A thread on how Nelco ltd, a Tata group company is well poised to reap the benefit of development in space industry and telecommunication. 👇🧵(1/n)

Nelco is a micro cap company from the Tata group which derives all its revenues from the business of Satellite Communication (SATCOM). (2/n)

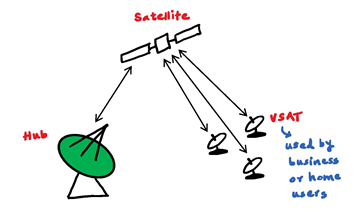

For us to know what Nelco does, we must first know few technicalities of the Satellite business. So, let us first understand how a satellite works. (3/n)

Let us keep this simple. There are three devices which are used for connecting a remote area: Satellite, VSAT and the hub or the earth station. VSAT stands for Very Small Aperture Terminal. This is installed at the end user’s place. (4/n)

VSAT is responsible for sending and receiving signals to and from satellite. VSAT essentially sends signal to the satellite, which then sends signal to the earth station or the hub. So, the earth station then sends the signal to the satellite which transmits it to the VSAT. (5/n)

VSAT users can also be connected to each other via hub. This way, satellite communication can be used to connect the remote locations to the main station. (6/n)

Nelco specializes in manufacturing VSAT and providing allied services consisting of network management, project management, infrastructure services, turnkey solutions for satellite communication systems, and co-location services to customers. (7/n)

The Satellite based communication finds wide application in the areas like banking for ATM connectivity, Education to connect remote areas, IFMC (In Flight and Maritime Connectivity) which can help a traveler use internet in flight and in territorial waters, etc. (8/n)

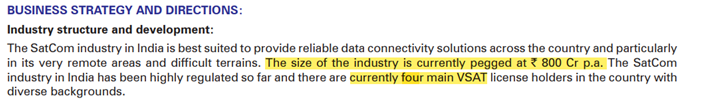

The VSAT industry in India has been tightly regulated with only 4 players and the total market is very small of just Rs.800 cr. (9/n)

However, the space is evolving faster than ever. Nelco believes that the global satellite industry has evolved faster in the last 2 – 3 years than in the previous 25 years, with large investments in innovations and technology advancements. (10/n)

The market share of Nelco has improved from mere 8% in 2011 to 26% in 2020. The company has clearly strengthened its position in the market. All other companies have actually lost a considerable market to Nelco. (11/n)

Airtel Hughes is the market leader with more than 60% market share in this space after NCLT approved the merger of Bharti Airtel with Hughes Communication India ltd. (12/n)

mnacritique.mergersindia.com/bharti-airtel-…

mnacritique.mergersindia.com/bharti-airtel-…

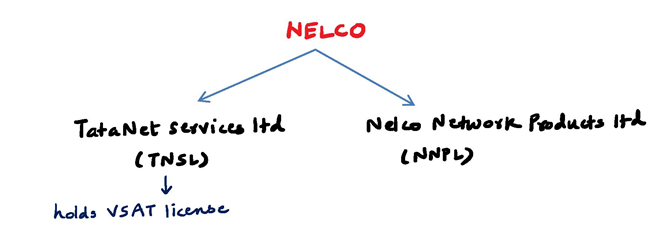

The company is in the process of restructuring to make itself more eligible to apply for additional licenses in new business opportunities around satellite communication. (14/n)

Nelco, on June 10, 2021, announced that it received the requisite approval from DoT for transfer of the Internet Service Provider license and VSAT license from the amalgamating company i.e. Tatanet Services to the amalgamated company i.e. Nelco under the Scheme. (15/n)

What is more interesting about Nelco is the fact that last year it partnered with Telesat, one of the major global satellite player launching LEO satellites. (16/n)

For the uninitiated, LEO satellites are low earth orbit satellites which specialize in providing high internet speed to remote areas with low latency. As these satellites are orbiting very close to earth, the latency issue can be solved to give great experience. (17/n)

The tailwinds for the space industry are strong. In the recently held Qatar Economic Forum, Sunil Mittal of Bharti group spoke about how OneWeb is planning to launch LEO satellites to connect the remotest areas with high speed internet. (18/n)

So, the entire ecosystem is going to change rapidly with so many companies like OneWeb, Telesat, Starlink, Project Kuiper commercially launching their services. This can provide ample opportunity for Nelco to grow. (19/n)

Nelco is the only company in the entire listed space that has its revenues from SATCOM business. Hence, it is poised to gain from the evolving space industry which is finding new applications with time. (20/n)

With market cap of just 700-800 odd crores, it can seize the opportunity of the growing space industry. (21/n)

This is by no means an investment advice. Please consult your financial advisor before investing. (22/22)

• • •

Missing some Tweet in this thread? You can try to

force a refresh