Crypto Reading & Notes Thread for Week of June 21-27

Total Time Saved via Notes: 7 Hours

Topics included: Bollinger Bands, Polygon, Technical Roundup, ETH Dev Call, Defi vs NFT, China Mining, and Real life updates on trading / bear markets from top traders.

(1/n)

Total Time Saved via Notes: 7 Hours

Topics included: Bollinger Bands, Polygon, Technical Roundup, ETH Dev Call, Defi vs NFT, China Mining, and Real life updates on trading / bear markets from top traders.

(1/n)

@UpOnlyTV conversation with @bbands notes (6/22)

https://twitter.com/cmsintern/status/1407447357185212421?s=20

@Unchained_pod: @laurashin <> @_jdkanani (Polygon co-founder / CEO)

https://twitter.com/cmsintern/status/1406969938791780355?s=20

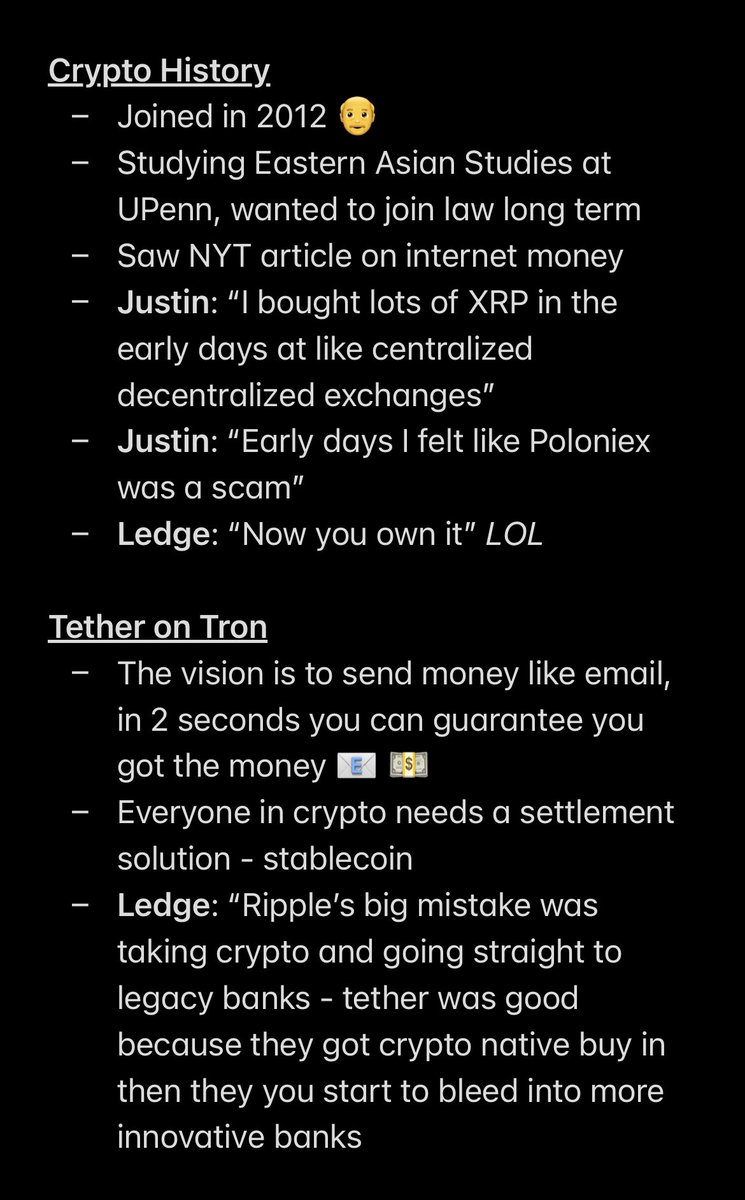

Technical Roundup #9 w/@ledgerstatus @CryptoDonAlt @CryptoCred on the bull market, BTC vs ETH, DeFi decoupling, @FlipMetrics and more

https://twitter.com/cmsintern/status/1408201336072687618?s=20

@TimBeiko Dev Call Wrap up 116

https://twitter.com/TimBeiko/status/1408459851349467136?s=20

@RyanWatkins_ Thread on Economic Viability of Pegged Asset protocols

https://twitter.com/ryanwatkins_/status/1408056220938870788?s=21

@SinoCrypto - China Mining Update

https://twitter.com/sinocrypto/status/1407524150885994497?s=21

Some Real Life Threads on Trading, Bear Markets and Loss:

1. @AWice - Life Update:

2. @SplitCapital - Remembering 2018/2019 Bear Market:

3. @pythianism - Bear Market 2018/2019:

1. @AWice - Life Update:

https://twitter.com/awice/status/1407745573189345282?s=21

2. @SplitCapital - Remembering 2018/2019 Bear Market:

https://twitter.com/SplitCapital/status/1407846398859563010?s=20

3. @pythianism - Bear Market 2018/2019:

https://twitter.com/pythianism/status/1407394843135856645?s=20

@Melt_Dem here is some of your weekly reading 😀

EIP1559 overview must read! thx @TeddyRoosevalt cc @evan_van_ness

https://twitter.com/evan_van_ness/status/1407784691718148100

• • •

Missing some Tweet in this thread? You can try to

force a refresh