Just finished a piece on secular stagnation and interest rate. Developed version of what I send a few month ago to Trust and Estate magazine. Here are the main points:

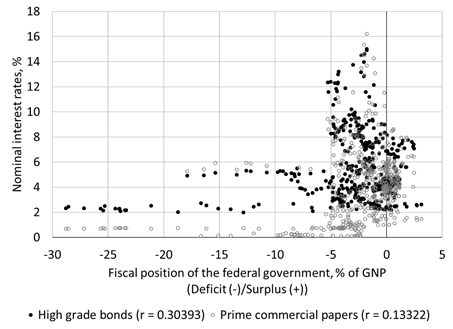

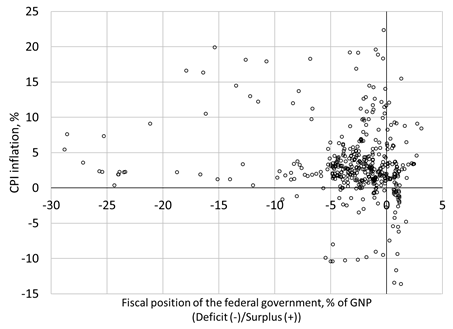

1- key driver of interest-rate trend is monetary policy. It is not inflation, fiscal balance, or credit rating.

1- key driver of interest-rate trend is monetary policy. It is not inflation, fiscal balance, or credit rating.

2- to make sense of what interest rates will do in the future, need to make expectations about what FOMC will do

3- low-growth + high leverage economy makes it difficult for FOMC to raise rate quickly and much + low inflation will persist no incentive to raise policy rates much.

3- low-growth + high leverage economy makes it difficult for FOMC to raise rate quickly and much + low inflation will persist no incentive to raise policy rates much.

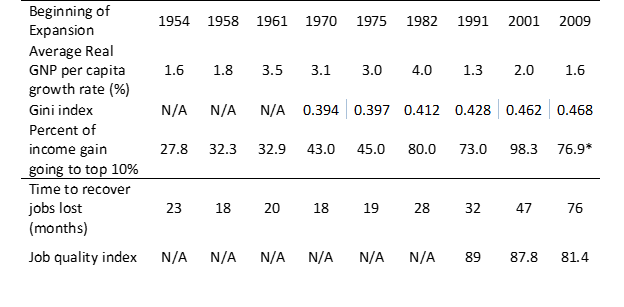

4- growing inequalities, jobless recovery, growing job precariousness, lack of shared prosperity => we can expect low rate to last for a decade or more unless policies are put in place to reverse stagnationist forces.

5- low interest rate environment poses challenge for Money Manager Capitalism that is deeper than "bubble". Money managers have rate of return targets => buy riskier assets and use leverage to compensate for low => promotes use and spread of Ponzi finance

6- Private pension system can't generate financial safety for retirees without promoting overall financial fragility.

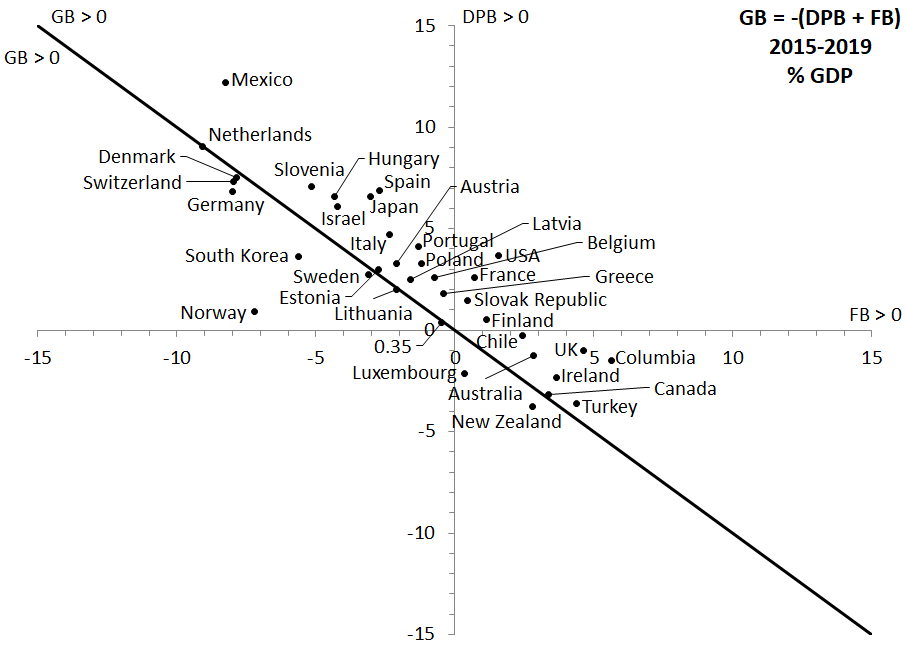

7- Economic growth is demand driven (Domar, Walker and Vatter, PKs...) and investment-led growth is unstable => central role for gov to promote ecological and financially sustainable shared economic growth

8- example of major role: ILE show need of rapid and radical shift in energy structure that requires heavy involvement of gov at all levels to shift domestic resources to that goal (R&D, invention to innovation, dvpt and promotion of market)

IEA (not ILE): International Energy Agency (recent Net Zero by 2050 report)

As for my other papers, draft will be on my webpage shortly

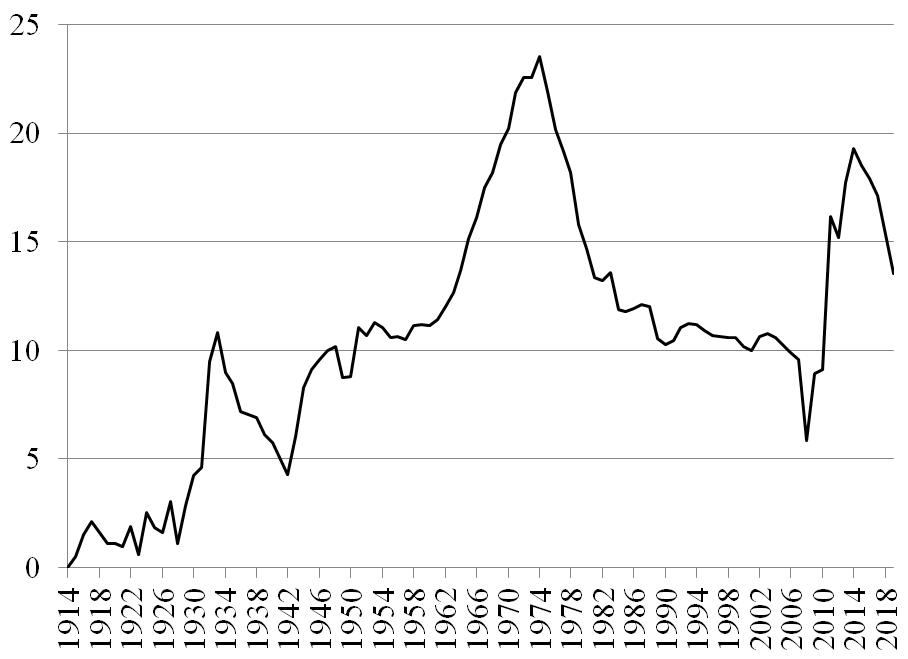

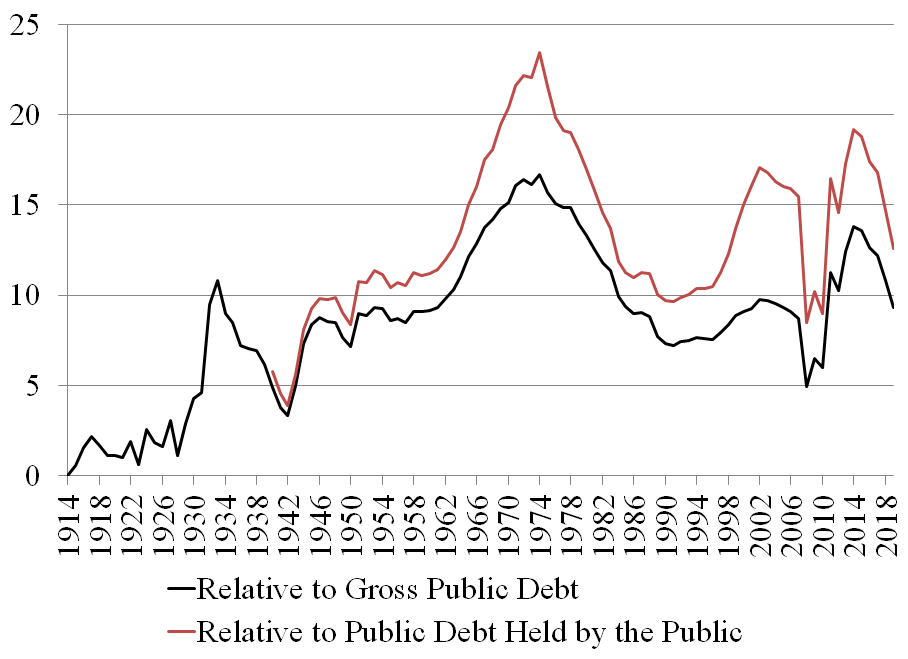

A few graphs and tables from the paper (US driven I am afraid)

Monetary policy and nominal interest rates, January 1919 to June 2021

Monetary policy and nominal interest rates, January 1919 to June 2021

• • •

Missing some Tweet in this thread? You can try to

force a refresh