AR20-21 Notes

Tata Consumer Products

Transforming for Better

Hang on Tight, as we deep dive

Retweet for wider reach. 🙂🙏

Tata Consumer Products

Transforming for Better

Hang on Tight, as we deep dive

Retweet for wider reach. 🙂🙏

2/

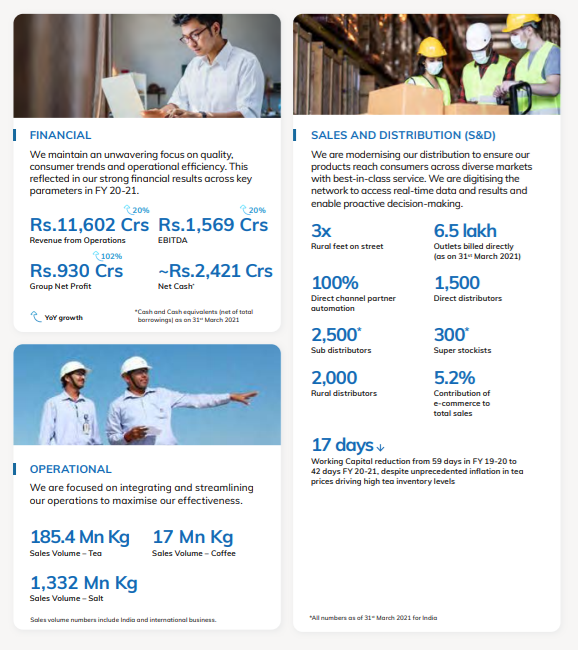

Performance Highlights

~Financial

~Operational

~S&D

~People

~Procurement

~Community

~Sustainability

Performance Highlights

~Financial

~Operational

~S&D

~People

~Procurement

~Community

~Sustainability

5/

N Chandra’s (Chairman) Letter

~Integration of F&B

~Broad-based growth

~Building Blocks in Place

~Positioned for Accelerated Growth

~Targeted Acquisitions

~Divestment of Non-core International Business

N Chandra’s (Chairman) Letter

~Integration of F&B

~Broad-based growth

~Building Blocks in Place

~Positioned for Accelerated Growth

~Targeted Acquisitions

~Divestment of Non-core International Business

6/

MD & CEO Speaks

~SSS Philosophy of Simplify, Synergize & Scale

~A multi-category FMCG behemoth in the making

~Acquisitions-Soulful & NourishCo

~Distribution scaled up

~Emergence of Do It Yourself & Convenience Shopping

~E-com as a % of sales from 2.5% to 5.2%

MD & CEO Speaks

~SSS Philosophy of Simplify, Synergize & Scale

~A multi-category FMCG behemoth in the making

~Acquisitions-Soulful & NourishCo

~Distribution scaled up

~Emergence of Do It Yourself & Convenience Shopping

~E-com as a % of sales from 2.5% to 5.2%

8/

Emerging Trends

~At-home Cooking

~Health & Wellness

~Traction gained for Socially Conscious Brands

~Family Bonding

~Rapid Digital Adoption

Emerging Trends

~At-home Cooking

~Health & Wellness

~Traction gained for Socially Conscious Brands

~Family Bonding

~Rapid Digital Adoption

9/

Strategies Adopted by TCPL

~Strengthen and accelerate core business

~Drive digital and innovation

~Unlock synergies

~Explore new opportunities

~Create a future-ready organization

~Embed sustainability

Strategies Adopted by TCPL

~Strengthen and accelerate core business

~Drive digital and innovation

~Unlock synergies

~Explore new opportunities

~Create a future-ready organization

~Embed sustainability

13/

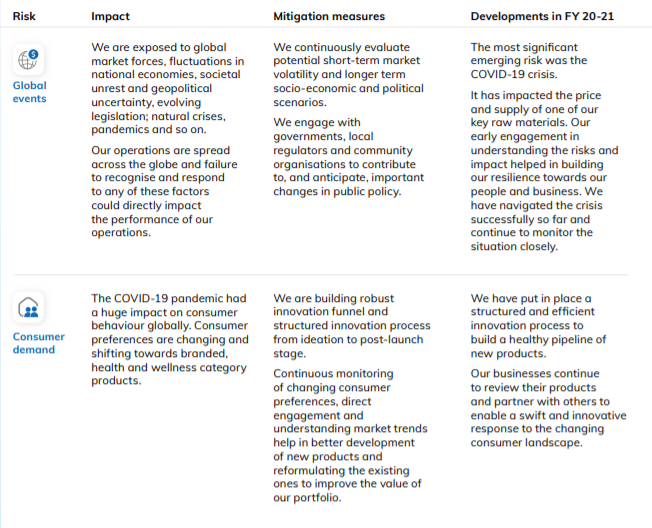

Risk Mitigation Strategies

External Risks

~Global Events

~Consumer Demand

~Interest Rate & Exchange Rate

~Commodity Costs

~Plantation yield

Operational Risk

~Supply chain

~Environmental

~Product Safety & Integrity

~Cyber Security

Risk Mitigation Strategies

External Risks

~Global Events

~Consumer Demand

~Interest Rate & Exchange Rate

~Commodity Costs

~Plantation yield

Operational Risk

~Supply chain

~Environmental

~Product Safety & Integrity

~Cyber Security

14/

Business Performance:

~Packaged Beverages- India

~Packaged Foods- India

~Nourishco

~Tata Starbucks

Business Performance:

~Packaged Beverages- India

~Packaged Foods- India

~Nourishco

~Tata Starbucks

17/

Financials

~Consolidated Balance Sheet

~Consolidated Profit & Loss Account

~Consolidated Cash Flow Statement

Financials

~Consolidated Balance Sheet

~Consolidated Profit & Loss Account

~Consolidated Cash Flow Statement

18/

SSS Research

~Last 10 concalls notes: bit.ly/3wqQIkA

~5 Min Stock Idea: bit.ly/35lSEPk

~Stock Infographic: bit.ly/3iPTaNs

~ FY20 AR Notes: bit.ly/3vsSSPg

~Detailed Analysis: bit.ly/3guj9Yc

Hit Retweet if you found value. 🙂🙏

SSS Research

~Last 10 concalls notes: bit.ly/3wqQIkA

~5 Min Stock Idea: bit.ly/35lSEPk

~Stock Infographic: bit.ly/3iPTaNs

~ FY20 AR Notes: bit.ly/3vsSSPg

~Detailed Analysis: bit.ly/3guj9Yc

Hit Retweet if you found value. 🙂🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh