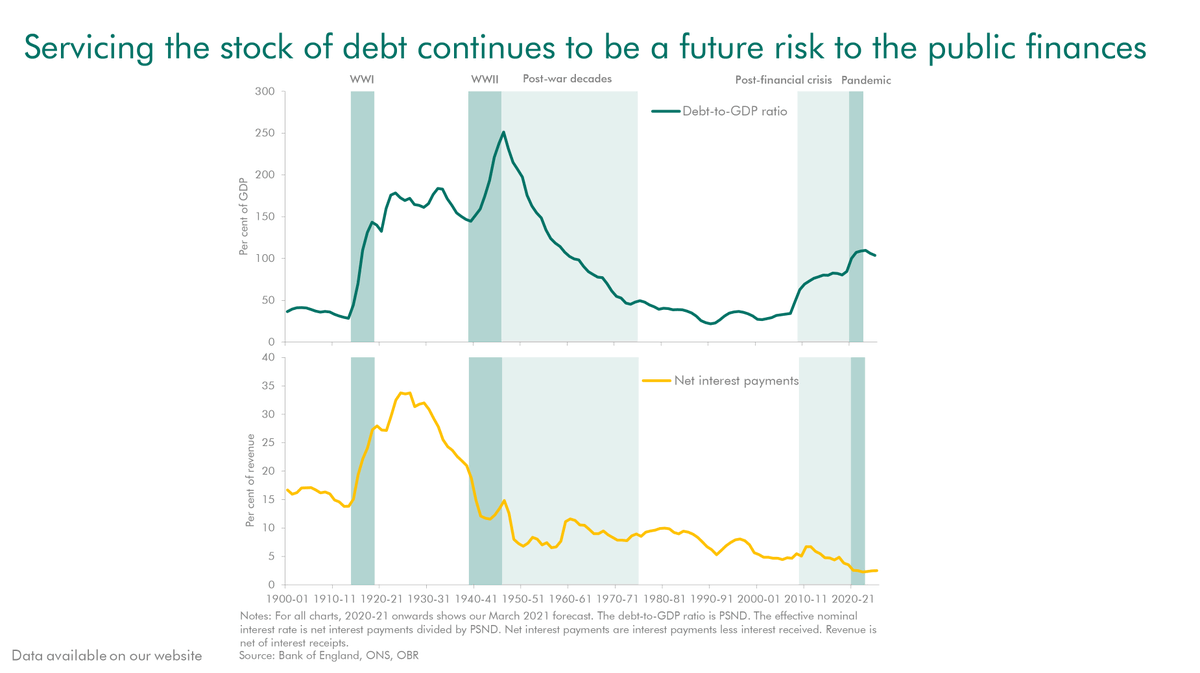

The Government’s elevated debt stock is both a product of past fiscal risks and a source of future risks to the public finances. Two-thirds of the 80% of GDP increase in debt since 2000 happened in the wake of the 2008 financial crisis and 2020 pandemic.

Despite the stock of debt reaching its highest level since the early 1960s, the cost of servicing that debt remains near historical lows thanks to falling interest rates.

#OBRfiscalrisks

#OBRfiscalrisks

But there are no guarantees that interest rates will remain low, so in Chapter 4, we test the impact of different factors that could push up government borrowing costs.

#OBRfiscalrisks

obr.uk/frr/fiscal-ris…

#OBRfiscalrisks

obr.uk/frr/fiscal-ris…

The scenarios illustrate the greater sensitivity of public debt to future changes in its cost since pre-financial crisis, as a result of both the almost trebling in the stock of debt as well as the shortening of the effective maturity of that debt.

• • •

Missing some Tweet in this thread? You can try to

force a refresh