Action Construction Ltd - ACE

Stock is showing good upmove with a 3 year breakout on back of tailwind in sector and strong volumes.

Company is guiding for 20-25% growth in FY22 with 13-14% margins!

Stock is showing good upmove with a 3 year breakout on back of tailwind in sector and strong volumes.

Company is guiding for 20-25% growth in FY22 with 13-14% margins!

1/n

Input costs tackled by price increase of 5-7% of their products.

Seeing upcoming capex in Metros, Rail & Real Estate.

Cranes: 63% market share. Target is make it 70% as utilization increases from current 50%

Above video credit to original creator

Input costs tackled by price increase of 5-7% of their products.

Seeing upcoming capex in Metros, Rail & Real Estate.

Cranes: 63% market share. Target is make it 70% as utilization increases from current 50%

Above video credit to original creator

2/n

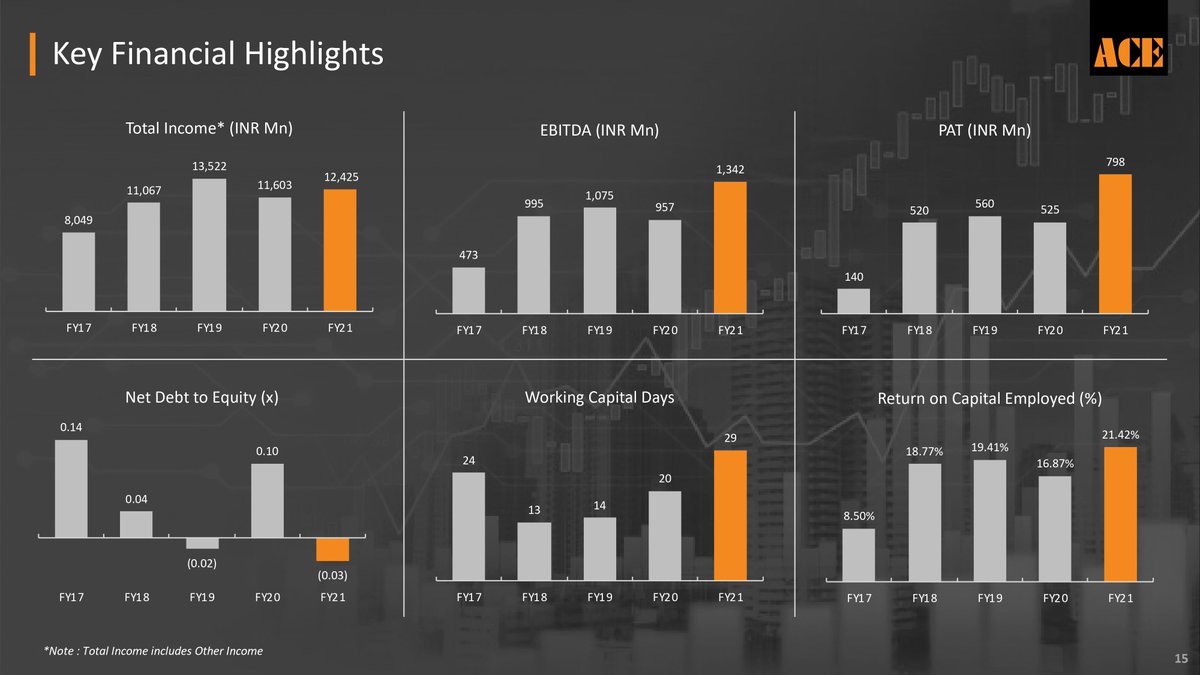

FY21

Highest revenue-1227 cr

OPM-119 cr

PAT: 80 cr

EPS: 7.03

CFO: 86 cr

Fixed Assets: 429 cr

WHV-EAM International Small Cap Equity Fund added 12.93 lakh shares at 230.70/share recently.

FY21

Highest revenue-1227 cr

OPM-119 cr

PAT: 80 cr

EPS: 7.03

CFO: 86 cr

Fixed Assets: 429 cr

WHV-EAM International Small Cap Equity Fund added 12.93 lakh shares at 230.70/share recently.

3/n

Keeping FY22 outlook in mind, we can expect stock to cross 275-300 in medium term and aim for 375-400 in longer term. Can be good add on dips till 200-175.

Attached technical chart gives stock outlook based on trends and patterns. Rounding Bottom seen in chart.

Keeping FY22 outlook in mind, we can expect stock to cross 275-300 in medium term and aim for 375-400 in longer term. Can be good add on dips till 200-175.

Attached technical chart gives stock outlook based on trends and patterns. Rounding Bottom seen in chart.

• • •

Missing some Tweet in this thread? You can try to

force a refresh