I struggled with investing in my 20s and although there is a lot ‘gyaan’ out there, I feel there is lack of actionable ‘gyaan’ for people in their 20s. Had someone told me these basic things to do a decade back, I would have made some wealth. Time for another🧵(1/n)

All you need to do is follow the following steps and let compounding do its work. Caveat:

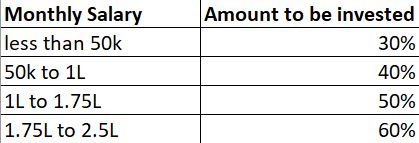

Only for people earning <2.5L per month

For people <30 years old

If you don’t have time to do active investing

This is all from personal experience

(2/n)

Only for people earning <2.5L per month

For people <30 years old

If you don’t have time to do active investing

This is all from personal experience

(2/n)

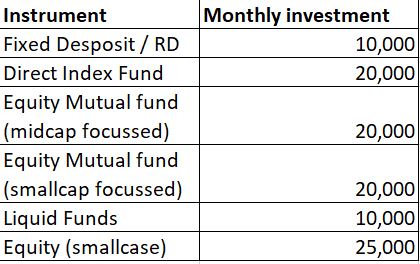

Once you identify the amount to be invested, the following question is ‘what all instruments should I invest in?' Get a SIP done for the following instruments and move to the next instrument only once the amount mentioned against it touches monthly SIP. (4/n)

- Opt for a direct index fund from @CoinByZerodha or @_groww

- Register with @bankoncube, get a wealth advisor and start your SIPs in equity mutual funds

- SBI Liquid funds have worked out for the best for me.

(5/n)

- Register with @bankoncube, get a wealth advisor and start your SIPs in equity mutual funds

- SBI Liquid funds have worked out for the best for me.

(5/n)

- Open a demat account with @zerodhaonline & sign up on @smallcaseHQ for your equity investing

- Best managers on @smallcaseHQ : @WeekendInvestng , @capitalmind_in & @ResearchWright

- FD/RD should be stopped once a reserve equivalent to your 9months expenses is made (6/n)

- Best managers on @smallcaseHQ : @WeekendInvestng , @capitalmind_in & @ResearchWright

- FD/RD should be stopped once a reserve equivalent to your 9months expenses is made (6/n)

- Don’t only invest in equities, invest in safe instruments and save your taxes simultaneously.

These are approx amounts, feel free to move within +/- 15% (7/n)

These are approx amounts, feel free to move within +/- 15% (7/n)

- If you have some spare money left, flirt with some hyped IPOs to cash on the listing gains.

- Please don’t opt for debt/hybrid instruments in your 20s.

- Spend the rest of the amount post investing like there is no tomorrow. (8/n)

- Please don’t opt for debt/hybrid instruments in your 20s.

- Spend the rest of the amount post investing like there is no tomorrow. (8/n)

If you need funds for a rainy day, dig into your liquid fund first and then your FDs.

- Don’t play around with equity and F&O trading without external guidance and on hearsay.

(9/n)

- Don’t play around with equity and F&O trading without external guidance and on hearsay.

(9/n)

Retweet if the thread makes sense. I have tried to make investing binary and easy for youngsters.

Happy Investing

#MondayMorning #investing #wealthmanagement

Happy Investing

#MondayMorning #investing #wealthmanagement

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh