🟨 CEO of @BBWealthMGMT

🟨 BB Discord: https://t.co/uTtuxg2bTf

🟨 NEWSLETTER: https://t.co/WGT5pNd3er

45 subscribers

How to get URL link on X (Twitter) App

We remain bullish as long as the market is.

We remain bullish as long as the market is.

#BTC since 2022 has been mainly defined by these three major ranges with a mini one in between at 40K

#BTC since 2022 has been mainly defined by these three major ranges with a mini one in between at 40K

When it comes to bullish/bearish posts it always comes down to TimeFrames. You can have a trader that is bullish on H1 screaming at a bearish trader on D1 while the Weekly trader is bullish again

When it comes to bullish/bearish posts it always comes down to TimeFrames. You can have a trader that is bullish on H1 screaming at a bearish trader on D1 while the Weekly trader is bullish again

1) A decent portion of them sold the bottom, especially after the #FTX crash

1) A decent portion of them sold the bottom, especially after the #FTX crash

First of all, I did expect we would get the upside we got from the 40-45K range, but after, I thought we would get a deeper pullback at some point to like 32K or so

First of all, I did expect we would get the upside we got from the 40-45K range, but after, I thought we would get a deeper pullback at some point to like 32K or sohttps://twitter.com/i_am_jackis/status/1746179917060915667

We start HTF, scale in & create the valuable context 👇

We start HTF, scale in & create the valuable context 👇https://twitter.com/i_am_jackis/status/1637381298510524416

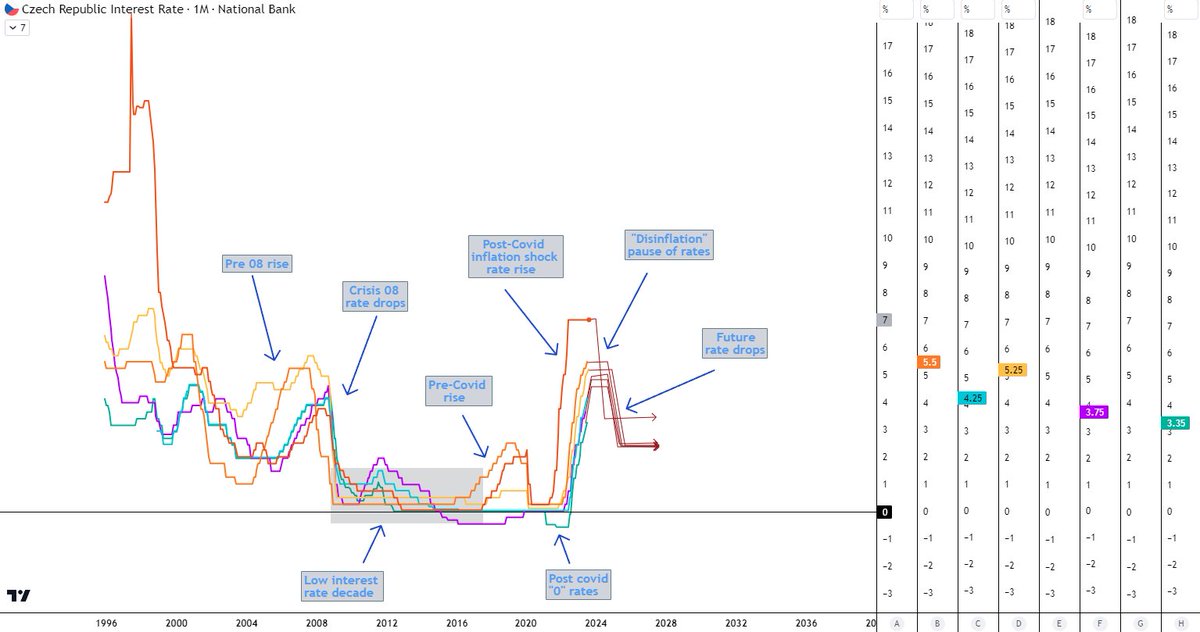

As you can see from the picture, central banks in Western economies tend to move the interest rates on average in a similar trend

As you can see from the picture, central banks in Western economies tend to move the interest rates on average in a similar trend

For example, one (in)famous trader called ICT kept waiting for BTC to sweep the 2015 HTF equal lows

For example, one (in)famous trader called ICT kept waiting for BTC to sweep the 2015 HTF equal lows

Risk to reward, in shortcut RRR or just RR, is an amazing concept that we use every day without even realizing it

Risk to reward, in shortcut RRR or just RR, is an amazing concept that we use every day without even realizing it

The reward system on Twitter is mainly through 4 things:

The reward system on Twitter is mainly through 4 things:

The market however is not giving any clean retests and this creates frustration and "built-up energy" in the market

The market however is not giving any clean retests and this creates frustration and "built-up energy" in the market

Nearly all major longer-term tools a lot of people use such as market structure, moving averages, supertrend, RSI, MACD, MVRV, Puell, % drop, and so on are pointing out to a trend reversal

Nearly all major longer-term tools a lot of people use such as market structure, moving averages, supertrend, RSI, MACD, MVRV, Puell, % drop, and so on are pointing out to a trend reversal

#Bitcoin is here to stay, whether you like it or not.

#Bitcoin is here to stay, whether you like it or not.

The major critical part is that after the bull run we experienced the first major drop, which was bigger than -50% to test the first demand zone (OB+), which was followed by a Complacency +100% rally

The major critical part is that after the bull run we experienced the first major drop, which was bigger than -50% to test the first demand zone (OB+), which was followed by a Complacency +100% rally

1) We got a year of sell-off followed by an 8-month long range

1) We got a year of sell-off followed by an 8-month long range

2/ Few things that raise the probabilities when trading with the INSIDE bar Weekly Candle.

2/ Few things that raise the probabilities when trading with the INSIDE bar Weekly Candle.

People telling me I cannot use H8 vs D1 are trying to teach the eagle how to fly, when in reality, they are the mice about to get caught by the eagle 🦅

People telling me I cannot use H8 vs D1 are trying to teach the eagle how to fly, when in reality, they are the mice about to get caught by the eagle 🦅https://twitter.com/i_am_jackis/status/1425019659359866891