There’s clearly differences of opinion in the $TSLA community about TSLA’s strategy and it’s impact on stock price. I’ll try to explain why these different views exist, and offer my perspective on why TSLA’s stock is lagging in the face of so many potential positive catalysts.

2/ First, some perspective:

1) $TSLA remains my largest position at ~15%. I don’t see this changing anytime soon

2) There’s a difference between price and value; price is what you pay; value is what you get

3) TSLA sells every EV it makes. This will likely continue through 2022.

1) $TSLA remains my largest position at ~15%. I don’t see this changing anytime soon

2) There’s a difference between price and value; price is what you pay; value is what you get

3) TSLA sells every EV it makes. This will likely continue through 2022.

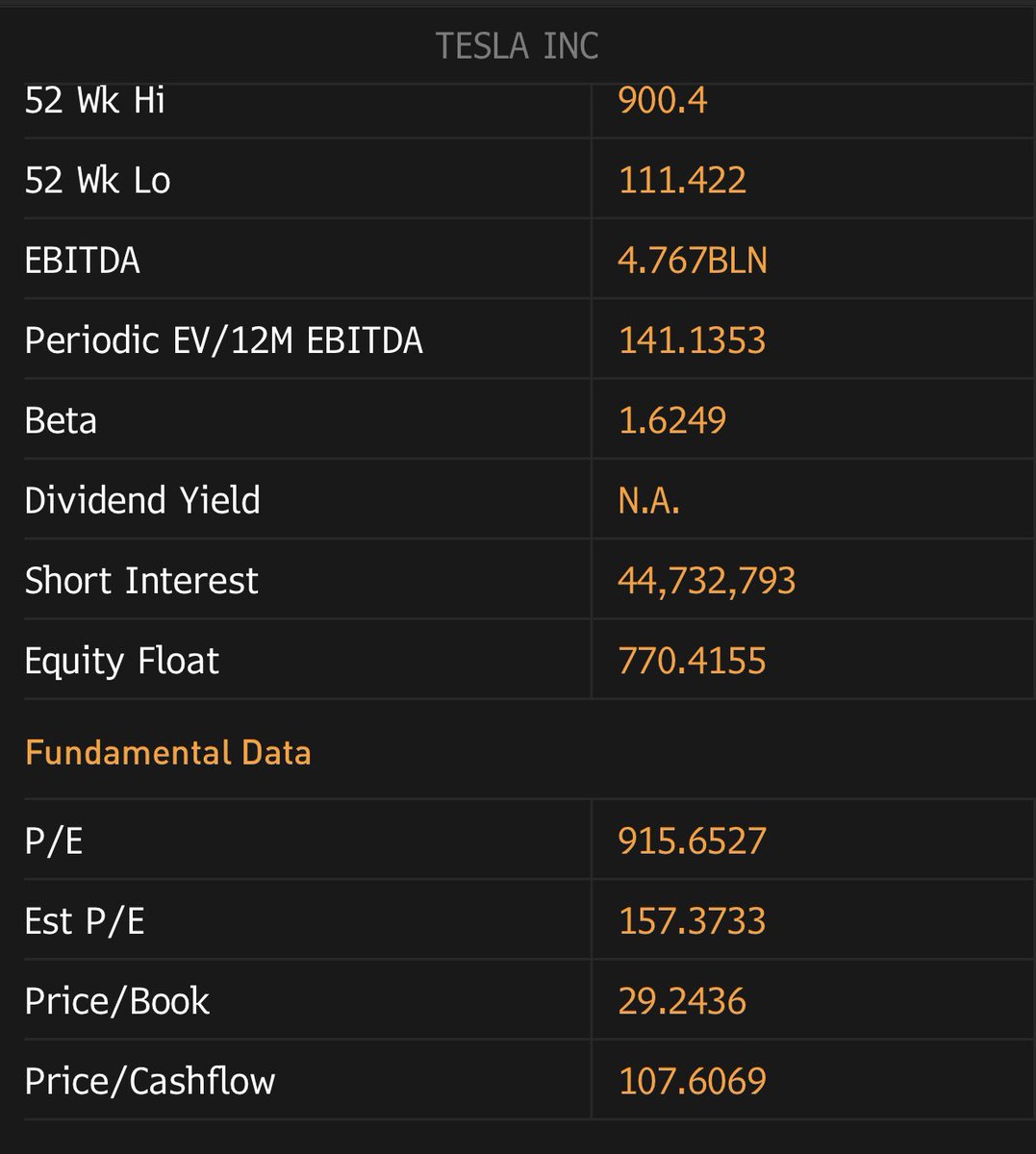

3/ I tend to look out 3-5 years when assessing the value of a company. For TSLA, I project earnings out to 2025, apply a 2025 P/E that captures future expected growth, and discount it back to the present. My current $TSLA present value of $1,000 compares to a current $610 price.

4/ $TSLA ‘s +743% gain last year was the result of the market realizing global EV adoption was accelerating, that TSLA TAM would triple from 24% to ~85% as TSLA entered CUVs (M-Y), pickups (Cytruck), TSLA’s success in China, the 5:1 stock split, and getting added to the S&P 500.

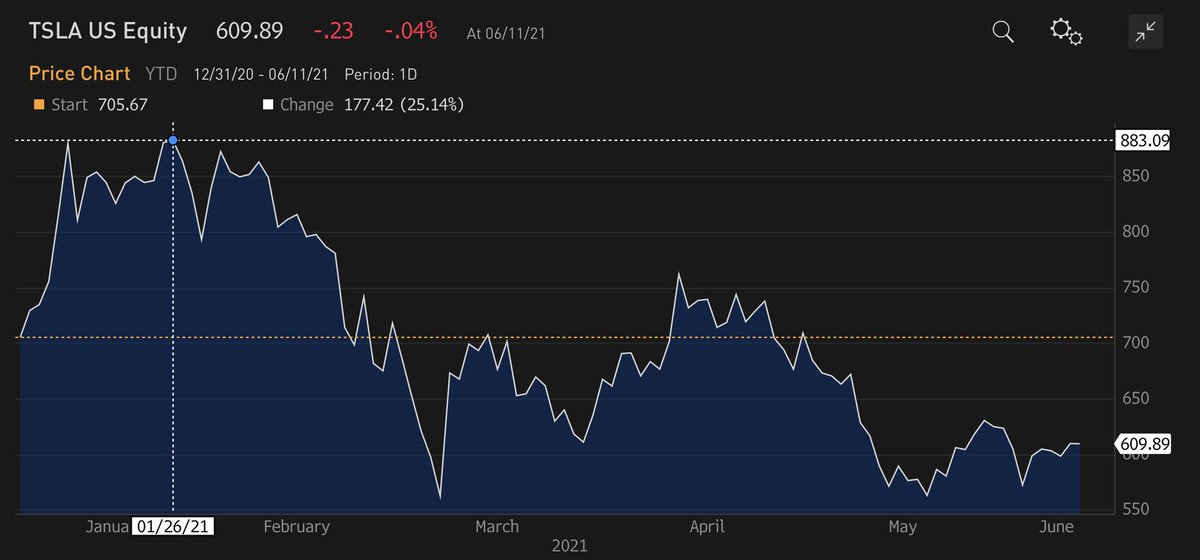

5/ 2021 again started strong after S&P inclusion, with investors hopeful $TSLA would beat in 4Q, offer strong FY deliv guidance, and active PMs with S&P bms would go to a 1.5% weight out of fear of underperforming. TSLA reached a high of $883 on 1/26, one day before 4Q results.

6/ Three things happened, which changed $TSLA momentum:

1) TSLA missed 4Q EPS by 22% after 5 consec qtrly beats

2/ TSLA failed to provide 2021 vol guidance, reiterating long-term growth goal of 50%

3/ TSLA bought $1.5B #btc, causing P/E dilution and EV share of voice to plunge

1) TSLA missed 4Q EPS by 22% after 5 consec qtrly beats

2/ TSLA failed to provide 2021 vol guidance, reiterating long-term growth goal of 50%

3/ TSLA bought $1.5B #btc, causing P/E dilution and EV share of voice to plunge

7/ $TSLA stock fell -36% in the next 40 days, vs NDX fell -8%. Long term Treas yields spiked from 1.05% to 1.74%, although they’ve since retreated to 1.47%. $TSLA is now -14% YTD, while Nasdaq 100 is within a hair from a new all time high, up +9% YTD.

8/ $TSLA 2021 and 2022 earnings ests have moved higher, so TSLA’s P/E has been crushed. This suggests the market is not worried about near term earnings (TSLA sells every EV it makes), but remains wary of TSLA’s long term growth, with every auto mfr now focused on selling EVs.

9/Many investors are worried that $TSLA 3-5 year growth will fall short of expectations, either because TSLA won’t adapt to the new landscape as competitors launch their own EVs, or it gets distracted from its mission of accelerating the world’s transition to sustainable energy.

10/ Many investors look to the smartphone industry a decade ago to understand how competitive dynamics might evolve in EVs over the next few years. On the Android side, HTC is an example of a market leader with products that stood out for their technical superiority and design.

11/ HTC ethos of “quietly brilliant” and reluctance to advertise was based on their view that the product spoke for itself. From 2009-12, HTC share of Android phones fell from 67% to 20%, as Samsung share grew from 4% to 27%. AAPL destroyed RIMM and Nokia on the non-Android side.

12/ With 60 new competitor EVs set to launch over the next 24 months, TSLA must lay out a plan to differentiate its EVs from others. TSLA clearly doesn’t have to advertise now. But TSLA needs to start putting in place the “soft infrastructure” to fight the coming EV onslaught.

13/ So why has $TSLA stock been weak despite so many positive catalysts? Many point to mgmt’s clear reluctance to evolve from the strategy that got it here - focus on production; let superior design/technology sell itself - while competitors all aggressively push their new EVs.

14/I believe @elonmusk will realize this and evolve before it’s too late. While fanboys argue there’s no need for advertising / PR, China events over the past few months suggest otherwise. One has to fight the FUD (e.g. alleged faulty brakes) or it will impact brand/future sales.

15/ The argument that $TSLA sells every EV it makes so doesn’t need to advertise is short-sighted. It fails to look 3-5 years out when every auto manufacturer is focused on growing EV share as they convert to an all EV world, and spending $ billions in advertising to get there.

16/Some will argue I should just sell my stock. That’s immature. I love $TSLA: It has by far the best products, superior technology, first mover advantage, full TAM, lowest cost, iconic brand, revered CEO. TSLA needs to plan for where the EV world is headed, not where it’s been.

Many here are viewing the world as it exists today, not how it will evolve over the next 3-5 years. TSLA clearly doesn’t need to advertise today, but it needs to start building the foundation for better communications in the same way $AAPL did. The two are not mutually exclusive.

• • •

Missing some Tweet in this thread? You can try to

force a refresh