Bitclout actually has an interesting possible counter to cancel culture.

Long-term holders of someone’s creator coin now have a financial incentive to defend them if attacked unfairly.

All holders suffer downside if a cancellation crashes a creator coin price, so they defend.

Long-term holders of someone’s creator coin now have a financial incentive to defend them if attacked unfairly.

All holders suffer downside if a cancellation crashes a creator coin price, so they defend.

https://twitter.com/zebleckswan/status/1403407253068210180

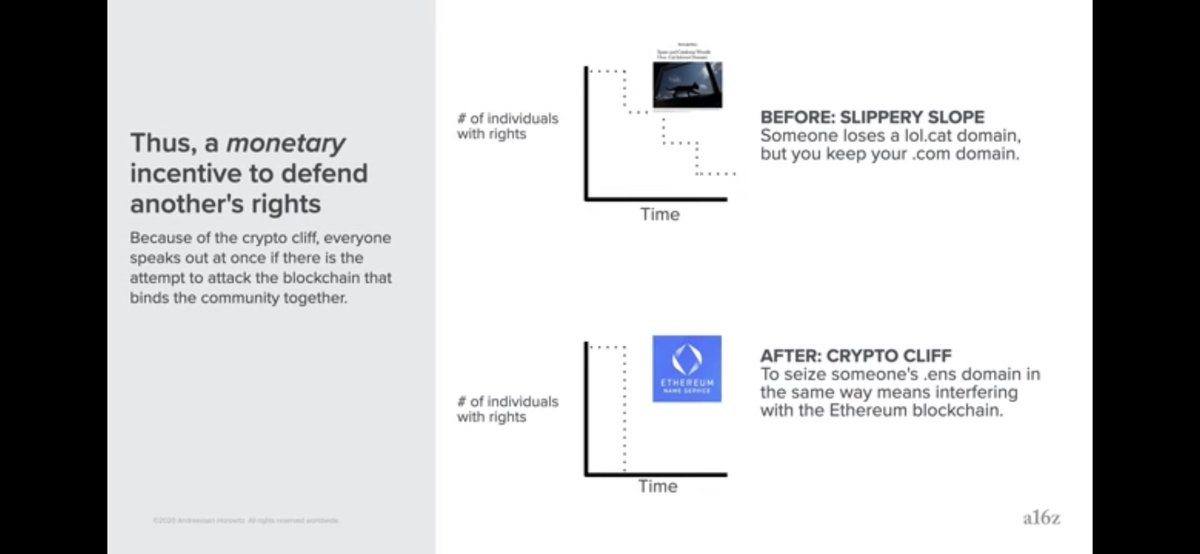

Blockchains take us from the slippery slope to the crypto cliff.

An attacker can no longer pick off one party at a time; attempted seizure (or, now, cancellation) is an attack on all holders.

This gives a monetary incentive to defend another’s rights.

An attacker can no longer pick off one party at a time; attempted seizure (or, now, cancellation) is an attack on all holders.

This gives a monetary incentive to defend another’s rights.

This is what *some* of the defense of Elon is about.

I generally support Elon’s work in rockets & cars because I think it’s technologically pioneering. I hold no TSLA.

Others support in part because they are TSLA holders, so attacks on the CEO can hit them too financially.

I generally support Elon’s work in rockets & cars because I think it’s technologically pioneering. I hold no TSLA.

Others support in part because they are TSLA holders, so attacks on the CEO can hit them too financially.

https://twitter.com/Molson_Hart/status/1403440466666852355

The introduction of a creator coin means you don’t need to run a public company to align other people behind your success.

You can imagine a new kind of community where everyone has at least a partial stake in everyone else’s creator coin.

Alignment via personal portfolio.

You can imagine a new kind of community where everyone has at least a partial stake in everyone else’s creator coin.

Alignment via personal portfolio.

Thiel mentions the value destroyed by clickbait.

A media corporation attacks someone (not their owner!) to gain some ad revenue. Their stock goes up slightly, while their target takes a hit. They capture some of the value they destroy.

With creator coins, this is quantifiable.

A media corporation attacks someone (not their owner!) to gain some ad revenue. Their stock goes up slightly, while their target takes a hit. They capture some of the value they destroy.

With creator coins, this is quantifiable.

Of course it’d be better if people defended a victim of a social media mob even in the absence of incentives.

But right now it’s all downside. If one person speaks out alone the mob turns on them.

Creator coins align all hodlers, so there is *collective* defense against mobs.

But right now it’s all downside. If one person speaks out alone the mob turns on them.

Creator coins align all hodlers, so there is *collective* defense against mobs.

In the limit, the transition from real name social media to pseudonymous decentralized media with creator coins takes opportunity & profit out of cancellation.

Even if they can get past the pseudonym, a prospective canceller now knows hodlers will mount a collective defense.

Even if they can get past the pseudonym, a prospective canceller now knows hodlers will mount a collective defense.

• • •

Missing some Tweet in this thread? You can try to

force a refresh