1. My thesis on the market is pretty simple. The market thinks this we are in September 2011 - early recovery stage with inflation concerns. In reality we are in September 2008. The first shoe has dropped but the second will be the knockout punch.

2. Recall that the housing market peaked in 2006, stocks peaked in 2007, and the market crises didn't occur until 2008.

3. The post GFC "conventional wisdom" was that the Fed could have avoided the crises by acting earlier and stronger, including a Lehman bailout. Powell followed this wisdom as COVID began to crater markets by unleashing unprecedented accommodation together with fiscal stimulus

4. This unprecedented policy has created the veneer of economic progress via consumer spending but more importantly, inflated the greatest asset bubble of all time

5. But talk is cheap. Let's look at data. Parabolic commodities - near perfect analog. Commodities peaked in July 2008. We've already seen most commodities peak and begin to crash in June 2021.

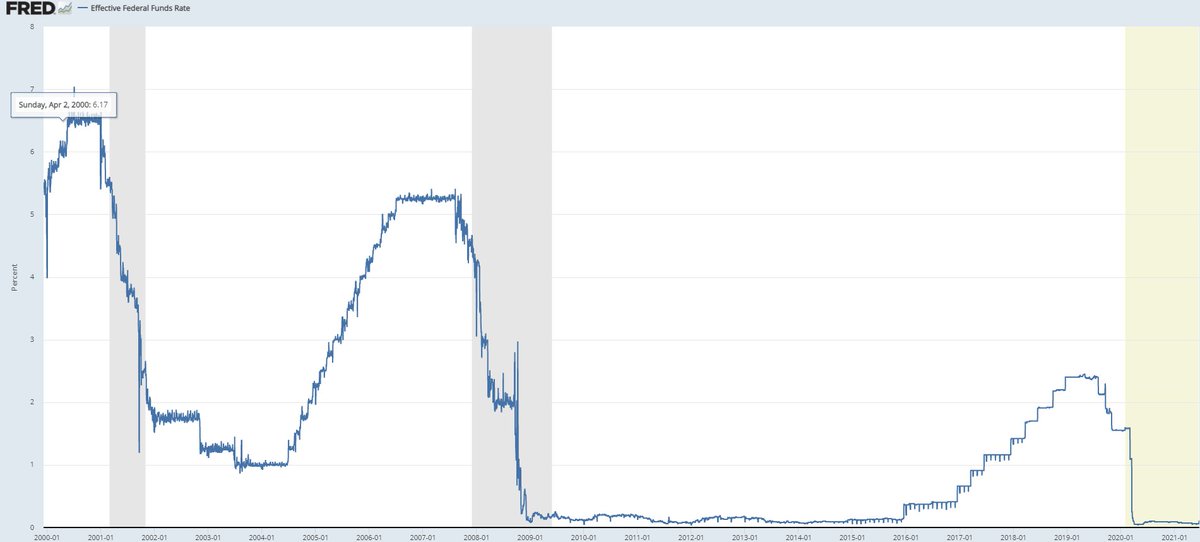

6. Interest Rates: Fed rate cycle is match except we hit the lower bound much sooner (and now have no room to go).

7. Yield Curve: 2-10 spread analog is eerie. After rapid steepening, the YC actually began to dramatically flatten from March 2008 - September 2008. Exact same dynamics, now with rapid steepening giving way to unexpected rapid flattening

8. However of course there are key distinctions. Absent a monetary firehose, stocks traded down from 2007 - Sept 2008 about 20% before the GFC kicked in and brought peak to trough drawdowns over 50%. Currently the market is UP 40% since early 2020.

9. Further, the stock market was not even at historically stretched levels in 2007-2008. In nearly every valuation metric either all time highs or only surpassed by the largest stock bubbles in previous history 2000/1929.

10. Additionally, market structure is much weaker. The proliferation of passive ETFs, algo/HFTs and vol control strategies has led to three distinct rally->crashes since volmagedon in 2018 with iteration even more intense

11. To contrarily believe that we are in an early stage of a new economic cycle, you must believe the bear market lasted for ~1 month ended before COVID really started, and was surpassed by new market highs in ~6 months, when that process has always taken many years historically

12. You must believe that the observable economic devastation (7 million lost jobs, 30% of small businesses extinct) is congruent with markets plumbing new highs on the most extraordinary valuations we have ever seen

13. You must also discount all sorts of tailrisks including contracting Chinese credit, and the dire warnings on its financial system, fracturing geopolitical instability, and an ongoing mutating virus that continues to impact economies globally

14. You must believe that the most rampant expressions of speculation (crypto, NFTs, baseball cards, biotech, SPACs etc) both form AND peak at the BEGINNING of market cycles, not in their final breaths.

15. Deductively - the case for September 2008 seems much stronger. So why is that not the conventional wisdom? I posit that greed and jealousy is a much stronger human emotion than logic and deduction.

16. Further, much of the "market narrative" is driven by banks who earn fees for capital markets activity - guess what, they just had their best year ever.

17. When you're winning in basketball, the "SCOREBOARD!" defense is pretty foolproof - this is the same logic the market uses today. The bulls are correct because the market says its so. But these assessments are inherently backwards looking.

18. Can I say with certainty that the market will crash in [X] days/months? No. But that doesn't make it the most logical hypothesis supported by a ton of data and common sense, and the best way position yourself for what is invisible over the horizon.

19. In the meantime recognize that the carry trade has been very profitable and may continue to be for sometime, but that risks have never been higher.

• • •

Missing some Tweet in this thread? You can try to

force a refresh