Africa is the next great tech market.

Why? Let's get into it.

@pkisadha @iaboyeji @Nicho0le @haydenalcalde @sgrin77 @LewamKefela @Daudex @aaronqfu @cm @lymusing

readthegeneralist.com/briefing/africa

Why? Let's get into it.

@pkisadha @iaboyeji @Nicho0le @haydenalcalde @sgrin77 @LewamKefela @Daudex @aaronqfu @cm @lymusing

readthegeneralist.com/briefing/africa

1. It has some thriving national markets.

- 🇳🇬 Nigeria has a great fintech scene

- 🇪🇬 Egypt is active in edtech and logistics

- 🇰🇪 Kenya is dominant in agtech

- 🇿🇦 South Africa has a strong enterprise market

These can become massive ecosystems in time.

- 🇳🇬 Nigeria has a great fintech scene

- 🇪🇬 Egypt is active in edtech and logistics

- 🇰🇪 Kenya is dominant in agtech

- 🇿🇦 South Africa has a strong enterprise market

These can become massive ecosystems in time.

2. VC investment is growing *fast*

In 2020, $1.43B was invested into African startups. That sounds small, but it's growing fast.

Since 2015, capital investment has grown *40%* per year. That is nuts.

In 2020, $1.43B was invested into African startups. That sounds small, but it's growing fast.

Since 2015, capital investment has grown *40%* per year. That is nuts.

3. Foreign capital is flooding in

US + Chinese investors are increasing interest in African tech.

Example: @OPay_NG is owned by Chinese investors. They recently poured *$400M* in to help it scale.

US + Chinese investors are increasing interest in African tech.

Example: @OPay_NG is owned by Chinese investors. They recently poured *$400M* in to help it scale.

4. That's creating winners

Africa already has some powerful unicorns (or close).

- Flutterwave (raised $235M)

- Chipper ($150M)

- Gro Intelligence ($115M)

- Andela ($180M)

- Swvl ($175M)

+ many more

Africa already has some powerful unicorns (or close).

- Flutterwave (raised $235M)

- Chipper ($150M)

- Gro Intelligence ($115M)

- Andela ($180M)

- Swvl ($175M)

+ many more

5. Exits are recycling capital

Africa is still early here. But there have been some wins that bring capital and talent back into the ecosystem.

- Jumia went public

- Fawry went public

- Paystack sold to Stripe

- Sendwave sold to WorldRemit

- Uber bought OrderTalk

Africa is still early here. But there have been some wins that bring capital and talent back into the ecosystem.

- Jumia went public

- Fawry went public

- Paystack sold to Stripe

- Sendwave sold to WorldRemit

- Uber bought OrderTalk

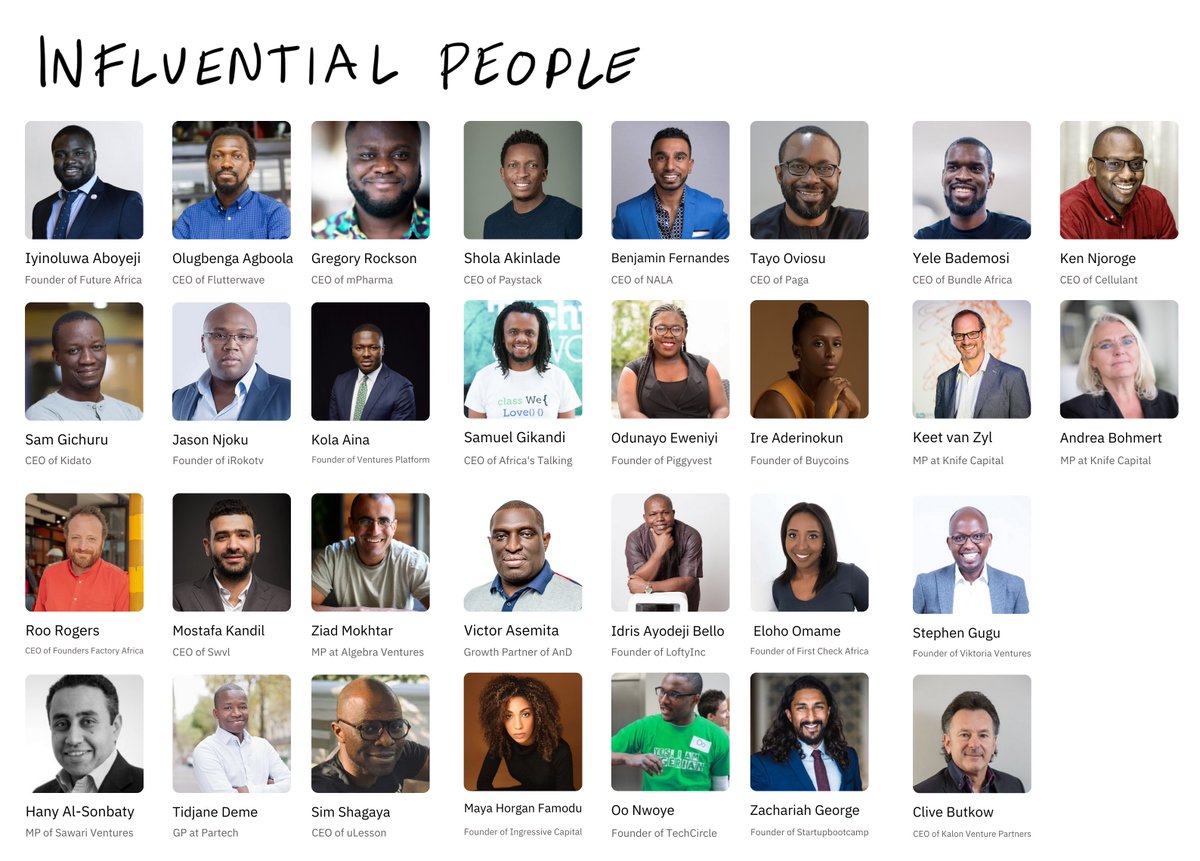

6. The talent is absurd

Tons of smart people are working to build the national and continent ecosystem.

It feels inevitable those efforts will many something uniquely great businesses.

Tons of smart people are working to build the national and continent ecosystem.

It feels inevitable those efforts will many something uniquely great businesses.

7. There's so much room to run

African startups still receive a *tiny* portion of global VC dollars. A crazy comparison...

- Hopin: Raised a $400M Series C last year

- EVERY TECH CO IN NIGERIA: Raised $307M last year

That's a lot of brilliance that's undercapitalized.

African startups still receive a *tiny* portion of global VC dollars. A crazy comparison...

- Hopin: Raised a $400M Series C last year

- EVERY TECH CO IN NIGERIA: Raised $307M last year

That's a lot of brilliance that's undercapitalized.

If you want to better understand the market check out the full piece and subscribe. It's free.

We discuss the risks, and some of the clear opportunities.

And if you want to track the space, I highly recommend following the awesome contributors.

readthegeneralist.com/briefing/africa

We discuss the risks, and some of the clear opportunities.

And if you want to track the space, I highly recommend following the awesome contributors.

readthegeneralist.com/briefing/africa

• • •

Missing some Tweet in this thread? You can try to

force a refresh