Inside Bar 📚

▪️ What it is?

▪️ Why is it so powerful?

▪️ How to use it?

▪️ Fakeouts?

▪️ Which Timeframe to use?

1/14

▪️ What it is?

▪️ Why is it so powerful?

▪️ How to use it?

▪️ Fakeouts?

▪️ Which Timeframe to use?

1/14

▪️ What it is

An Inside Bar is a simple 1 Bar candle that is hidden inside of the previous OHLC candle

There are two types:

▫️ Inside body & outside wicks

▫️ Inside body & inside wicks

If you are not familiar with what OHLC means read here:

2/14

An Inside Bar is a simple 1 Bar candle that is hidden inside of the previous OHLC candle

There are two types:

▫️ Inside body & outside wicks

▫️ Inside body & inside wicks

If you are not familiar with what OHLC means read here:

https://twitter.com/jackis_trader/status/1284487087505506306

2/14

▫️ Inside body & outside wicks

The body of the candle closes inside of the previous body candle but wicks below

- Weaker of the two

3/14

The body of the candle closes inside of the previous body candle but wicks below

- Weaker of the two

3/14

▫️ Inside body & inside wicks

Both, the body & the wick of the candle close inside of the previous candle between the High & Low

- Stronger of the two

4/14

Both, the body & the wick of the candle close inside of the previous candle between the High & Low

- Stronger of the two

4/14

▪️ Why is it so powerful?

Inside Bar is nothing much different than a compression range on a higher timeframe.

If you zoom in you gonna see a nice long consolidation taking place

The inside bar helps us to establish where the range is broken.

5/14

Inside Bar is nothing much different than a compression range on a higher timeframe.

If you zoom in you gonna see a nice long consolidation taking place

The inside bar helps us to establish where the range is broken.

5/14

And just like with any consolidation, when it finally breaks, expansion is next, usually followed by a violent break

The inside bar can help us see when the range is coming to the end and a new trend is about to get established early on.

6/14

The inside bar can help us see when the range is coming to the end and a new trend is about to get established early on.

6/14

▪️ How to use it?

The best application is when you align it with strong support, then try to spot the inside bar.

Once it's established you can either

1) Aggressive - Put a buy once Inside Bars forms

2) Conservative - Buy on a confirmed break out of the Inside Bar High

7/14

The best application is when you align it with strong support, then try to spot the inside bar.

Once it's established you can either

1) Aggressive - Put a buy once Inside Bars forms

2) Conservative - Buy on a confirmed break out of the Inside Bar High

7/14

The other way is in an already established trend.

Price runs big but needs to pause for a few days or weeks to then continue its run.

We call this "Re-accumulation"

A great place to buy or add to your already existing position

8/14

Price runs big but needs to pause for a few days or weeks to then continue its run.

We call this "Re-accumulation"

A great place to buy or add to your already existing position

8/14

A nice example of a short/sell of an Inside Bar

1) Price broke an old significant high and started to consolidate below.

2) Formed an Inside Bar

3) Broke down significantly afterwards

9/14

1) Price broke an old significant high and started to consolidate below.

2) Formed an Inside Bar

3) Broke down significantly afterwards

9/14

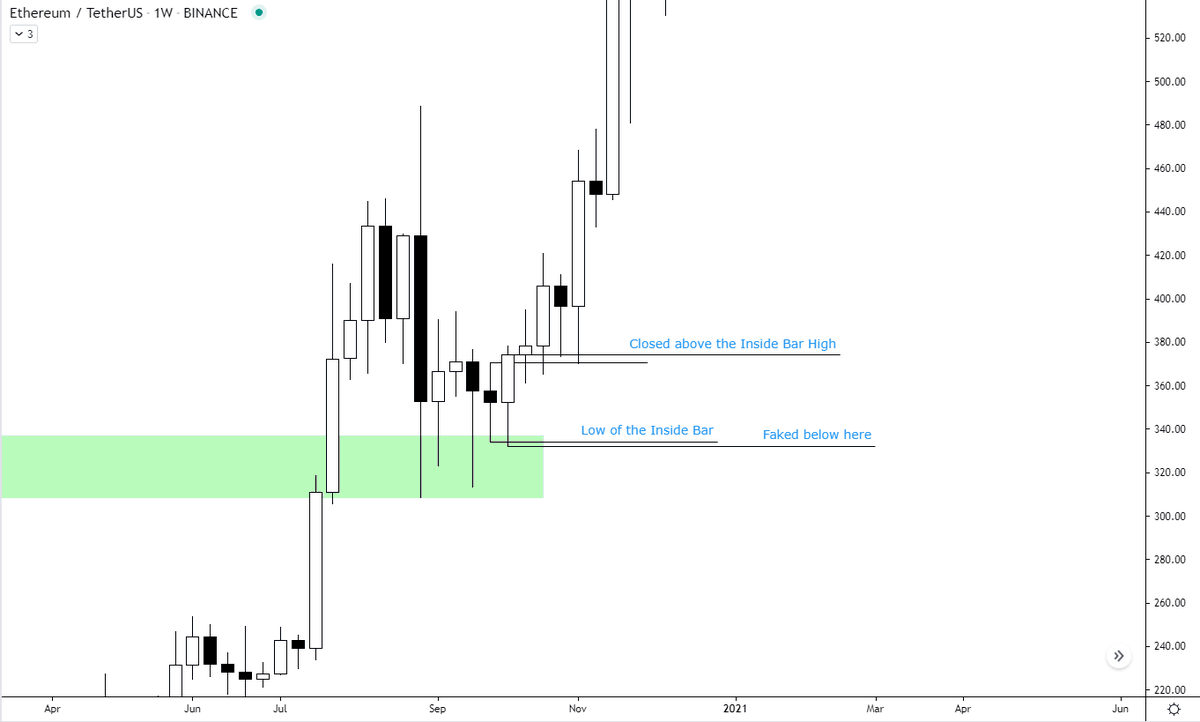

▪️ Fakeouts?

Sometimes, when we spot the Inside Bar we can see price breaks on the opposite side which many could see as a bearish break but i's important to remember we are at HTF support

This is where we must wait for the candle to close to indicate the true intentions

10/14

Sometimes, when we spot the Inside Bar we can see price breaks on the opposite side which many could see as a bearish break but i's important to remember we are at HTF support

This is where we must wait for the candle to close to indicate the true intentions

10/14

In this case, we can clearly see the move below was a clear manipulation and the candle proceeded to break the Inside Bar High later on in the week.

Establishing a new strong uptrend.

11/14

Establishing a new strong uptrend.

11/14

Currently, we are seeing the same thing happening in the #Bitcoin price & only time will tell if this is about to happen again.

Either way, it adds up to the probabilities

12/14

Either way, it adds up to the probabilities

12/14

▪️ Which Timeframe to use?

The best timeframes for Inside Bars are:

1) Monthly

2) Weekly

3) Daily

13/14

The best timeframes for Inside Bars are:

1) Monthly

2) Weekly

3) Daily

13/14

In the end, I would like to add that as with everything this is not a holy grail but another great real-time tool to use to spot the future markets moves and add to your probabilities

If you have found this thread valuable please like & share it with your friends.

14/14

If you have found this thread valuable please like & share it with your friends.

14/14

• • •

Missing some Tweet in this thread? You can try to

force a refresh