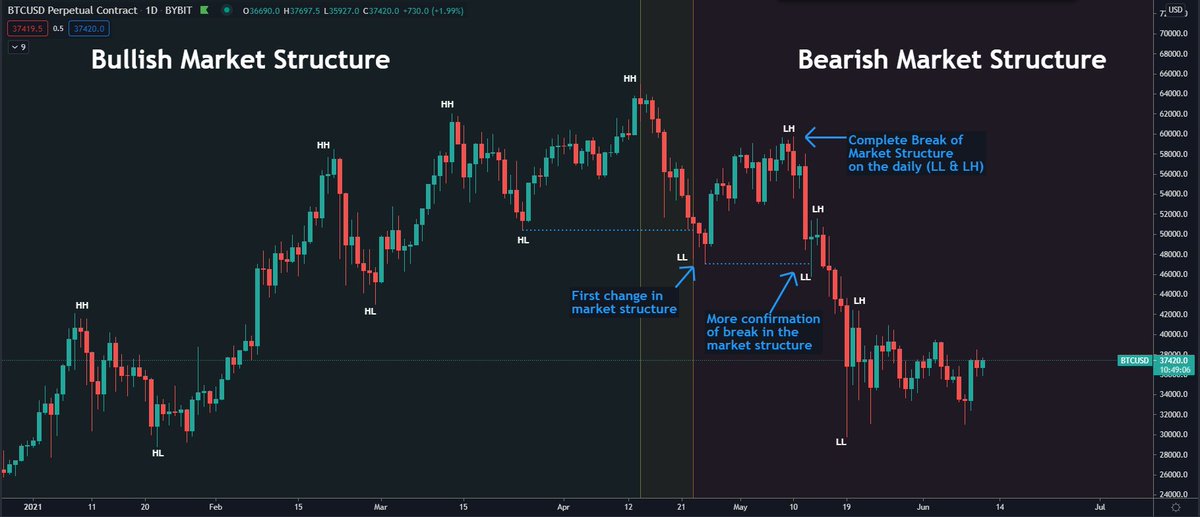

We all know we're in a range. This range is defined by the $30K Low on the 19th of May and the $43K High made on the same day.

2/10

2/10

During this range we've seen sentiment shift from bearish to bullish after each few percent move. Which is very common during such sideways market movements.

3/10

3/10

What's especially interesting is how most people tend to call for a sweep of the range highs or lows, once price approaches that level. Be it up or down.

4/10

4/10

This makes sense, we're used to seeing these levels get swept and for price to reverse afterwards. This is because a lot of stop losses are often placed above or below these lows and a sweep of those levels usually generate a lot of liquidity.

5/10

https://twitter.com/DaanCrypto/status/1403273398134968321

5/10

What's funny in this range is that so far, price has reversed within the 10-20% & 80-90% area on both sides. What this means is that people waiting for those sweeps never get their fills and others, that are in the correct trade for that move, miss their take profit levels.

6/10

6/10

In return, most people keep buying and selling at the wrong times or holding their profitable positions until they are in loss again. All because price just isn't reaching "The Logical" targets everyone is assuming.

7/10

7/10

This is why most people are being destroyed trying to trade this range.

Panic selling on the way down, hoping for lower. Then fomo'ing back in on the way up. Likely timing it wrong every single time.

8/10

Panic selling on the way down, hoping for lower. Then fomo'ing back in on the way up. Likely timing it wrong every single time.

8/10

That's what ranges do. Especially such a big range where so much money is changing hands every day.

Be careful out there. Stick to the plan and don't get too caught up in the range.

If price starts trading above or below it for a while, THAT is your confirmation.

9/10

Be careful out there. Stick to the plan and don't get too caught up in the range.

If price starts trading above or below it for a while, THAT is your confirmation.

9/10

Also, the 10-20% and the 80-90% area's are just some numbers I cherry picked to fit into this scenario to prove my point. These aren't fib levels or proven to work for trades. Please don't see them as an indicator to base your investments on.

Have a good week!

10/10

Have a good week!

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh