Breaking: Justice Dept is about to penalize @DeutscheBank for violating anti-bribery laws as it tried to win business in places like China. The bank is expected to pay more than $100 million in penalties. nytimes.com/2021/01/08/bus…

The charges involve Deutsche's efforts to win business in China (and possibly other countries), where the bank for years doled out lavish gifts and huge amounts of money to Chinese insiders.

Deutsche and DOJ are expected to enter into a so-called deferred prosecution agreement.

Deutsche and DOJ are expected to enter into a so-called deferred prosecution agreement.

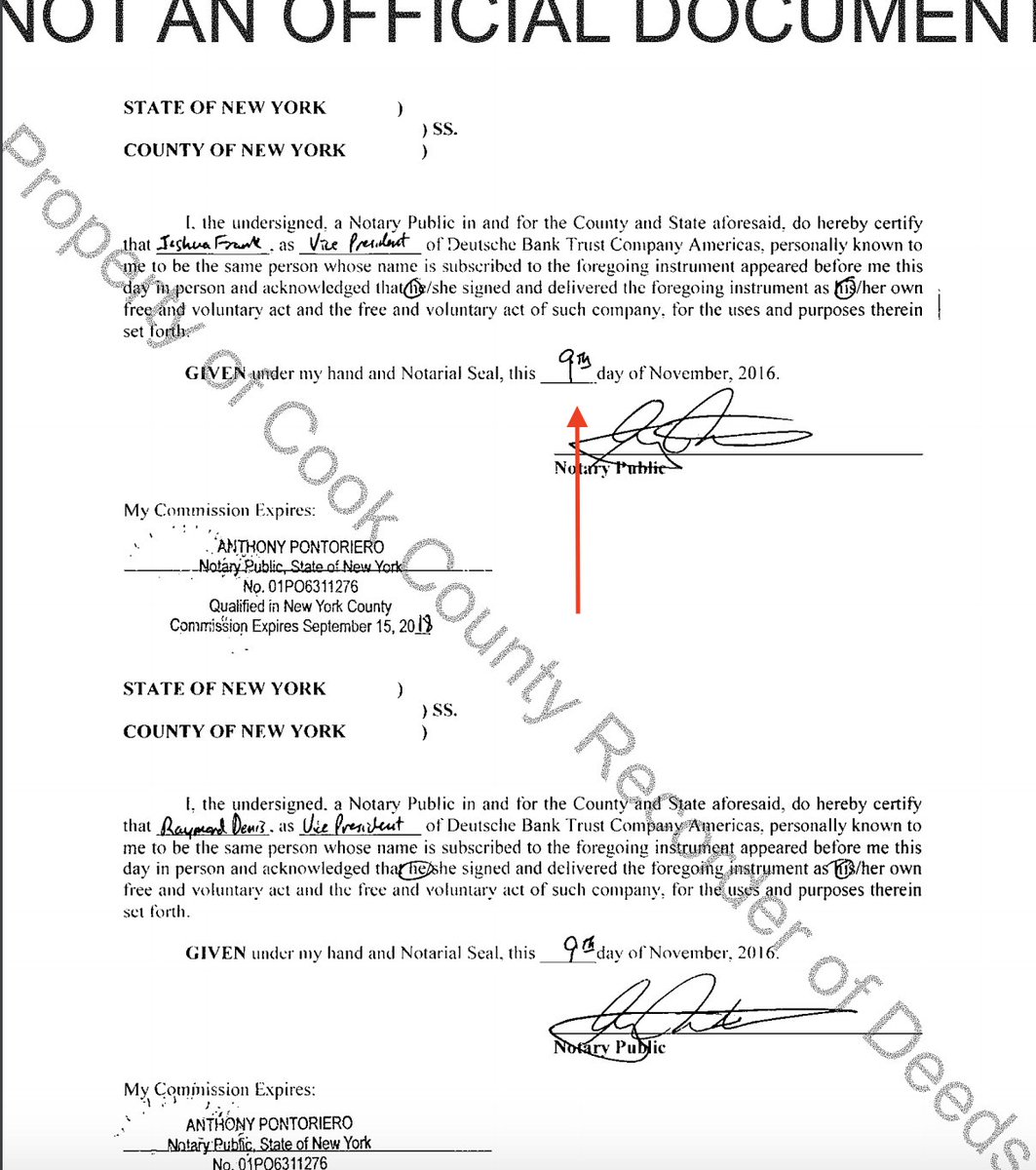

It is very noteworthy that this settlement is coming in the dying days of @realDonaldTrump's presidency.

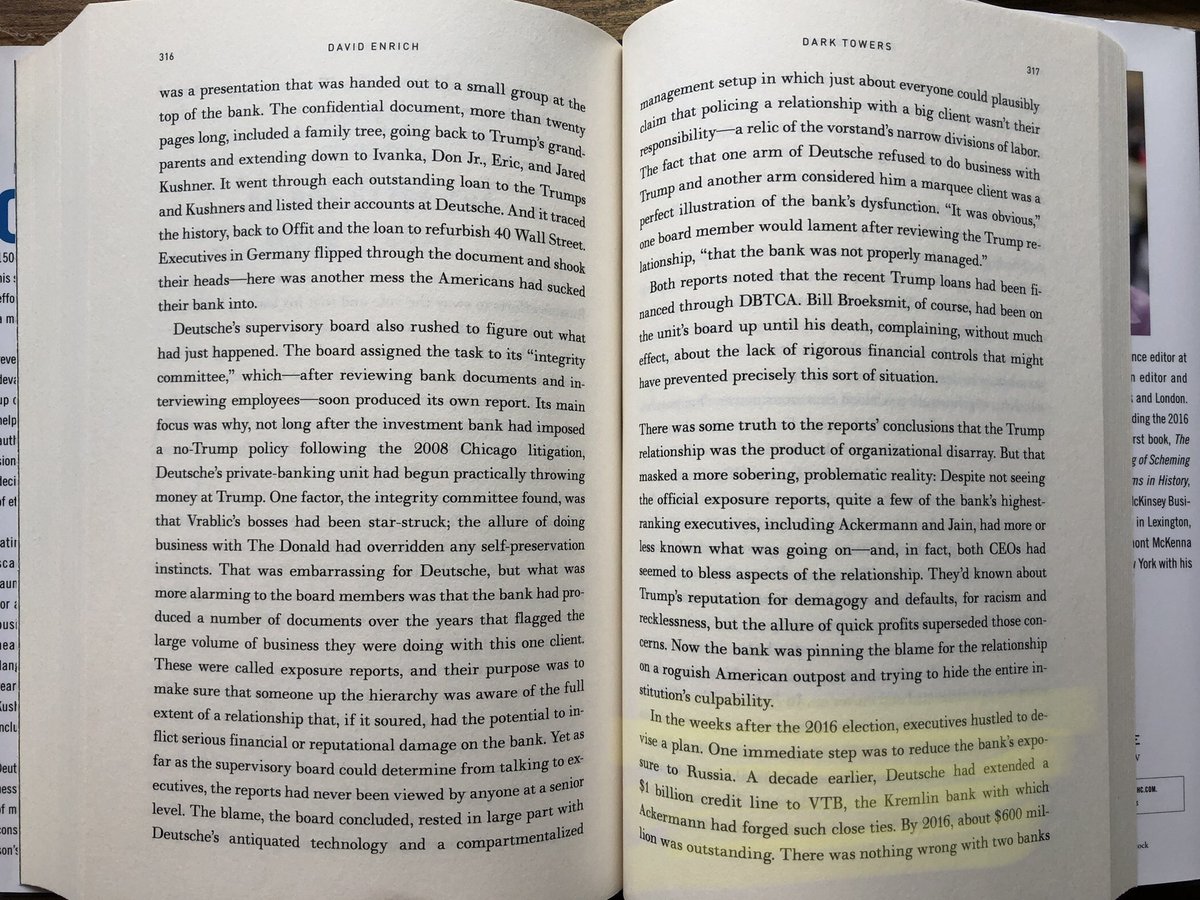

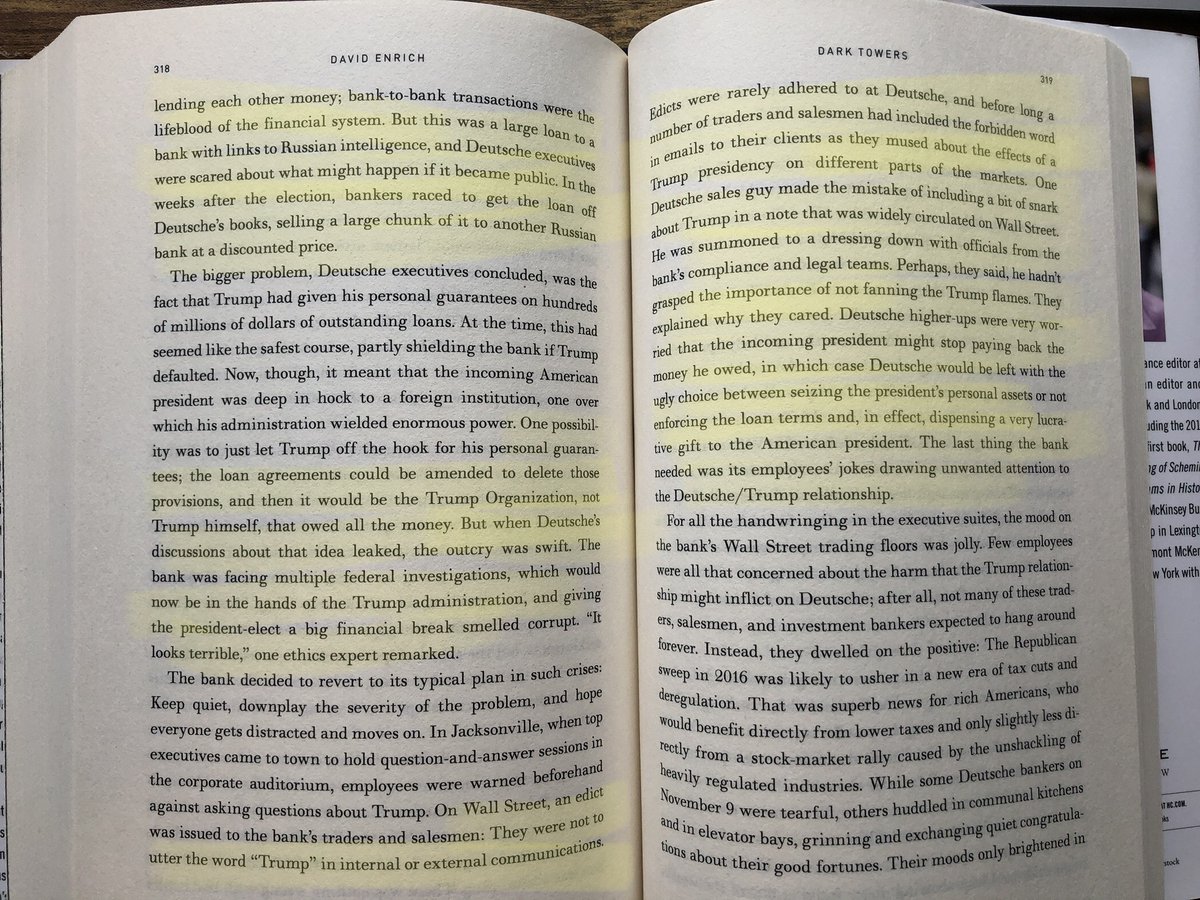

He owes the bank more than $300M, which he personally guaranteed and is coming due soon. There is no avoiding the appearance of a conflict of interest here.

He owes the bank more than $300M, which he personally guaranteed and is coming due soon. There is no avoiding the appearance of a conflict of interest here.

The roughly $125 million penalty against @DeutscheBank is **half** of what the bank's own lawyers warned executives that they were likely to have to pay.

See this 2019 article with @PekingMike @jotted for more gory details on DB's 15-year Chinese scheme. nytimes.com/2019/10/14/bus…

See this 2019 article with @PekingMike @jotted for more gory details on DB's 15-year Chinese scheme. nytimes.com/2019/10/14/bus…

The details from the DOJ agreement with @DeutscheBank are...ugly. The bank was paying straight-up bribes to win business in Saudi Arabia and Abu Dhabi (among other places).

A few examples below justice.gov/usao-edny/pres…

A few examples below justice.gov/usao-edny/pres…

The SEC also busted Deutsche Bank today for corruption in China and elsewhere. sec.gov/litigation/adm…

For those of you paying close attention, yes, the SEC also punished Deutsche for similar corruption in Russia and China in 2019. sec.gov/litigation/adm…

For those of you paying close attention, yes, the SEC also punished Deutsche for similar corruption in Russia and China in 2019. sec.gov/litigation/adm…

I know we are all kind of inured to big banks' bad behavior.

But...it is truly remarkable how Deutsche keeps getting caught, then pays a big fine and promises to reform itself, then gets caught and promises to reform itself, and round and round we go, year after year after year.

But...it is truly remarkable how Deutsche keeps getting caught, then pays a big fine and promises to reform itself, then gets caught and promises to reform itself, and round and round we go, year after year after year.

• • •

Missing some Tweet in this thread? You can try to

force a refresh