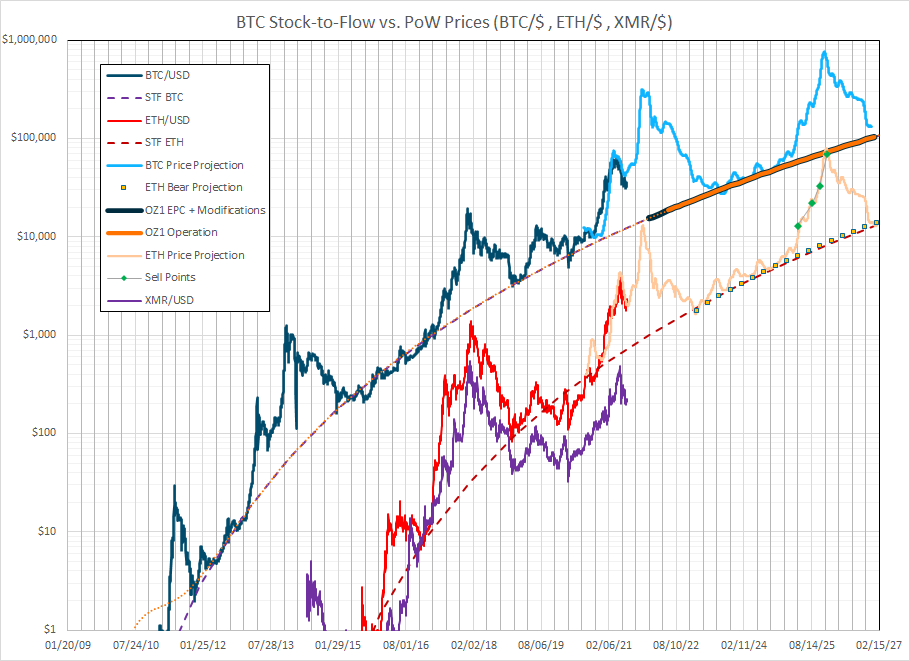

One of the things that is interesting to me is teasing out the differences between how digital assets are value relative to the Bitcoin liquidity waterfall & their own inherent properties that drive their network effect inflation.

For example, one can study the narrative drive of Ethereum as a composable, smart contract platform that continues to add diverse use cases like DeFi, NFTs, AMMs, SCs, etc. (network effect drivers) vs. a single purpose digital asset like Monero (XMR), a privacy coin.

What you quickly notice is that for a while XMR & ETH traded at near parity (nascent networks without clear differentiation equally in the shadow of BTC). Once the additional network drivers took hold in ETH the deviation grew substantially.

For a while (between Dec.2017 & ETH & XMR were trading in relative tandem with some fixed premium, ETH ~ 175% or 3.4x the value of XMR & then suddenly started to accelerate in price appreciation (network inflation) w/ respect to XMR (~900%). This is dramatic.

We know anecdotally that BTC being the first, & arguably most single purpose digital asset from a narrative perspective (SoV), enjoys the branding network swell. We also know that ETH will likely see similar narrative swell alongside it's multi-use case inflows.

What I'm interested in is seeing whether or not privacy once again becomes a compelling use (& therefore narrative driver of network swell) once regulations inevitably overshoot on the upstarts that are digital assets to the traditional financial system. Privacy may overshoot!

• • •

Missing some Tweet in this thread? You can try to

force a refresh