1) Liquidity mining rewards should be paid with KPI or call options built on @UMAprotocol .

The launch of L2 solutions will bring a new round of farming rewards as projects battle for assets. These mining rewards need to be updated - let’s welcome...

👋Liquidity Mining 2.0 👋

The launch of L2 solutions will bring a new round of farming rewards as projects battle for assets. These mining rewards need to be updated - let’s welcome...

👋Liquidity Mining 2.0 👋

2) Using KPI or call options for LM will:

👍 prevent farmers from dumping a project’s token regardless of price

👍incentivize farmers to learn about the protocol and potentially contribute to the community

👍give more rewards to farmers if the protocol performs well

WIN-WIN-WIN

👍 prevent farmers from dumping a project’s token regardless of price

👍incentivize farmers to learn about the protocol and potentially contribute to the community

👍give more rewards to farmers if the protocol performs well

WIN-WIN-WIN

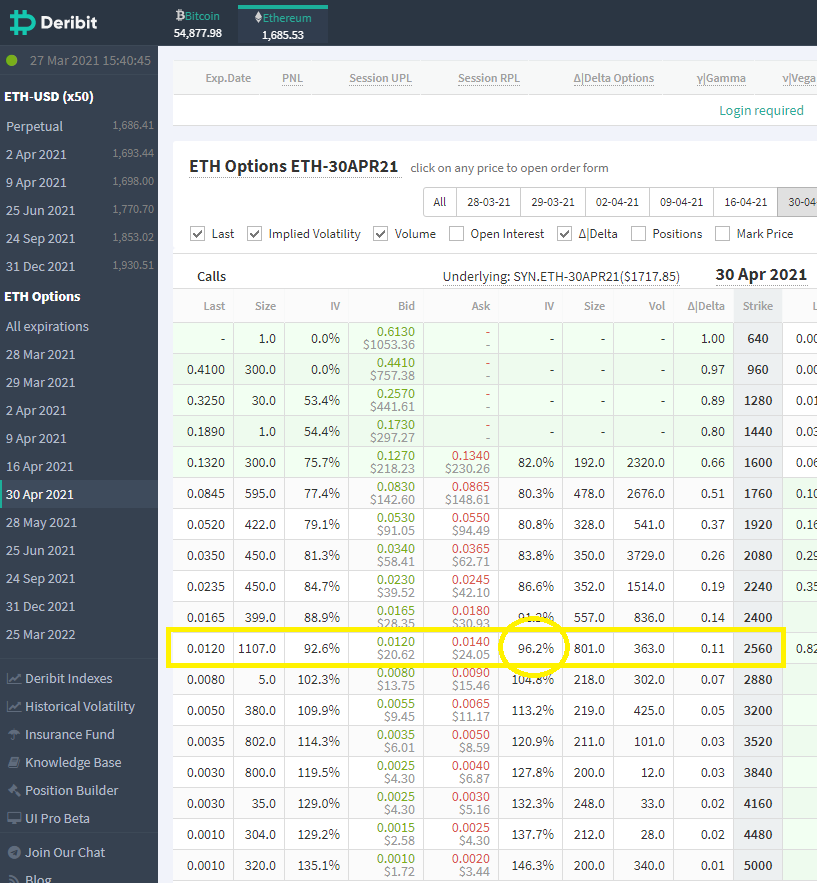

3) @SushiSwap has already started a new round of mining rewards on @0xPolygon with some impressive APY’s. (Personally something I like to farm 😋🍣.) Let’s show a couple examples of how we can make these rewards better for everybody.

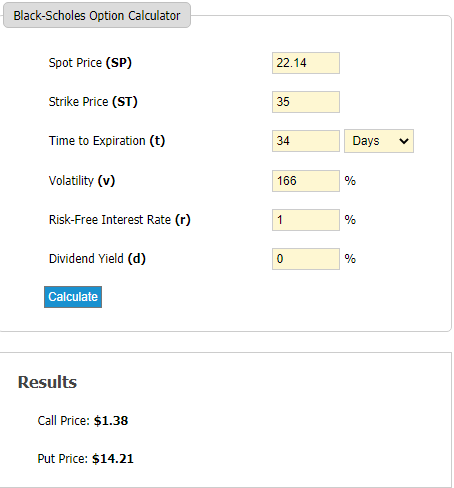

4) Let’s assume $SUSHI is at $8.

Instead of rewarding

🍣1 $SUSHI

@SushiSwap should reward

🍣0.75 $SUSHI

+

🍣0.75 $SUSHI 1 month call option struck at $8

*Options are cash settled, payout function in $SUSHI is (Price - Strike) / Price)

Instead of rewarding

🍣1 $SUSHI

@SushiSwap should reward

🍣0.75 $SUSHI

+

🍣0.75 $SUSHI 1 month call option struck at $8

*Options are cash settled, payout function in $SUSHI is (Price - Strike) / Price)

5) If $SUSHI is less than $8 after 1m, the farmer only receives 0.75 $SUSHI - reducing selling pressure on a weak market

If $SUSHI is over $8 then the farmer participates on the upside and can earn more!

Price$SUSHI

🙂$ 80.75

😃$100.95

😍$151.22

🤑$201.35

🤯$501.59

...

If $SUSHI is over $8 then the farmer participates on the upside and can earn more!

Price$SUSHI

🙂$ 80.75

😃$100.95

😍$151.22

🤑$201.35

🤯$501.59

...

6) Rewarding a call option does a few things to the farmer:

🛑Prevents them from dumping immediately

🧐Encourages them to learn about the protocol

😃Rewards them when the protocol succeeds

🤩Possibly converts them into a long term hodler and community member!

🛑Prevents them from dumping immediately

🧐Encourages them to learn about the protocol

😃Rewards them when the protocol succeeds

🤩Possibly converts them into a long term hodler and community member!

7) This can also be done with KPI options…

Let’s assume @SushiSwap volume on @0xPolygon averages $100MM per day.

Instead of 1 $SUSHI, a 1 month KPI option could pay the following

1m Avg Daily Volume$SUSHI

🙂<100MM0.5

😃100-200MM0.75

😍201-300MM1.0

🤑>300MM1.5

Let’s assume @SushiSwap volume on @0xPolygon averages $100MM per day.

Instead of 1 $SUSHI, a 1 month KPI option could pay the following

1m Avg Daily Volume$SUSHI

🙂<100MM0.5

😃100-200MM0.75

😍201-300MM1.0

🤑>300MM1.5

8) KPI options incentivize a certain behaviour. In this case the farmer is encouraged to drive liquidity and volume to @SushiSwap on @0xPolygon. If the community is successful then everybody is rewarded and @SushiSwap would be happy to pay more.

9) These options can be customized and built on @UMAprotocol instantly with no governance vote needed if the DeFi token is already approved. Just choose the expiry, strike and parameters and deploy. This can all be built on the LSP contract and secured by the Optimistic Oracle.

10) DeFi should advance to Liquidity Mining 2.0 using KPI and Call Options built on @UMAprotocol. No need to blindly attract TVL and risk pressuring the token price. We can now do enhanced liquidity mining to attract new community members and incentivize desired actions.👨🌾🤝💕👨👩👧👧

• • •

Missing some Tweet in this thread? You can try to

force a refresh