Last week, I did a deep dive into the backstory of Tiger Global. After, I got a lot of requests for a similar deep dive into their $48bn peer Coatue, another super successful Tiger Cub.

So here it is: everything you need to know about Coatue and its founder, Philippe Laffont. 👇

So here it is: everything you need to know about Coatue and its founder, Philippe Laffont. 👇

1/ Philippe graduated from MIT in 1991 w/ a degree in Computer Science.

He applied for jobs in 3 different divisions at Apple, and got rejected from all 3. Instead of becoming an engineer, he decided to take a job at McKinsey in Madrid.

He applied for jobs in 3 different divisions at Apple, and got rejected from all 3. Instead of becoming an engineer, he decided to take a job at McKinsey in Madrid.

2/ FWIW, Philippe has said that he's not sure his technical background has really been that useful as a tech investor.

Many of the best tech investors do not have technical degrees, and most PhDs are not particularly talented investors, so he doesn't think it really correlates.

Many of the best tech investors do not have technical degrees, and most PhDs are not particularly talented investors, so he doesn't think it really correlates.

3/ Philippe left McKinsey in '94, and started investing in blue-chip tech stocks of the time, like Intel, Microsoft, and Dell, w/ his brother Thomas.

It was early in the dot-com bubble and returns were good, which hooked him onto tech investing.

It was early in the dot-com bubble and returns were good, which hooked him onto tech investing.

4/ He returned to the US to try to find a job in investing, but nobody was willing to hire him, so he ended up working for free for a mutual fund in NYC.

5/ Eventually, through a friend of a friend, he got 2 mins w/ Julian Robertson. He told him he wanted to pick tech names for Tiger, so Julian sent him to meet his tech guys and they ended up hiring him in '96.

6/ Philippe spent 3.5 years at Tiger before launching Coatue's main L/S fund w/ $50m in '99.

Obviously, the timing was not ideal as the dot-com bubble burst shortly afterward.

Obviously, the timing was not ideal as the dot-com bubble burst shortly afterward.

7/ Yet, Coatue survived and by 2003 were managing $500m, with Philippe's father serving as CFO. His brother Thomas joined in '03 from CAA, where he had previously been a Hollywood agent.

8/ In '04 they bought Tencent at the IPO price of HK$6 - today, the stock is almost HK$3,000, split-adjusted. Unfortunately, the sold along the way.

Like Tiger Global, Coatue had an early, differentiated focus on Asian tech.

Like Tiger Global, Coatue had an early, differentiated focus on Asian tech.

9/ Through the 2000s, performance was good and helped by Asian tech bets and an early call on Apple.

The fund was down only -14% in '08, while NASDAQ was down -40%. By '09, Coatue was managing $2.2bn.

The fund was down only -14% in '08, while NASDAQ was down -40%. By '09, Coatue was managing $2.2bn.

10/ Philippe developed a reputation for being a tough boss and Coatue was known for high churn among analysts... but this doesn't seem to have hurt them.

11/ In 2012, Thomas moved to California and they launched their first private fund in 2013 w/ $400m - 10 years after Tiger Global launched their first private fund.

12/ Coatue was new to privates at the time but that didn't stop them from making large, concentrated bets... out of that 1st fund, they invested $50m into Snap at a valuation of $1.5bn in 2013 as the only investor in the round - a huge early win.

13/ Ride-sharing was also an early focus for the private fund - they invested in Lyft at a $750m valuation in 2014, and in Grab and Didi in 2015.

Other private investments include Meituan (2017), ByteDance (2017), DoorDash (2018), etc.

Other private investments include Meituan (2017), ByteDance (2017), DoorDash (2018), etc.

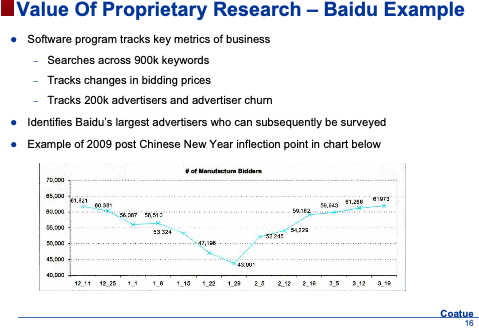

14/ Both public and private, Coatue is known for its focus on data science. They spend ~$30m/year buying prop. data, and make investments based on trends they see.

15/ For example, Coatue reached out to Afterpay in 2019 after seeing data on how their platform was helping retailers - leading to a $200m investment.

Coatue's 2018 investment into DoorDash also happened after data showed DoorDash overtaking Uber Eats in key markets.

Coatue's 2018 investment into DoorDash also happened after data showed DoorDash overtaking Uber Eats in key markets.

17/ On publics, they are known for doing incredibly deep diligence (like most Tiger Cubs).

One analyst told me that when they buy or short a stock, they know the industry better than anyone else, included mgmt. teams, since they only see their own P&L.

One analyst told me that when they buy or short a stock, they know the industry better than anyone else, included mgmt. teams, since they only see their own P&L.

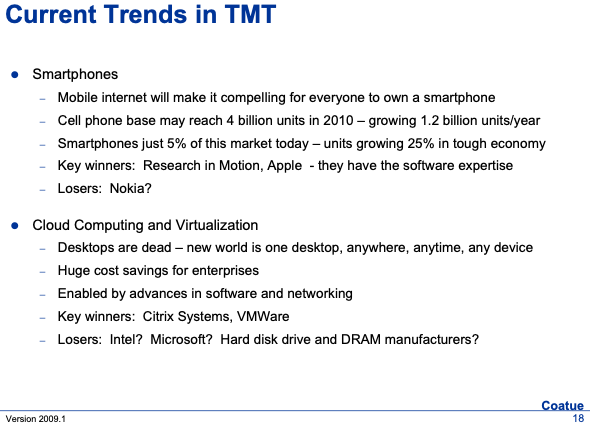

18/ They invest in themes - major 5-7 year trends in the world. From each theme come losers and winners, which are long and short ideas. Here's another slide from that '09 presentation.

19/ Other themes over Coatue's life have included ride-sharing (Lyft, Uber, Grab, Didi), food delivery (Meituan and DoorDash), and scooters/bikes (Ofo, Lime), while a big current theme is AI.

20/ They have two types of shorts:

- Frauds (i.e. Wirecard)

- Losers from major themes (i.e. Intel in '09)

They don't short based on valuation alone.

- Frauds (i.e. Wirecard)

- Losers from major themes (i.e. Intel in '09)

They don't short based on valuation alone.

21/ Philippe says that "in the public markets, we look for stocks that can double in five years" while "on the private side, against the lack of liquidity, our bogey is more like a triple in five years."

22/ Although I couldn't find data on find data on performance since inception, I imagine it is very good. The L/S fund returned 52% net in first 11 months of 2020, handily beating NASDAQ.

Today, Coatue manages $48bn in aggregate, and Philippe is personally worth $2bn+.

Today, Coatue manages $48bn in aggregate, and Philippe is personally worth $2bn+.

23/ Like Tiger Global, they have no European offices. Their HQ is in NYC (in the same building as Tiger) and they have add'l offices in Menlo Park, San Francisco, and Hong Kong.

The future of Coatue is in Silicon Valley and Asia.

The future of Coatue is in Silicon Valley and Asia.

24/ To summarize, Coatue built their track record by:

- using alt. data heavily

- correctly identifying major themes (Asian tech, cloud compute, etc.)

Open Q now is to what extent they are simply a product of the current tech boom, and how they will do beyond it. Time will tell!

- using alt. data heavily

- correctly identifying major themes (Asian tech, cloud compute, etc.)

Open Q now is to what extent they are simply a product of the current tech boom, and how they will do beyond it. Time will tell!

• • •

Missing some Tweet in this thread? You can try to

force a refresh