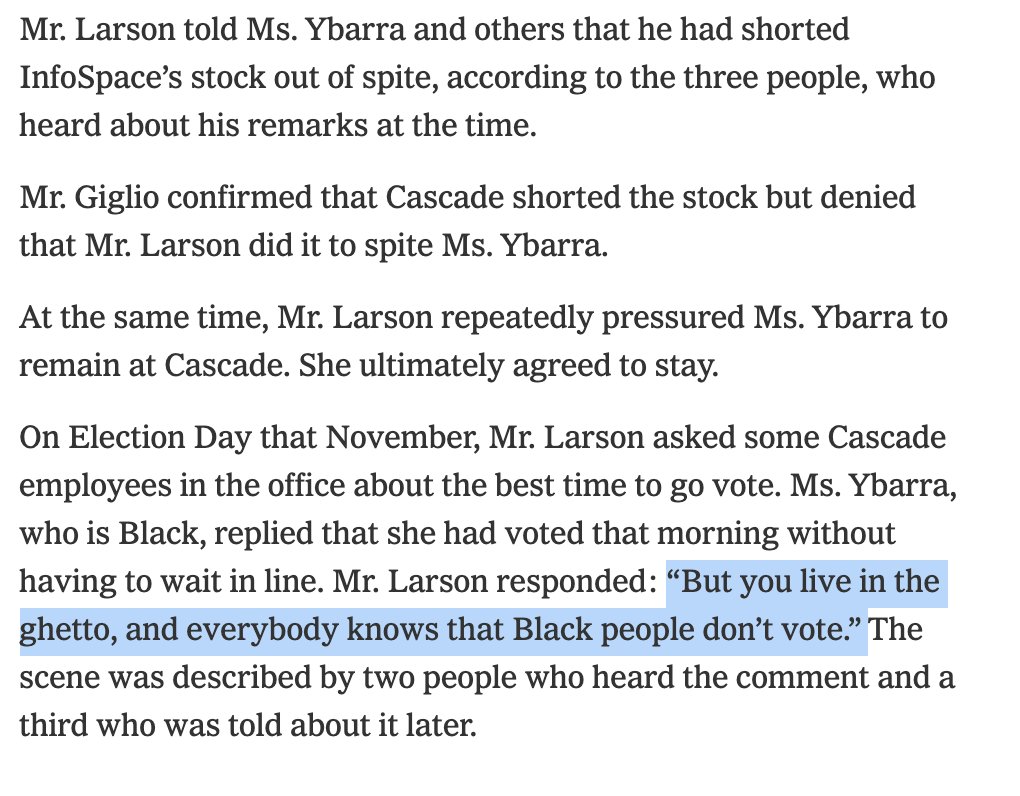

Big @nytimes investigation: How the private equity industry conquered the US tax system:

• Industry whistle-blowers have repeatedly flagged potentially illegal tax avoidance to IRS.

• Yet IRS has stopped auditing the industry. @JesseDrucker @dannyhakim nytimes.com/2021/06/12/bus…

• Industry whistle-blowers have repeatedly flagged potentially illegal tax avoidance to IRS.

• Yet IRS has stopped auditing the industry. @JesseDrucker @dannyhakim nytimes.com/2021/06/12/bus…

If you earn less than $25K, you are much more likely to face IRS audit than a billionaire private equity exec.

Meanwhile, the industry has steamrolled the Treasury in GOP and Dem administrations.

Billions of dollars in income go untaxed.

More to come in this vein. Stay tuned.

Meanwhile, the industry has steamrolled the Treasury in GOP and Dem administrations.

Billions of dollars in income go untaxed.

More to come in this vein. Stay tuned.

Industry lawyer says move on, there’s nothing new to see here ⬇️⬇️

https://twitter.com/professortax/status/1403684414454894592

One indication of how far the balance of power has tilted against aggressive enforcement of tax laws is that lawyers for private equity firms are not only publicly boasting about their successes but are even willing to sit for @nytimes photo shoots.

• • •

Missing some Tweet in this thread? You can try to

force a refresh