1/8

From a very feisty 1933 FDR letter: “A financial element in the largest centers has owned the Government since the days of Andrew Jackson. The country is going through a repetition of Jackson’s fight with the Bank of the United States – only on a bigger and broader basis.”

From a very feisty 1933 FDR letter: “A financial element in the largest centers has owned the Government since the days of Andrew Jackson. The country is going through a repetition of Jackson’s fight with the Bank of the United States – only on a bigger and broader basis.”

2/8

Although the account by Feis of the events of that time is not always disinterested, he does a great job of showing just how politically complex financial policymaking can be. What really strikes me is the intellectual dissonance between FDR and his financial advisors.

Although the account by Feis of the events of that time is not always disinterested, he does a great job of showing just how politically complex financial policymaking can be. What really strikes me is the intellectual dissonance between FDR and his financial advisors.

3/8

While FDR wasn’t always sure about what he wanted when it came to US monetary policy, he had a pretty clear vision of what he didn’t want, and for him stabilizing the value of the USD dollar in international markets was simply not nearly as important as managing...

While FDR wasn’t always sure about what he wanted when it came to US monetary policy, he had a pretty clear vision of what he didn’t want, and for him stabilizing the value of the USD dollar in international markets was simply not nearly as important as managing...

4/8

its domestic value and retaining control over domestic financial policy.

His financial team however – dominated by Wall Street bankers and Ivy League economists – was almost incapable of understanding a monetary system in which external stability was not the ruling...

its domestic value and retaining control over domestic financial policy.

His financial team however – dominated by Wall Street bankers and Ivy League economists – was almost incapable of understanding a monetary system in which external stability was not the ruling...

5/8

principle, and they constantly tried to box him into a return to the gold standard, even when they didn't realize that that was what they were doing, and that important allies like JM Keynes and Mariner Eccles fully supported FDR’s approach.

principle, and they constantly tried to box him into a return to the gold standard, even when they didn't realize that that was what they were doing, and that important allies like JM Keynes and Mariner Eccles fully supported FDR’s approach.

6/8

FDR however had incredible self-confidence and a sense that his Wall Street and Ivy League advisors were genuinely unable to distinguish between what was best for the big banks and what was best for the country, so that he was able to see off their relentless assaults.

FDR however had incredible self-confidence and a sense that his Wall Street and Ivy League advisors were genuinely unable to distinguish between what was best for the big banks and what was best for the country, so that he was able to see off their relentless assaults.

7/8

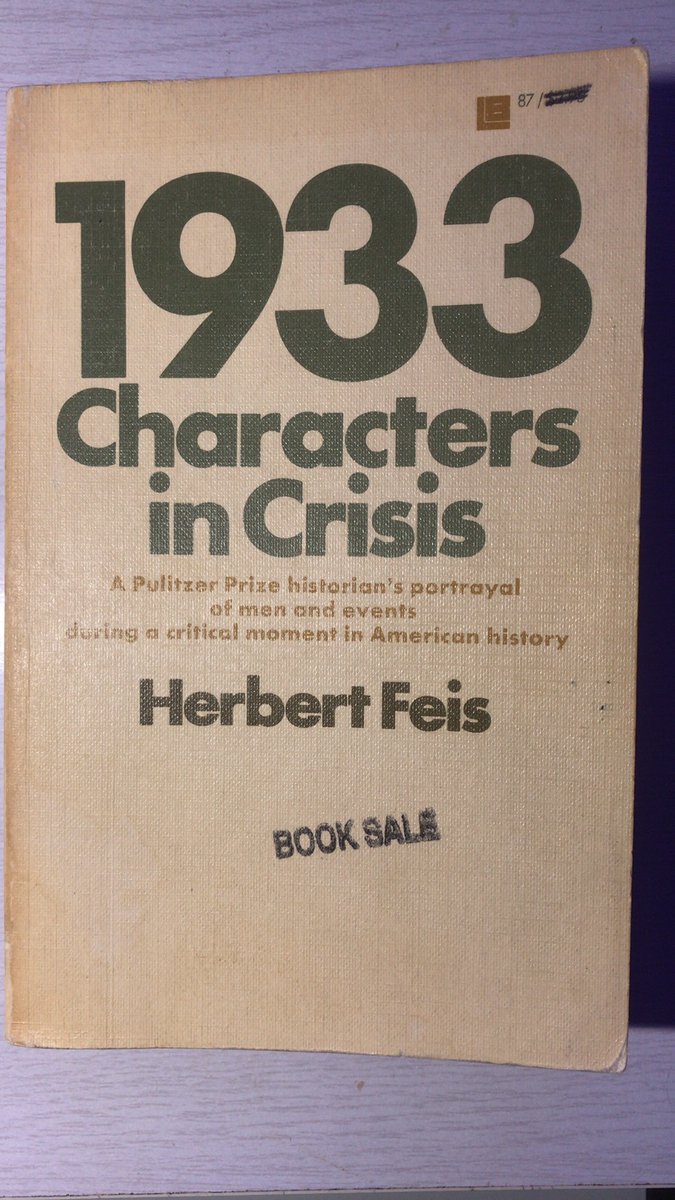

I am convinced that the US today faces a similar conflict over monetary policies that affect Wall Street and the rest of the US in opposing ways. It’s a pity that this book is out of print, but for anyone with access to a good library, I recommend it highly, especially...

I am convinced that the US today faces a similar conflict over monetary policies that affect Wall Street and the rest of the US in opposing ways. It’s a pity that this book is out of print, but for anyone with access to a good library, I recommend it highly, especially...

8/8

for those currently involved in financial and monetary policymaking. It is not a very long book, but it gives a powerful account of the terrible frustration involved in developing and implementing financial and monetary policy at a time of great change.

for those currently involved in financial and monetary policymaking. It is not a very long book, but it gives a powerful account of the terrible frustration involved in developing and implementing financial and monetary policy at a time of great change.

Born in 1893, Herbert Feis was a distinguished author and historian, whose work focused on American foreign policy and international economic affairs. Early in his career, Feis worked as Economic Advisor for International Affairs at the State Department under the Hoover and...

...Roosevelt administrations. His books include "The Road to Pearl Harbor" (1950), "Europe, the World's Banker, 1870-1914" (1964), "From Trust to Terror: The Onset of the Cold War" (1970), and the Pulitzer Prize-winning "Between War and Peace: The Potsdam Conference" (1960).

• • •

Missing some Tweet in this thread? You can try to

force a refresh