Case Study #1

Company: Mastek

Super Investor: Ashish Kacholia aka @LuckyInvest_AK

@LuckyInvest_AK is praised for his stock picks in a bull market.

Very few realize the patience and temperament required to hold through a stock position in a bear market.

Company: Mastek

Super Investor: Ashish Kacholia aka @LuckyInvest_AK

@LuckyInvest_AK is praised for his stock picks in a bull market.

Very few realize the patience and temperament required to hold through a stock position in a bear market.

As per public filings, we know Ashish sir, picked up a 1.73% stake in @Mastekltd sometime between Jun and Sep of 2018.

This was during the height of previous small cap rally in India.

Nifty Small cap index hit a high of 9665 in Jan 2018.

Post hitting that high, the index collapsed almost 20% in next six months by Aug 2018

(It collapsed even more later)

PS: The previous high of Nifty Small Cap from 2018 was just broken last month in Jun 2021!

Post hitting that high, the index collapsed almost 20% in next six months by Aug 2018

(It collapsed even more later)

PS: The previous high of Nifty Small Cap from 2018 was just broken last month in Jun 2021!

During the same period of time, Mastek went against the index and rose almost 50% from Jan 2018 to Aug 2018.

This is the time around which Ashish sir started buying Mastek to increase his position above a 1% and appear in public filings.

Based on his filings, his transaction price must have been anywhere between Rs 500 and Rs 600 per share.

Based on his filings, his transaction price must have been anywhere between Rs 500 and Rs 600 per share.

I am sure he did his research before buying, an experienced investor like him would have even used technical analysis to buy at the right possible price.

Usually when an investor like him adds to a position, the market rewards by moving the stock 10% higher.

Usually when an investor like him adds to a position, the market rewards by moving the stock 10% higher.

So surely, the stock priced moved up and he got timing of everything correctly.

Wrong.

Wrong.

This is what Mastek stock price did over the next 20 months (almost 2 years!)

It went from Rs 600 odd to finally touching bottom of Rs 175 in Mar of 2020

A 70% Drawdown!

It went from Rs 600 odd to finally touching bottom of Rs 175 in Mar of 2020

A 70% Drawdown!

So what did Ashish sir do?

He bought more till he had bought about 2.89% of the company and then stayed put.

He bought more till he had bought about 2.89% of the company and then stayed put.

He didn't pay attention to what the stock price was doing.

Because while the stock was moving down, business stayed constant and even showed some improvement.

Because while the stock was moving down, business stayed constant and even showed some improvement.

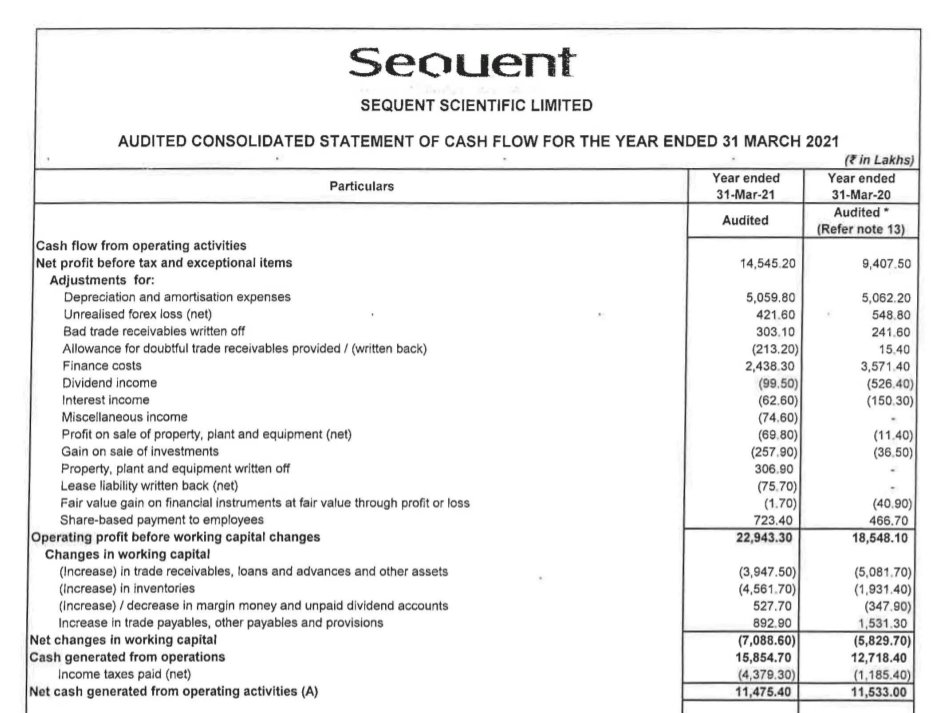

From Sep 2018 to Mar 2020, Sales and Margin remained stable and didn't bear the same decline as witnessed by the stock.

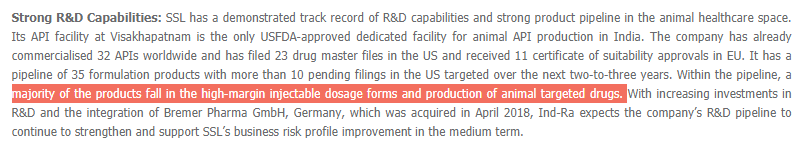

Meanwhile, Mastek was reshuffling its business.

It hived off its insurance arm called Majesco and sold that to raise cash.

Using that cash, it bought a cloud service company called Evosys.

It hived off its insurance arm called Majesco and sold that to raise cash.

Using that cash, it bought a cloud service company called Evosys.

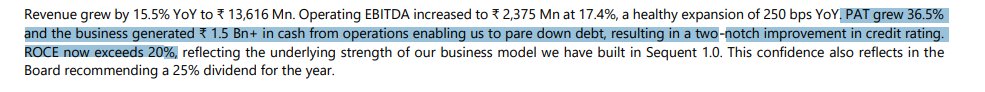

Its because of those events and actions of Mastek's management from 2018 to 2020, you see Mastek's sales doubling and margin rising to 22%.

Major rise in sales and margin today is because of Evosys business.

Major rise in sales and margin today is because of Evosys business.

Meanwhile, from Mar 2020, the stock price has moved from its low of 170/share to its recent high of 2350/share.

That's a gain of more than 12x

That's a gain of more than 12x

So what are the lessons we can learn here?

1⃣ Bull Markets can change anytime

2⃣ No one can time the market, not even super investors

3⃣ Those who put in work to research a business, will reap the reward

4⃣ Bear Markets, will test you

5⃣ Real wealth is build over long term

1⃣ Bull Markets can change anytime

2⃣ No one can time the market, not even super investors

3⃣ Those who put in work to research a business, will reap the reward

4⃣ Bear Markets, will test you

5⃣ Real wealth is build over long term

Look at your portfolio, will you be able to hold through your holding with a 70% Drawdown for years?

Do you know your holding really well?

Do you have the patience and temperament for the same?

Mastek went to a PE of 3.9!

Will you be able to digest that if it happens to you?

Do you know your holding really well?

Do you have the patience and temperament for the same?

Mastek went to a PE of 3.9!

Will you be able to digest that if it happens to you?

To Ashish sir and his mic dropping investments! 👏🏼

• • •

Missing some Tweet in this thread? You can try to

force a refresh