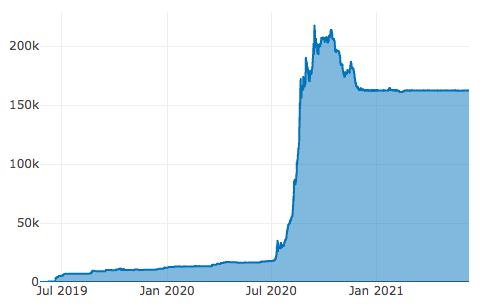

2/ In terms of the fund, Nexus Mutual is currently stuck at a 100% MCR, and has been for all of 2021. There is a minimum capital requirement of 162,425 ETH. This means that no one can swap out of NXM, but only out of WNXM, which is a liquid version of NXM.

3/ WNXM ($59.34) trades at an extreme discount to NXM ($89.83) because it essentially serves as the price to pay for exit liquidity.

Anyone that wants to be a cover provider will have to face this illiquid issue, potentially making it less desirable to use Nexus Mutual at all.

Anyone that wants to be a cover provider will have to face this illiquid issue, potentially making it less desirable to use Nexus Mutual at all.

4/ In fact, denominated by ETH, the capital pool size has not changed for several months despite the growth of crypto prices YTD.

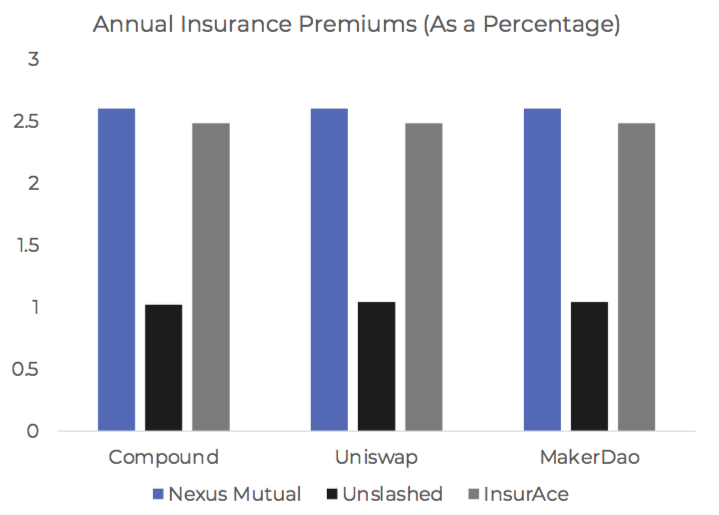

5/ From a cover buyer's perspective, Nexus Mutual's standard 2.6% annual premium is a high price to pay, especially for delta-neutral players, during a slow market. Insurance would effectively eat up potential yields.

The result? People will go shopping.

The result? People will go shopping.

6/ Unslashed Finance provides much cheaper rates at the moment for the various blue-chip protocols. These rates are partly possible because of the high amount of leverage that Unslashed is using: its active cover amount is much higher than its capital pool (~5x).

7/ Time will tell how long the MCR% will stay at 100%. One other thing to consider is that as crypto prices go down, cover amount will also go down. Moreover, desire to interact with DeFi protocols in general may decrease during a bear market.

Full report to come for our subs.

Full report to come for our subs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh