Some thoughts on the PNB Housing Finance (PNBHF) drama around raising INR 4000 crore via preferential issue and ceding management control to Carlyle PE.

On 31 May 21, PNBHF board approved fundraise via preferential issue of shares worth INR 4000 crore to Carlyle PE, General Atlantic and Salisbury Investments (Aditya Puri). The price was fixed at INR 390 per share, INR 6 above the floor under the SEBI ICD regulations. (1/n)

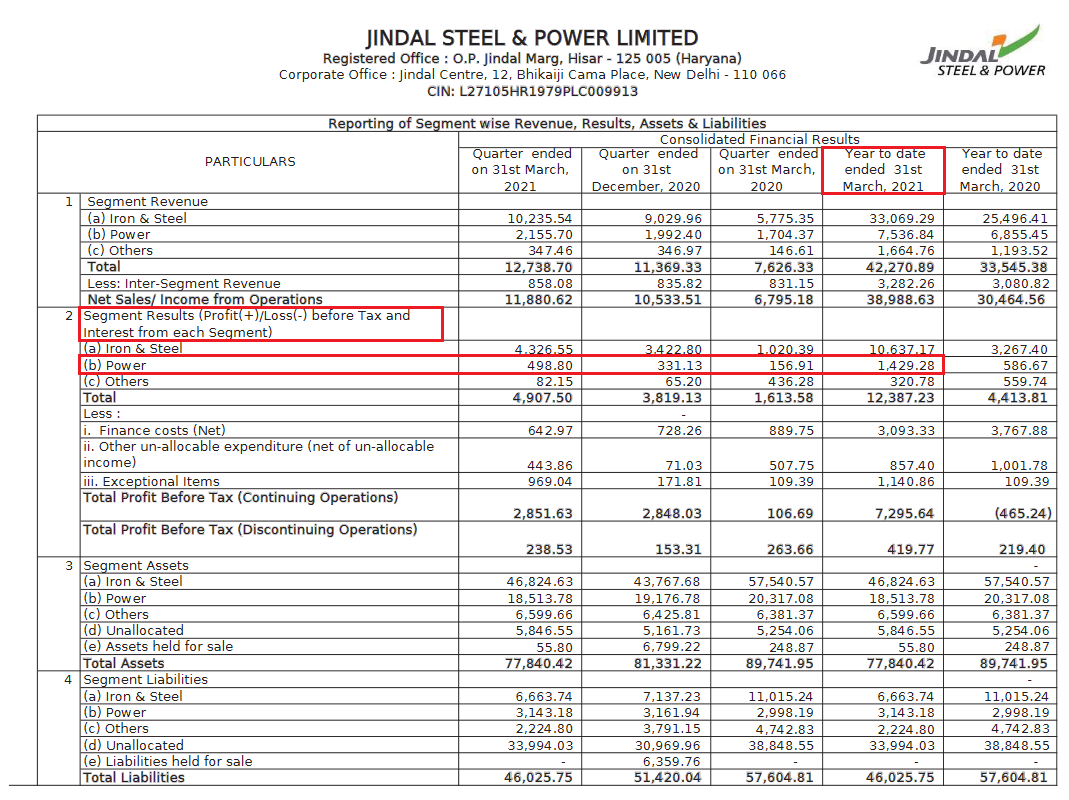

The share capital of PNBHF will increase from 16.82 crore equity shares of INR 10 each, to 27 crore equity shares of INR 10 each. Simple math - 39% dilution on the existing share capital base. That is a huge dilution for promoters and minority shareholders. (2/n)

PNBHF has been talking of raising INR 1800 crore for a while. In August 2020, the board approved a fund-raise of 1800 crore through rights issue or preferential issue. However, RBI seemingly blocked PNB (promoter) from investing any further funds into PNBHF. (3/n)

The RBI decision effectively meant PNB would be diluted regardless of mode of fund-raise. In a rights issue, the entitlement would go unfulfilled, resulting in existing shareholders acquiring higher stake. In a preferential issue, all except the acquirer would get diluted. (4/n)

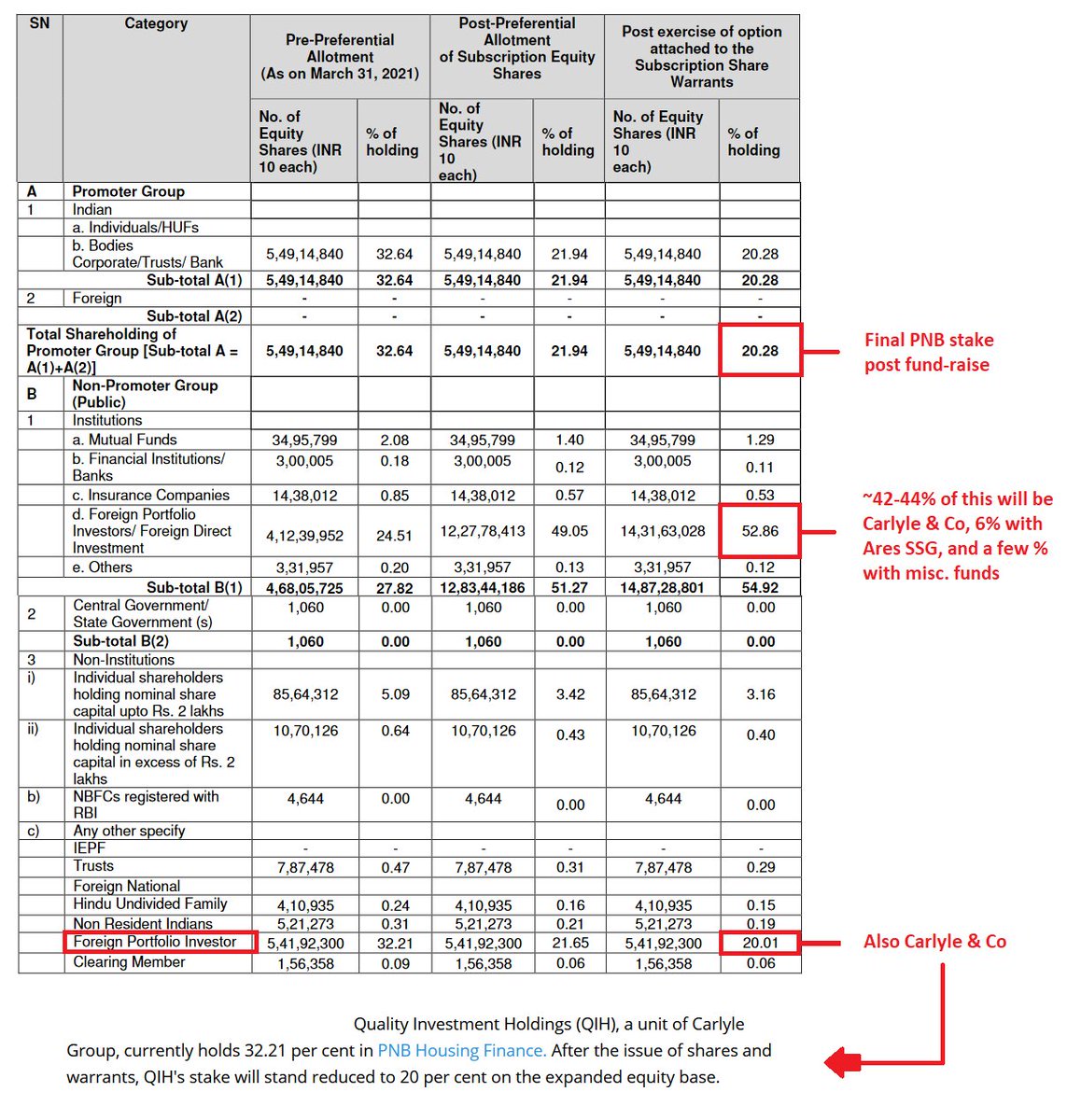

This is a slightly different situation than mere dilution, since PNB also stands to lose control over PNBHF. However, PNB suggests it will be in joint control of PNBHF and remain a 'promoter'. This argument is vacuous at best. PNB will be reduced to less 20.3% shareholding. (5/n)

Now, PNB cannot block special resolutions anymore, which require approval from 75% shareholders. Such as this very EGM being undertaken to approve the fund raise. PNB will lose control while retaining the titular tag of being a 'promoter'. (6/n)

The EGM notice doesn't clearly reflect how much Carlyle & Co will own after the fund-raise. After adding up their existing and incoming stakes, the number comes to 64%. Another 6% is held by a foreign fund Ares SSG (ARES - NYSE). Approx 70% with foreign investors. { (7/n)

Just for the sake of argument, if PNBHF issued shares worth INR 1800 crore (the stated requirement) instead of INR 4000 crore, PNB would still retain 25.6% shareholding instead of the 20.3% in the current proposal. The ramifications of that extra 5.6% are huge! (8/n)

When the requirement was for 1800 crore, why raise 4000 crore and give simple majority AND its special veto rights? The government has previously created immense value for itself and minority shareholders by tenaciously holding on to its 26% stake in Hindustan Zinc. (9/n)

But for that 26% stake, Hindustan Zinc would have disappeared into the Vedanta group, and going by their track record, with not much regard for minority shareholders either. It is the government's prerogative, as the promoter, to maximize value. (10/n)

PNB should, at the maximum, have diluted down to 26% if the fund-raise is important, and negotiated separately with the investors for transfer of control rights. Remember, PNB can’t invest more and has to work within its constraints. (11/n)

Alternatively, it could have also undertaken the valuation of the shares more seriously. As per the Share Capital Rules and Debenture Rules under the Companies Act, a preferential issue by a listed company does not require preparation of a valuation report. (12/n)

However, PNBHF’s articles of association clearly state that any preferential allotment shall be undertaken based on a valuation report by a registered valuer. The issue therefore lines in whether the AOA of a company can specify higher requirements than prescribed in law. (13/n)

The AoA can always prescribe additional requirements above the law – it is the constitution of the company and if it is not contravening the law, it can stipulate whatever the members agree it should stipulate. Not that a valuation report would make much difference. (14/n)

Valuation rules under the Companies Act 2013 give wide leeway to adopt many different methodologies with reasonable justification. One of these ‘methodologies’ is the price determined under SEBI ICD regulations. Which again comes back to floor price under SEBI regulations. (15/n)

SEBI ICD regulations prescribe a FLOOR price, they do not require the issue to be AT that price, but HIGHER. Similarly, the determination under valuation rules, when referring to SEBI ICD regulations, should take floor price only as a guidance and not the final value. (16/n)

Valuation reports are easily ‘managed’ into saying whatever you want it to say, as most industry people will know. The larger issue is why, in a change of control transaction, the PNBHF board approved a price per share that was only 1.5% higher than the bare minimum? (17/n)

These are cursory questions based on a preliminary look at the provisions. Those more experienced in matters of procedure for valuation, etc. may correct me if I am wrong. (18/n)

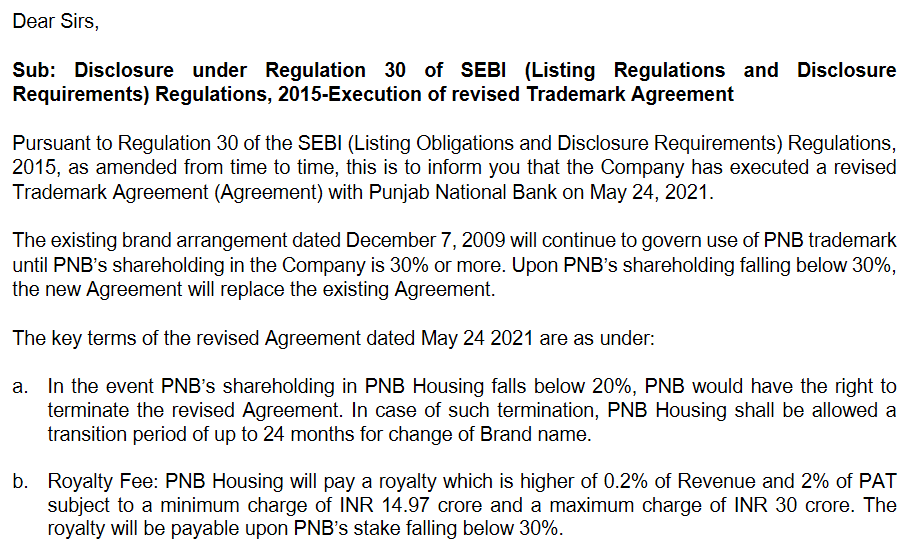

On another note, interestingly, the EGM notice proposes to allow PNB to nominate directors only if it holds 20%. Earlier, PNB agreed to allow continued use of its brand name subject to holding min 20% with transition period of 24 months if the stake falls below 20%. (19/n)

This sets up PNB to get kicked out whenever Carlyle wants, with 2 year honeymoon period. With 20.3% holding and RBI denial to invest any further, PNB will fall below 20% anytime Carlyle & Co dilute even 5% further, either by rights issue or preferential issue at any time. (20/n)

Carlyle PE has played its cards well. In 2019, it was preparing to exit PNB HF and even disposed 5% of PNBHF shares (80 lakh shares) @ INR 1200+ per share, netting over INR 1000 crore and handsome gains. Now in 2021 with Mr Puri they are seeking to take control. (21/n)

These are commercial decisions at the end of the day, and the take-over at depressed valuations is a sound tactic. However, it is the government (PNB) that needs to consider why no one made ANY effort whatsoever to maximize the value of their controlling rights. (22/n)

This issue extends further than just minority shareholders. PNB’s stake and controlling rights belong indirectly to the Government of India and the people of India. If the government is not maximizing value for itself, it is doing the people a disservice. (23/n)

Such criticism is always great in the rear-view mirror, but this ship has not set sail yet. The public and PNB can still choose to reject the EGM proposals, as the EGM will be held on 22 June 2021. With 32% stake, PNB and the government can still change the outcome here. (24/n)

As always, this is from an educational / commentary perspective only. No call to action or trade or anything of that sort. Please do RT if you like it. (25/n)

• • •

Missing some Tweet in this thread? You can try to

force a refresh