Fiat company

- paper incorporation

- paper contracts

- paper payments

- paper accounting

Crypto company

- on-chain incorporation

- on-chain smart contracts

- on-chain payments

- on-chain accounting

- paper incorporation

- paper contracts

- paper payments

- paper accounting

Crypto company

- on-chain incorporation

- on-chain smart contracts

- on-chain payments

- on-chain accounting

https://twitter.com/omarish/status/1407723322373115906

Yes, those "paper" forms are currently being sent electronically as PDFs. But we've just taken the paper workflow, scanned it, and put it online.

That was fine as a first step, but it isn't the inherently digital version. Crypto companies are.

archive.is/aP2hv#selectio…

That was fine as a first step, but it isn't the inherently digital version. Crypto companies are.

archive.is/aP2hv#selectio…

Internetification is like electrification. We're still digesting it. The digital native era is just beginning.

slate.com/culture/2007/0…

slate.com/culture/2007/0…

The Wyoming DAO law is a major step forward to bridging the fiat present and our crypto future. Amazing work by @CaitlinLong_, @GovernorGordon, and everyone in Wyoming. jdsupra.com/legalnews/wyom…

Just the accounting implications alone are huge. On-chain accounting automates so much of what is currently done manually.

That's why the Big 4 already use the Bitcoin & Ethereum blockchains as gold standards of truth when reconciling crypto transactions.

balajis.com/why-india-shou…

That's why the Big 4 already use the Bitcoin & Ethereum blockchains as gold standards of truth when reconciling crypto transactions.

balajis.com/why-india-shou…

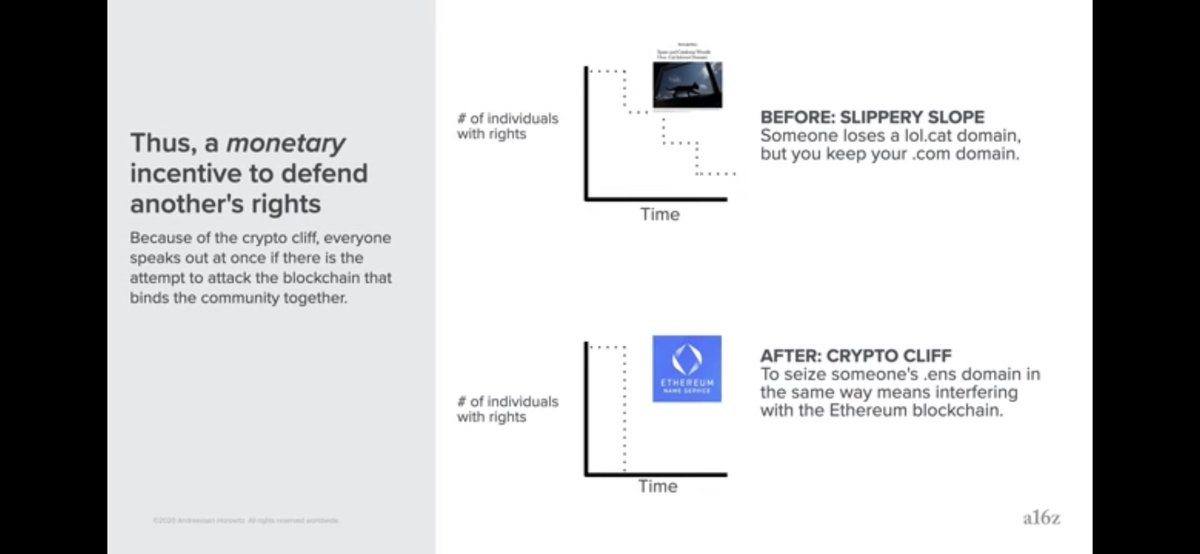

One thing some don't get: none of this will happen outside the cryptoeconomy. You can't decouple a blockchain from a digital asset.

It's when people use the digital asset that you get smart contracts, on-chain signatures, on-chain accounting, on-chain everything as a byproduct.

It's when people use the digital asset that you get smart contracts, on-chain signatures, on-chain accounting, on-chain everything as a byproduct.

All the blockchain accounting/supply chain/etc stuff will happen, but it'll start with entities that switch over to stablecoin-first transactions.

This is already happening, USDC is just better than wires once it's in your workflow.

Also flips your bank to a crypto exchange...

This is already happening, USDC is just better than wires once it's in your workflow.

Also flips your bank to a crypto exchange...

• • •

Missing some Tweet in this thread? You can try to

force a refresh