Good morning everyone, time for some SVR Updates🚀

Structure of todays post:

1.Intro

2. Sources and Exchanges I used

3. Correcting a mistake from my yesterdays work

4. The stuff you are looking for - The new SVR Charts with additional information😋😉

5. Outro

1/14

Structure of todays post:

1.Intro

2. Sources and Exchanges I used

3. Correcting a mistake from my yesterdays work

4. The stuff you are looking for - The new SVR Charts with additional information😋😉

5. Outro

1/14

Why is this post structured different? Where are the charts?

Because it is very difficult to get a feedback I want to do the peer review with all of you. If you got some time, knowledge or if I rised your interest for this topic - be the reviewer. 2/14

Because it is very difficult to get a feedback I want to do the peer review with all of you. If you got some time, knowledge or if I rised your interest for this topic - be the reviewer. 2/14

2. What sources/exchanges did I use:

regsho.finra.org/regsho-June.ht…

FINRA/NASDAQ TRF Chicago

ADF

FINRA/NASDAQ TRF Carteret

FINRA/NYSE TRF

ORF

cboe.com/us/equities/ma…

BZX Equities

BYX Equities

EDGA Equities

EDGX Equities

3/14

regsho.finra.org/regsho-June.ht…

FINRA/NASDAQ TRF Chicago

ADF

FINRA/NASDAQ TRF Carteret

FINRA/NYSE TRF

ORF

cboe.com/us/equities/ma…

BZX Equities

BYX Equities

EDGA Equities

EDGX Equities

3/14

2.

And here comes the part I am not sure:

On ftp.nyse.com/ShortData/ARCA… you can find the following exchanges:

Amexshvol (look below)

Chicagoshvol

NYSEshvol

Nationalshvol

These exchanges should be darkpools.I need help to verify this more.

4/14

And here comes the part I am not sure:

On ftp.nyse.com/ShortData/ARCA… you can find the following exchanges:

Amexshvol (look below)

Chicagoshvol

NYSEshvol

Nationalshvol

These exchanges should be darkpools.I need help to verify this more.

4/14

3. Yesterday I wrote, that the Short Exempt Volume can not be found in the Short Volume and has to be added - this is not correct. I made the mistake to NOT check the structure of the files before progressing because the form should be unified. Well - its not. 5/14

3. When i started to work on Short data I just knew RegSho. And so I knew the structure for the files. But when i work with the new data sets, I didnt check the structure. And this was a mistake because the structure for data at DP is different.😐 Thx... 6/14

3. To make it clear: SV does contain SEV. And so SEV should not be added to SV for calculations. Sorry for this mistake. When i copy the needed information I dont copy the column description - be cause they should all have the same fo... never mind^^ Now i know it. 7/14

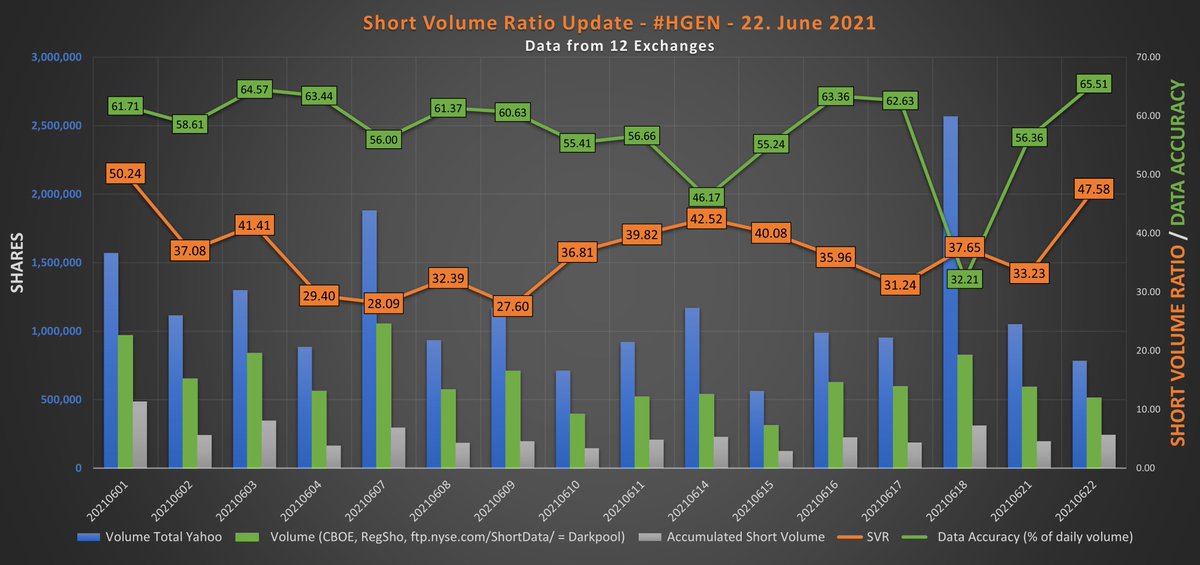

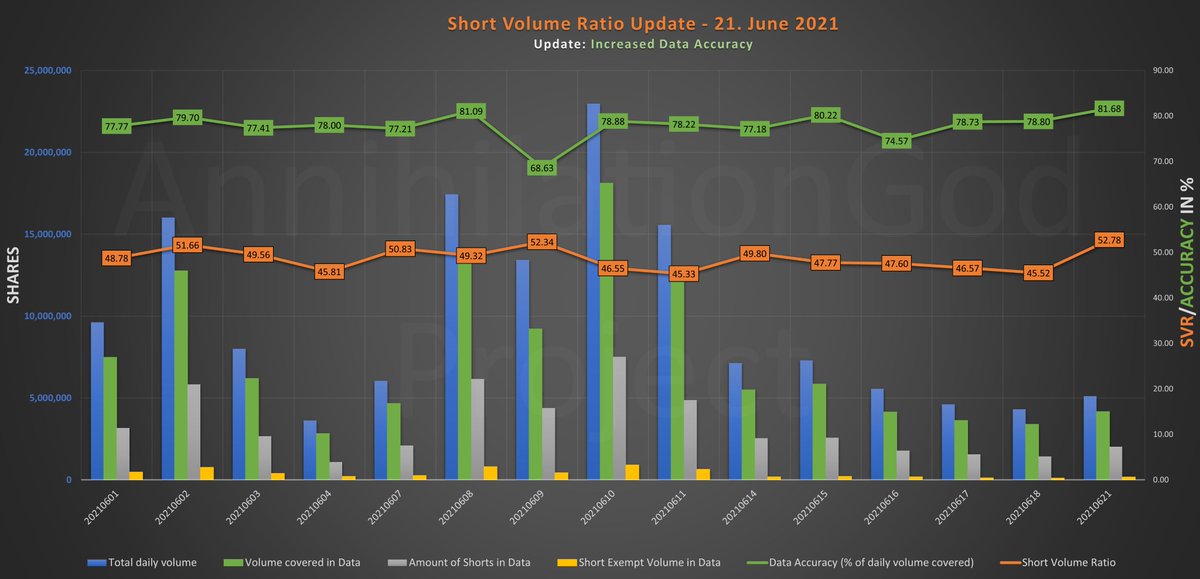

4. So, what charts are waiting for you?

1. The Updated SVR Ratio Chart with SVR, Accuracy and volume bars for Yahoo Volume, Reported Vol in Short data and amount of reported shorts.

2. Chart 2 is a comparison of CBOE RegSho data and Darkpool data (if it IS darkpool). 8/14

1. The Updated SVR Ratio Chart with SVR, Accuracy and volume bars for Yahoo Volume, Reported Vol in Short data and amount of reported shorts.

2. Chart 2 is a comparison of CBOE RegSho data and Darkpool data (if it IS darkpool). 8/14

5. I really hope that todays charts are correct. And that the exchanges are really DP and no value is used twice (like one exchange at RegSho already contains thos information, i calculated a lot combination but non matched so far). Thx for reading! Stay tuned!

Your

AG 14/14

Your

AG 14/14

Could you pls take a look and help us out with your knowledge and expertise? @dlauer

• • •

Missing some Tweet in this thread? You can try to

force a refresh